Image: Cova Software/Unsplash

Image: Cova Software/Unsplash

Several states provide data on the average retail price for cannabis flower in their respective markets, allowing us to compare it with Cannabis Benchmarks wholesale price assessments to gauge average retail markups. The data shows retail markups for cannabis flower can vary greatly between different state markets. Volatility in wholesale flower prices also means that retail markups can fluctuate significantly within state markets over time. This article examines data on retail markups for cannabis flower from a half-dozen legal markets and provides context for the differences across states.

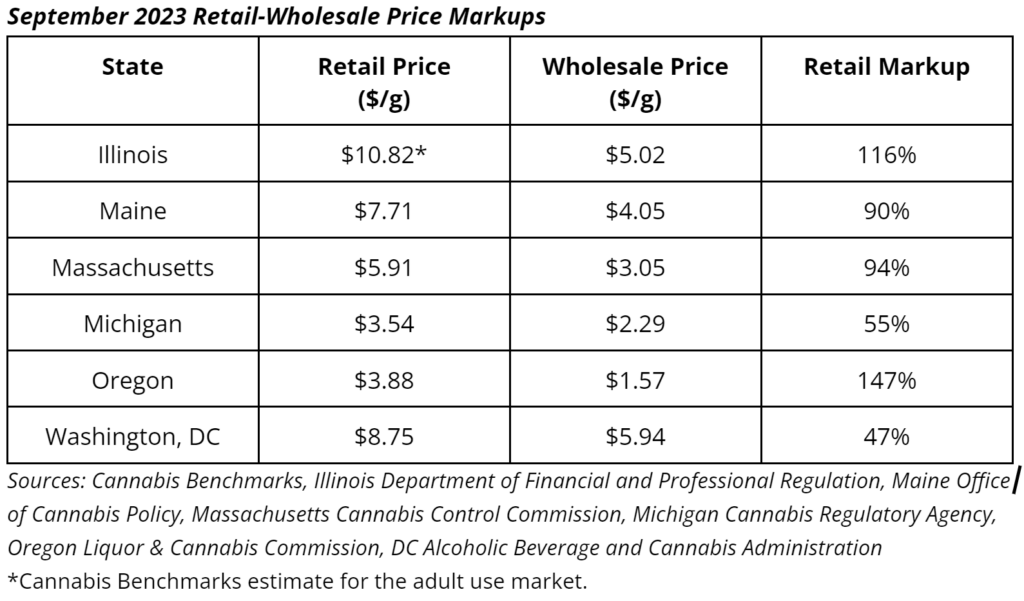

The table below shows average retail and wholesale flower prices for September, along with the retail markups in each market.

The data above includes several interesting and surprising findings:

Despite selling essentially the same product, retail markups for cannabis flower can vary a great deal across state lines. Seasonal and event-driven movement in wholesale cannabis prices means that markups within states will surely change over time. Analyzing retail markups data for cannabis flower and other products using Cannabis Benchmarks’ validated, unbiased wholesale price data is essential for those evaluating opportunities in different legal cannabis markets.