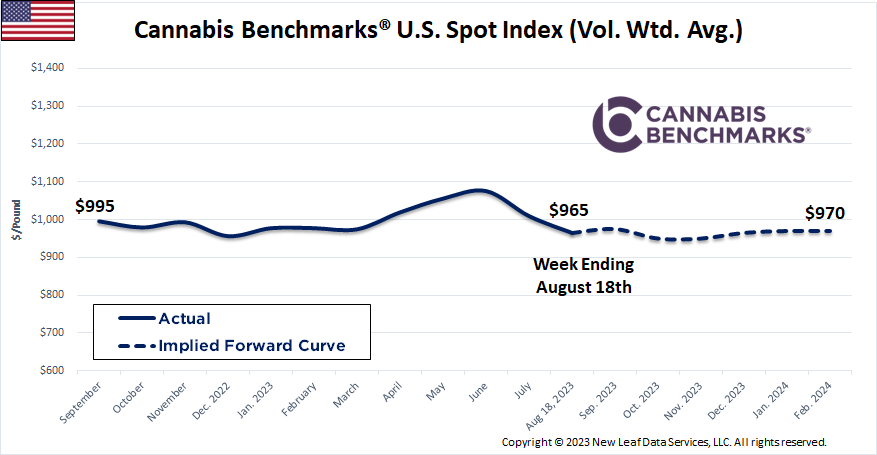

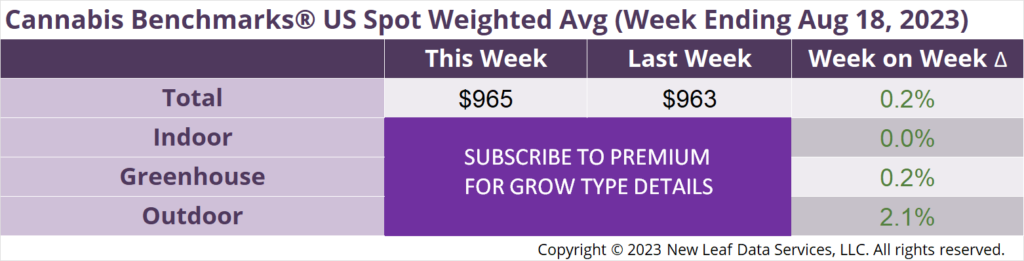

The U.S. Cannabis Spot Index increased 0.2% to $965 per pound.

In grams, the Spot price was $2.13.

The U.S. Spot wholesale flower price was essentially flat this week, blunting the downward momentum that has characterized its movement since the start of June. National prices for indoor and greenhouse-grown flower were stable as well, while outdoor product’s price ticked up 2.1%.

This week’s uptick in the U.S. wholesale flower price was driven almost entirely by rising prices in the West Coast markets. We noted recently that state data out of Oregon shows summer harvests on the West Coast began in July this year, about a month earlier than last year due to a relatively wet and cold spring in the region in 2022. In this week’s Premium report, we examine the Q2 financial disclosure from Glass House Brands, California’s largest greenhouse cultivator, which reported massive production for the period spanning spring and early summer and predicted comparable output for the current quarter.

In the past, fresh product from sun-grown summer harvests has been observed to garner higher prices for a time, lifting average wholesale prices for a bit until the swell of supply eventually pushes them down. Glass House’s financial disclosure noted that the company was able to sell wholesale for 17% higher prices on average in Q2 than in Q1, which broadly tracks with our own price assessments for the Golden State.

Oregon’s climbing composite price was due to upticks in average rates for greenhouse and outdoor product. A report this week from a licensed grower in the state notified us that over 20% of their recently-tested batches of flower failed required tests for aspergillus. The operator chose to destroy the product rather than incur additional costs for remediation and retesting. Prior to July, official data out of Oregon showed that production in the state was down relative to a year ago. It appears that the relatively new required tests are pinching reduced supply further.

Looking at other sizable adult use markets, Massachusetts was the only one to see an uptick in its spot wholesale price this week. July market data out of Michigan, analyzed in detail in our Premium report, shows that flower sales volume slipped in the month and that an outdoor crop significantly larger than last year’s is progressing toward harvest.

Illinois’ wholesale flower prices resumed their fall from the rarefied heights in which they dwelt previously. In reviewing the recent financial disclosures of publicly-traded cannabis companies, multiple firms stated that they were refocusing their efforts on limited license markets such as Illinois, with 4Front in particular touting the expansion of their production footprint in the state. With multi-state operators (MSOs) abandoning mature Western markets and doubling down on limited license states with higher prices, it’s likely spot rates in relatively expensive state markets will continue lower, especially as a number of MSOs continue to carry large debt loads scheduled to come due in the near future.

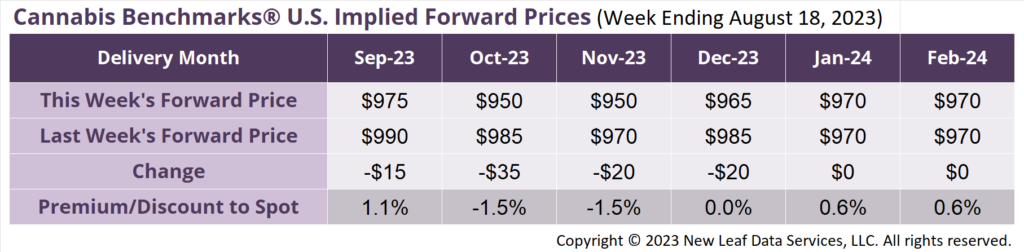

September 2024 Implied Forward assessed down $15 to $975 per pound.

At $975 per pound, the September 2023 Implied Forward represents a premium of 1.1% relative to the current U.S. Spot Price of $965 per pound.

Glass House Posts Massive Q2 Production Increase

Sales See First May-June Rise Since 2020

Wholesale Prices Creeping Up, but Outdoor Harvest Looms

New Production Sluggish to Enter Market, Wholesale Prices Climbing