Image: Ndispensable/Unsplash

Image: Ndispensable/Unsplash

March 19, 2024

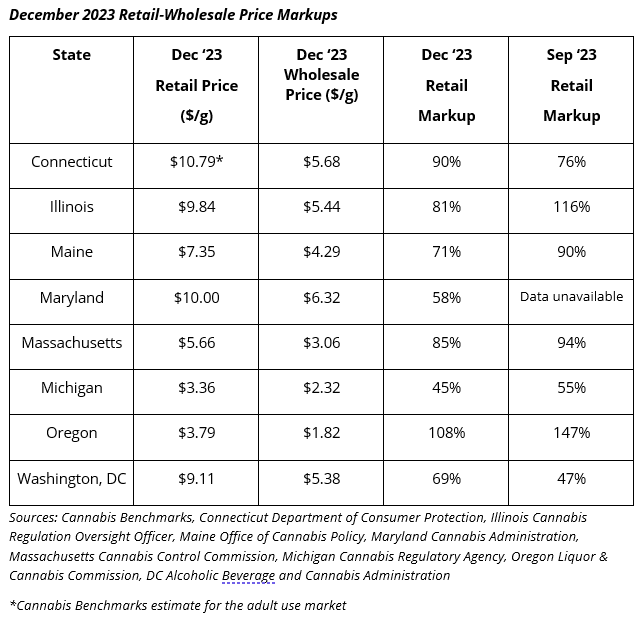

Several states cannabis regulators provide data on the average retail price for cannabis flower in their respective markets, allowing us to compare them with Cannabis Benchmarks wholesale price assessments to discover average retail markups. The data shows retail markups for cannabis flower vary greatly between different state markets. Volatility in wholesale flower prices also means that retail markups can fluctuate significantly within state markets over time.

Below, we examine data on retail markups for cannabis flower from selected legal markets. Specifically, we compare average markups for the end of Q3 2023 with those from the final month of Q4 2023 and provide context for the differences across states.

Cannabis Flower Retail Markup Data

The table below shows average retail and wholesale flower prices for December, along with the retail markups in each market and how they compare to the prior quarter.

Markups contracted nearly across the board in the states under consideration, with Connecticut and Washington, DC being the only exceptions. In the other markets, retail prices generally declined, likely owing to holiday-season promotions and sales. Meanwhile, average wholesale prices were on the upswing as markets seemed to be weighing reports of pullbacks in production relative to what the 2023 autumn harvest actually brought to market.

State-by-State Details

- Despite a end-of-year spike in wholesale prices in Connecticut, December 2023’s average spot flower price was down about 9% from September 2023. Meanwhile, retail prices have been steadier, according to our estimates based on state data, declining by under 2% in the same span. Connecticut will presumably see more supply enter its relatively young adult use market eventually and, if wholesale prices return to the range they occupied before the recent price spike, markups may expand once again. On the other hand, with increasing numbers of retailers entering the market, retail prices will likely see continued downward pressure as well.

- The robust markup observed in Illinois’ adult use market as of the end of Q3 2023 contracted a bit to close last year. We’ve pointed out that increasing numbers of retailers that are not owned by the large multi-state operators that control nearly all of the cultivation capacity in the state are opening for business, bringing increased competition to the retail side of the market. As of late January, 72 social equity retailers had received permission to operate, up from 50 as of late September 2023.

- We began reporting on wholesale flower prices in Maryland in December 2023. While we don’t have the data to compare to previous periods, retail markups on cannabis flower in Maryland’s relatively new adult use market came in as one of the lowest of the states we analyzed. Retailers are likely attempting to keep prices somewhat competitive in order to build and maintain a customer base, even as wholesale prices are at high levels less than a year after the market opened.

- Massachusetts wholesale flower prices were largely steady from September to December 2023, with an increase of only $0.01 per gram observed in that time. However, retail prices continued to see erosion, though downward momentum on that front has subsided a great deal compared to a year ago.

- Relatively slim markups in Michigan got even thinner in December 2023. As in Massachusetts, wholesale prices saw a small uptick, but most of the contraction in the average retail markup was due to persistently softening retail prices in another highly competitive, unlimited license market.

- Oregon retailers maintained 100%+ markups on average in December 2023, but they shrank by over a third compared to three months prior. Retail flower prices came down in Oregon from September to December 2023, but smaller markups in the Beaver State were due primarily to an unexpected wholesale price rise during Q4. As we’ve covered, there was significant talk in the Oregon industry of production pullbacks by outdoor growers in 2023 and harvest data from the summer seemed to support such statements. However, a large October harvest brough 2023’s overall production in line with 2022’s and buried hopes of relief from the state’s perpetual cannabis oversupply.

Conclusion

The lack of a pronounced seasonal wholesale price drop in many markets in Q4, combined with persistent retail price erosion, led to widespread contraction in retail markups on cannabis flower to close 2023. While December sales were up overall across many state markets, to record-setting levels in some cases, the above data indicates that retailers generally did not do as well from a financial perspective compared to a quarter earlier.

We pointed out in our prior analysis that seasonal and event-driven movement in cannabis prices means that markups within states will surely change over time. Analyzing retail markup data for cannabis flower and other products using Cannabis Benchmarks’ proprietary wholesale price data is an effective way of investigating and evaluating opportunities in different legal cannabis markets.

Image: Ndispensable/Unsplash

Image: Ndispensable/Unsplash