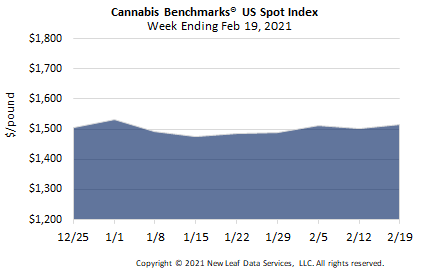

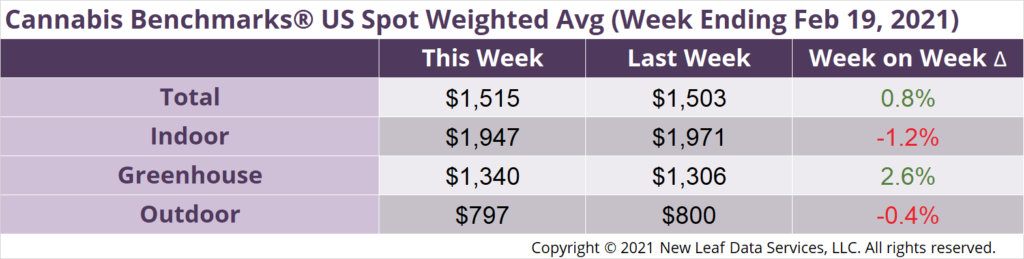

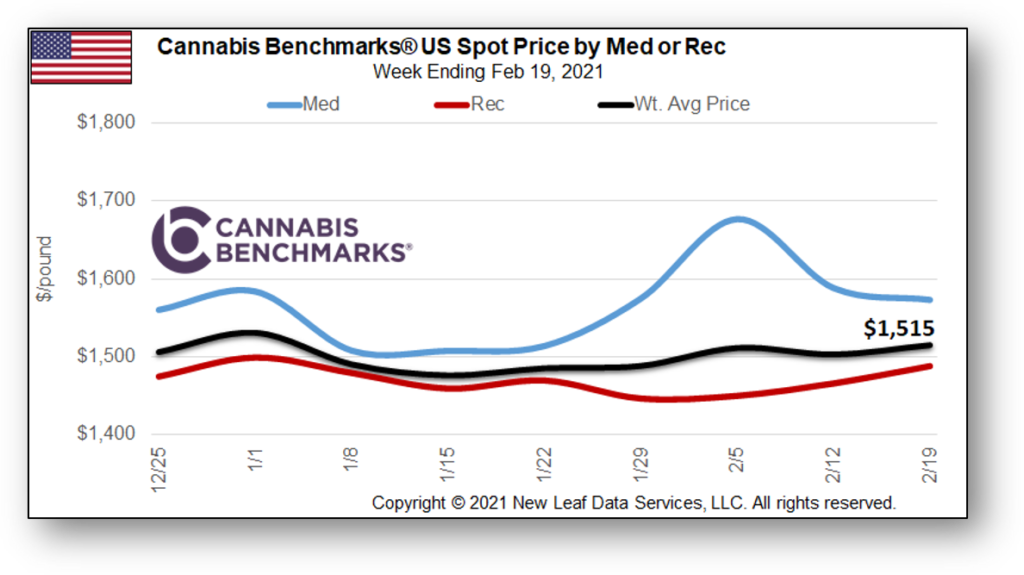

U.S. Cannabis Spot Index up 0.8% to $1,515 per pound. The simple average (non-volume weighted) price increased $3 to $1,782 per pound, with 68% of transactions (one standard deviation) in the $1,007 to $2,556 per pound range. The average reported deal size decreased to 2.4 pounds. In grams, the Spot price was $3.34 and the simple average price was $3.93.

The relative frequency of trades for indoor flower increased by 1%. The relative frequency of deals for greenhouse product decreased by the same proportion, while that for outdoor flower was unchanged.

The relative volume of warehouse flower expanded by about 2% this week. The relative volume of greenhouse product contracted by the same proportion, while that for outdoor flower was unchanged.

This week’s Premium Report analyzes new January sales data out of Oregon, Michigan, and Oklahoma. Although the aforementioned state markets are quite disparate (an over four-year-old licensed system serving both adult-use consumers and patients; regulated medical and adult-use markets that are mostly segregated and still developing; and a large, loosely-regulated medical-only system, respectively) they all reveal similar trends in demand in the opening month of 2021. Specifically, the elevated sales that manifested during the COVID-19 pandemic are persisting, albeit at levels lower than those observed in summer 2020.

While strong demand in legal cannabis systems has continued, wholesale prices are depressed relative to 2020’s peak of $1,665 per pound, observed in late October. Data from Oregon regulators shows that outdoor growers in the state boosted production volume by over 30% from 2019 to 2020. This despite the record-breaking wildfires that burned areas of Oregon home to intensive cannabis cultivation right as the harvest period was approaching. Given this data, as well as previous anecdotal reports from other West Coast states, it is likely that outdoor growers in California and Washington were also able to bring in their fall crops for the most part and that 2020’s outdoor harvest was robust overall in terms of volume. Still, it should be noted that retail sales revenue in Oregon increased at a significantly faster rate than production volume from 2019 to 2020 – sales rose about 45% compared to the over 30% expansion in harvest volume – which may lead to rising supply side rates in the months to come as demand picks up in the spring and summer.

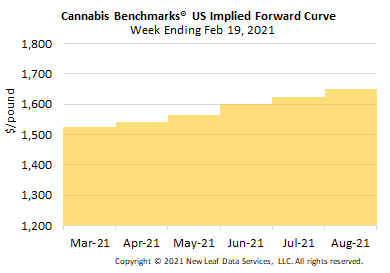

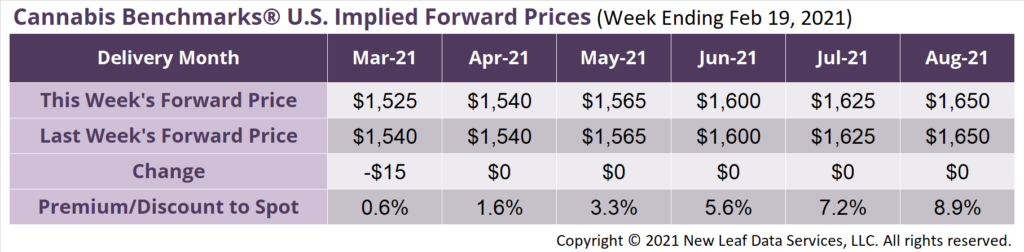

March 2021 Implied Forward down $15 to $1,525 per pound.

The average reported forward deal size was 39.8 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 53%, 36%, and 11% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 53 pounds, 24 pounds, and 25 pounds, respectively.

At $1,525 per pound, the March Implied Forward represents a premium of 0.6% relative to the current U.S. Spot Price of $1,515 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Recently-Introduced Bill Projected to Expand Licensed Cannabis Market by Providing Regulatory Support to Local Governments

Oregon

January 2021 Sales Rise 4% from December 2020 to Over $100 Million; Production Also Up Significantly YoY

Michigan

Both Adult-Use and Medical Sales Rose in January 2021 to Reach Combined Tally of Over $108 Million; Retail Flower Prices Drop in Both Market Sectors

Oklahoma

Steady, Strong Demand Continued Into 2021 with Almost $75 Million in Medical Cannabis Sales in January