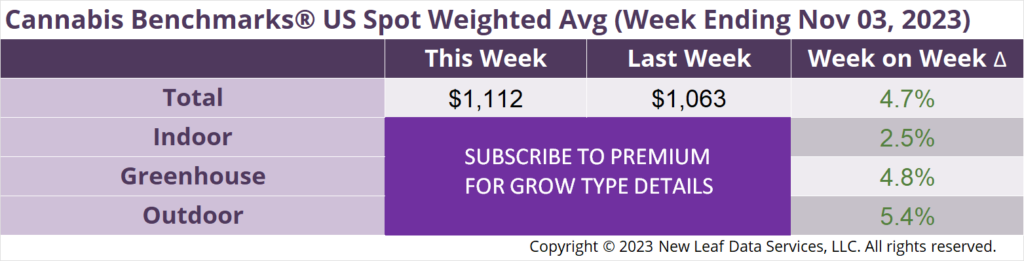

The U.S. Cannabis Spot Index increased 4.7% to $1,112 per pound.

In grams, the Spot price was $2.45.

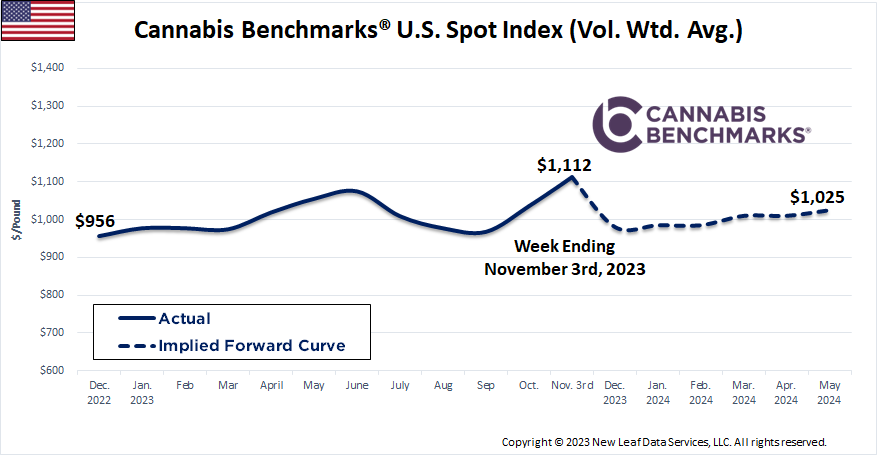

The U.S. Spot Index’s improbable harvest-season rise continued this week, with the national wholesale flower price climbing to a year-to-date high of $1,112 per pound. After relative steadiness in wholesale flower prices in the first half of this year, volatility is beginning to return. In H1 2023, the U.S. Spot occupied a fairly tight $144 range, between a low of $952 and a high of $1,096 per pound. That range has since widened to $176, with a new low of $936 per pound observed in mid-September and a new high this week.

As we’ve noted in recent reports, signals out of the U.S. cannabis markets have been mixed this year. For example, sales revenues are down or flat due in large part to price compression, in many cases obscuring increasing sales in volume or unit terms. The tough post-Covid market has led to cultivation license attrition in California, while large-scale operators such as Glass House have greatly expanded their low-cost production. Moving up the West Coast, talk of cultivators in Oregon pulling back or exiting was clearly overblown given October’s big harvest numbers.

Overall, the mixed signals and correspondingly unexpected price movement speak to an industry still trying to find its feet in the wake of the 2020 – 2021 pandemic shakeup. And as if Covid wasn’t enough, the hits have kept on coming. Macroeconomic shocks in the form of decades-high inflation leading to rapid interest rate rises have put pressure on both consumers and businesses. Meanwhile, international crises have pulled U.S. lawmakers’ attention away from federal cannabis reform, leaving the industry listing precariously in choppy waters, hoping the DEA of all organizations will throw a lifeline in the form of rescheduling.

Given unprecedented conditions and uncertainty on numerous fronts, a return to volatility is unsurprising. Taking a longer view, however, this year’s $176 price range remains much narrower than those documented in prior years. In 2020, the U.S. Spot saw a range of $343 between its low and high points; 2021’s range was $332; and 2022’s was $351. Still, recent movement in wholesale prices suggests the stability of Q4 2022 – Q1 2023 may have been anomalous and a return to more pronounced price swings could be in the offing. In such an environment, timely and unbiased wholesale price data is essential to informing day-to-day business decisions, as well as longer-term strategy.

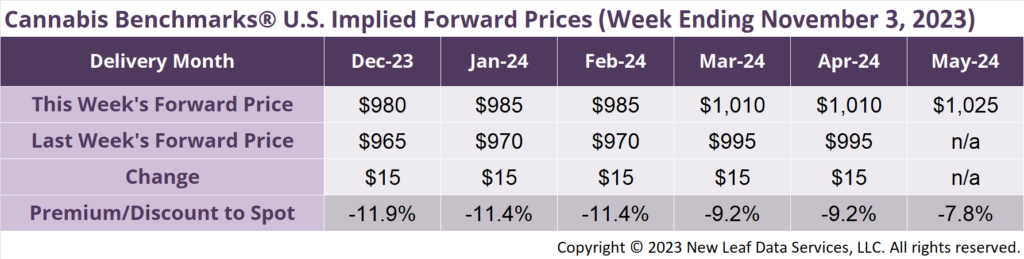

May 2024 Implied Forward initially assessed at $1,025 per pound.

At $980 per pound, the December 2023 Implied Forward represents a discount of 11.9% relative to the current U.S. Spot Price of $1,112 per pound.

Retail Margin Calculations Contain Surprising Findings

October Harvest Volume up 14% YoY, Defying Expectations of Cultivation Pullback

Wholesale Price Volatility: A Silver State Hallmark

Current Wholesale Price Retracement Echoes Historical Data