Image: Mykola Korzh/Unsplash

Image: Mykola Korzh/Unsplash

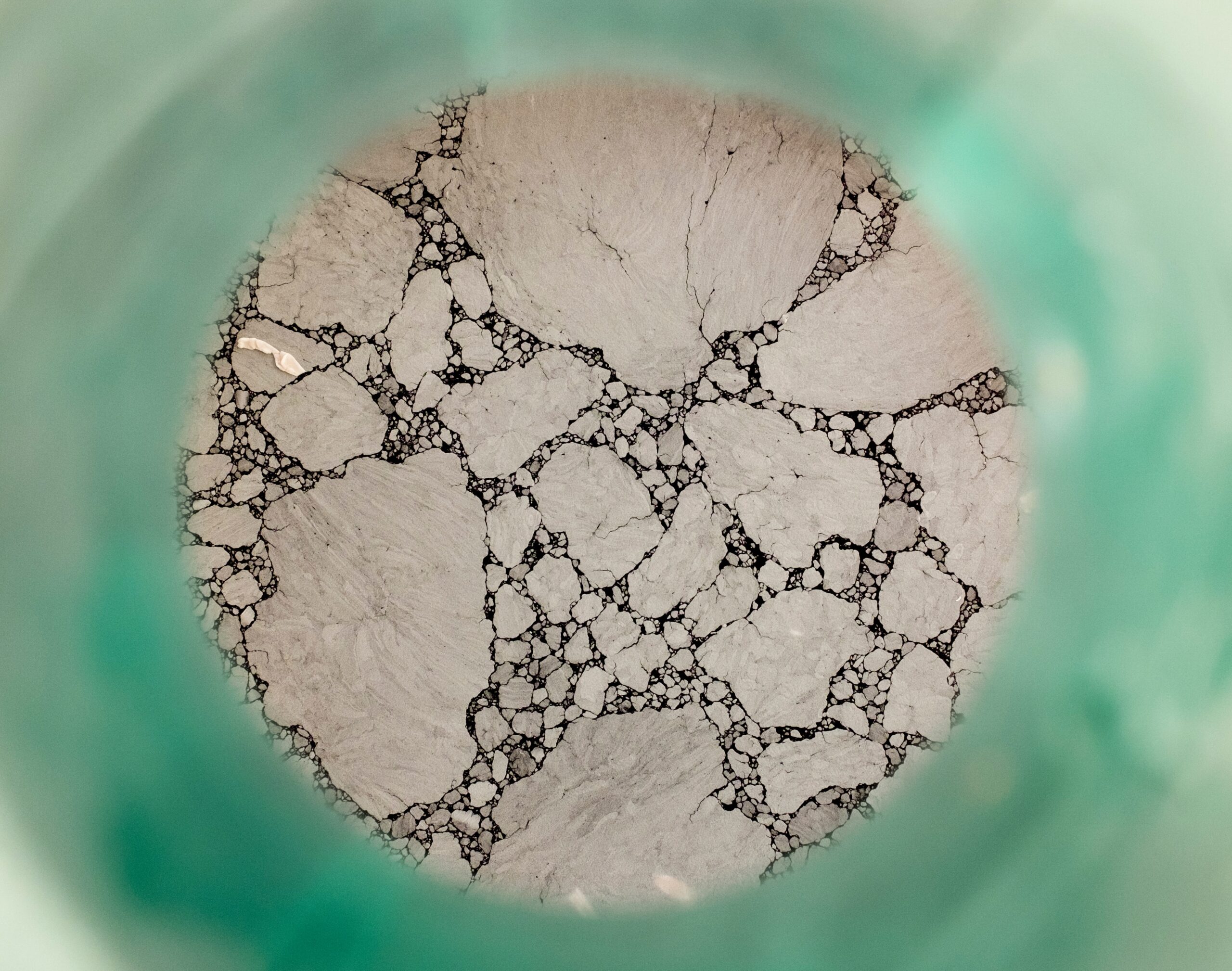

The Oregon cannabis industry faces significant changes with the recent suspension of required testing for aspergillus in cannabis products. This article examines the impact that the suspension of aspergillus testing will have on Oregon’s cannabis market dynamics and wholesale prices.

The Oregon Health Authority (OHA), which regulates cannabis testing in the state, recently notified stakeholders of a new temporary rule “to remove the requirement for aspergillus testing.” The temporary rule went into effect on September 15 and will remain so through March 12, 2024.

The new rule is in response to a lawsuit filed last month by an Oregon industry group and two licensed growers to stop required aspergillus testing, which began in March 2023. As we reported previously, and as the OHA notice states, the suspension of aspergillus testing is the result of a state appeals court decision in favor of the plaintiffs in the case.

The Oregon Liquor and Cannabis Commission (OLCC) last week notified stakeholders that holds on products that previously failed testing for aspergillus would be lifted. According to OLCC, OHA’s new temporary rule withdrawing the aspergillus testing requirement “also specifies that items that had previously tested to contain aspergillus are no longer considered to have failed a compliance test.” The OLCC notice states that the agency is working to coordinate the release of such products that have been on hold in the state’s plant and inventory tracking system.

OHA also alerted licensees that products that tested positive for aspergillus and were remediated, or attempted to be remediated, on or before August 25 must be resampled and retested before they can enter commerce.

OLCC’s notice specifies that about 2,500 pounds of cannabis and 65,000 units of infused pre-rolls that previously tested positive for aspergillus be released under the conditions of the new temporary rule.

While 2,500 additional pounds of plant material is unlikely to move the needle on wholesale prices in Oregon’s cannabis market, the suspension of required aspergillus testing should ultimately allow a great deal more product to enter the market, especially with late summer and fall harvests that are already occurring or imminent.

We can look to reported failure rates and historical harvest figures to gauge the potential impact of doing away with required aspergillus testing. The failure rate for flower while required aspergillus testing was in effect was 9%, according to OLCC. In 2022, Oregon outdoor growers harvested 5.3 million pounds of wet cannabis plant material.

If we assume a conversion rate of 10 – 15% from wet weight to dried flower (excluding trim for extraction and product manufacturing), last year’s outdoor harvests produced between roughly 530,000 to 795,000 pounds of dried flower. 9% of that amount equates to between 47,700 and 71,550 pounds of flower that would likely have failed aspergillus testing based on observed failure rates.

While this year’s harvest is almost certain to be smaller than last year’s, outdoor growers and other interested parties also feared that failure rates for outdoor crops would be higher due to the absence of environmental controls in the growing process. We reported previously that the failure rate for infused pre-rolls – which are typically made from outdoor-grown flower and trim – was 16% when aspergillus testing was in effect.

Additionally, growers no longer have to shoulder the costs of required aspergillus testing. Jesse Bontecou, head of the Cannabis Industry Alliance of Oregon, an industry advocacy group, previously told Cannabis Benchmarks that, along with increased testing costs, growers were also paying for remediation and retesting, which significantly increased the costs to bring product to market.

Ultimately, it’s safe to say that the suspension of aspergillus testing through spring next year will allow tens of thousands of pounds of flower to come to market that would not have otherwise, and with lower compliance costs, which should increase downward pressure on prices during and after the fall harvest season.