Image: James Morden/Unsplash

Image: James Morden/Unsplash

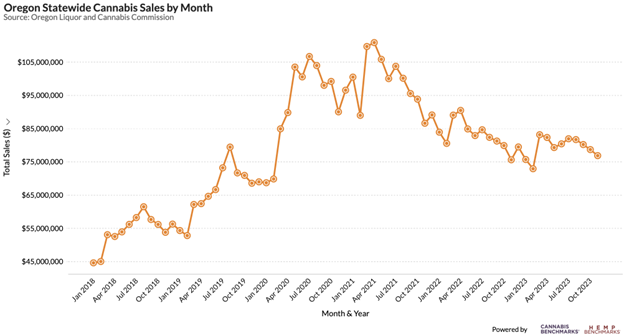

The Oregon Liquor and Cannabis Commission (OLCC) this week issued sales data for November 2023. November saw licensed retailers tally $76.8 million in sales, down 2.5% from October sales of under $78.7 million, but up 1.6% from sales of almost $75.6 million in November 2022.

Overall statewide sales are illustrated in the chart below. We noted last month that year-on-year losses are narrowing and this month saw an increase from the year prior. Monthly sales continue to track between $75 and $85 million, a range first established in May 2022. (February sales, at under $72.9 million, would be within the aforementioned range if the month had 30 days based on average daily sales.)

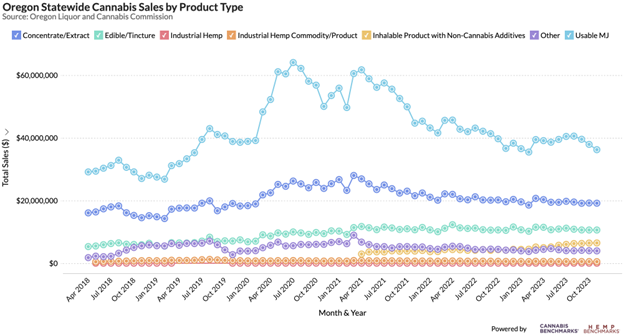

A breakdown of November sales by the major product types delineated by OLCC is as follows:

The median retail price for a gram of usable marijuana was essentially stable from October to November 2023, rising just $0.01 to $3.82 per gram in the latter month. November 2023’s median retail price is off 6.4% year-on-year, from $4.08 per gram in November 2022.

Median retail prices for concentrates and extracts slipped a few cents to $15.97 per gram. Previously, they had held at $16.00 per gram for the fourth straight month in October. Median concentrate prices were also recorded at $16.00 per gram in November 2022.

Retail flower prices have declined and concentrate prices were flat year-on-year, while overall sales revenues were up in the same span, indicating expanding sales volume.

November 2023’s total harvest volume – encompassing indoor, outdoor, and mixed light licensees – was 670,257 pounds of wet weight, down 36.6% from November 2022’s total harvest of 1,057,107 pounds.

A breakdown of November harvest data by producer type is as follows:

Cumulative harvest totals from July through October can better gauge how seasonal outdoor production in 2023 stacks up against prior years.

With November 2023’s harvest data accounted for, the numbers show that the volume of sun-grown product harvested in the summer and autumn this year was comparable to last year. October 2023’s roughly 15% year-on-year harvest volume increase discussed last month was largely due to timing, which was impacted by weather in 2022; specifically, a cold, wet spring forced outdoor growers to plant later than usual.

Still, in an oversupplied market, steady levels of production combined with modest sales volume growth means that oversupply will persist going into 2024.

The recent downturn in Oregon’s aggregate spot wholesale flower price has been driven primarily by notable declines in prices for indoor and greenhouse flower. Outdoor flower, on the other hand, has seen a modest downtrend from late October, with prices for the grow type in recent weeks holding at levels higher than those observed earlier this year.

While outdoor flower prices are holding firm for the time being, awareness of the fact that this year’s fall harvest is just as large as last year’s may be working to drive down rates for indoor and greenhouse flower. With plentiful fresh outdoor product on the market, buyers may have regained some power relative to just several weeks earlier, when many expected this year’s crop to come in significantly lighter.