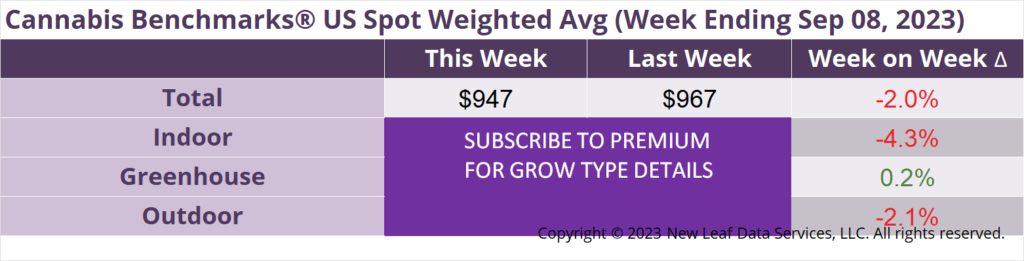

The U.S. Cannabis Spot Index decreased 2.0% to $947 per pound.

In grams, the Spot price was $2.09.

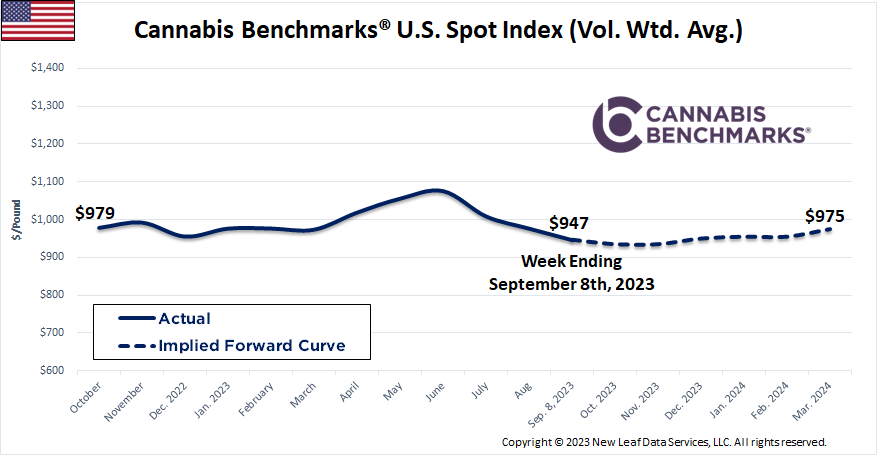

The U.S. Spot Index headed lower again this week, falling to a historic trough of $947 per pound, just below the previous low point of $950 observed in December 2022. The national spot wholesale price twice bounced off the $950 per pound floor earlier this year before a spring rally provided a respite from the downtrend that began over two years ago at this point. That the U.S. spot has slipped below the previous price floor, combined with the time of year, indicates that rates are set to slide even lower.

Indeed, the second half of each of the previous two years has been marked by sliding prices, a trend that is forming once again this year. Similar to this year, the U.S. spot peaked in June in 2021 and the current rate of decrease in the national wholesale price is comparable to that recorded two years ago. In 2021, the U.S. spot declined by just over 20% from its June high to its low point in early December. A decrease of the same magnitude this year would put the national wholesale flower price down around $870 toward the end of 2023.

However, given the dramatic price erosion that’s already occurred in the past two years, it’s unlikely that a decline of the magnitude of 2021’s is in the offing this year. While familiar states are leading the charge downward – primarily California, Colorado, and Oregon – there have been notable pullbacks in production or decreases in capacity in all of the aforementioned markets:

While sales in terms of revenue are down compared to 2021, this is due in large part to significantly lower prices across essentially all state markets. Official data out of Oregon and several other states indicates that demand in terms of volume or units sold is firming and even growing in some cases. As such, markets appear better positioned to absorb the seasonal supply surge this autumn and winter, especially as it will be reduced compared to recent years.

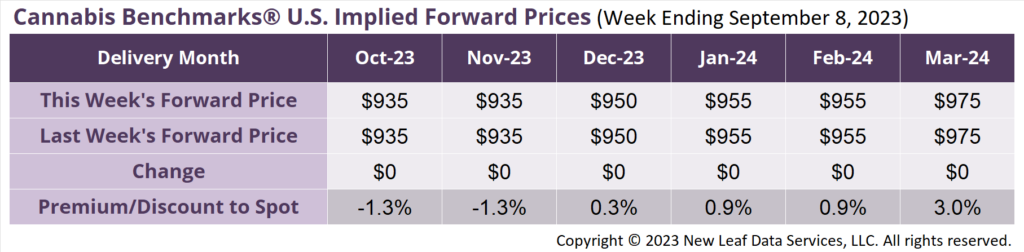

October 2023 Implied Forward unchanged at $935 per pound.

At $935 per pound, the October 2023 Implied Forward represents a discount of 1.3% relative to the current U.S. Spot Price of $947 per pound.

July-August Harvest Volume Down 24% YoY

Wholesale Price Slide Coincided With New Retailers Entering Market

Licensed Outdoor Canopy Up Over 7X from Two Years Ago

Demand Stabilizing but Wholesale Prices Hit All-Time Low