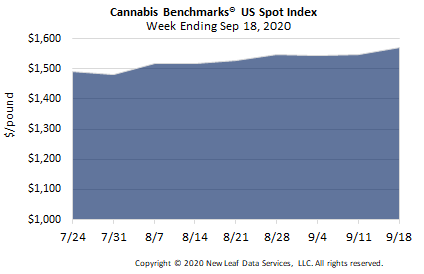

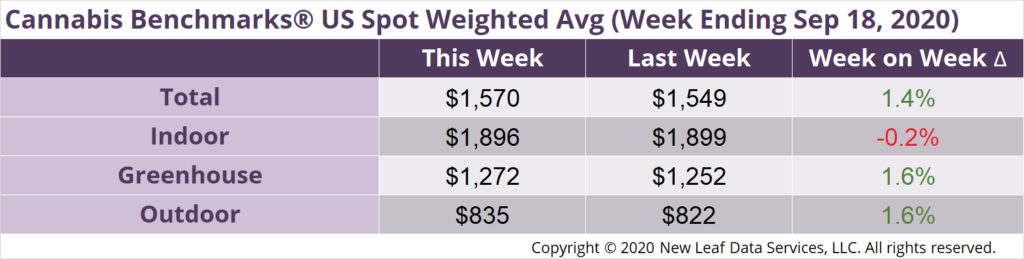

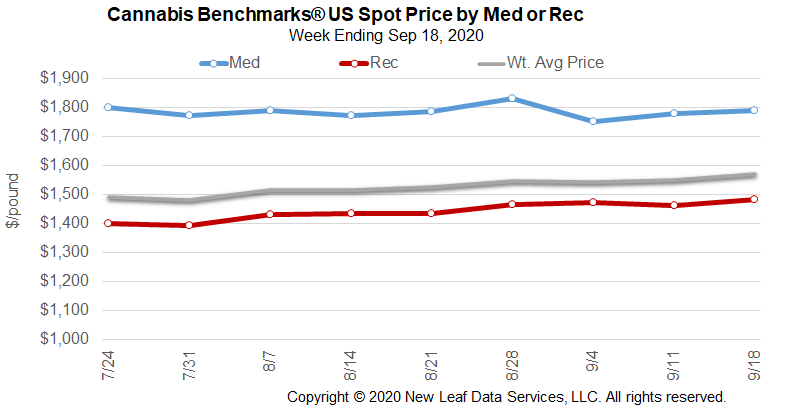

U.S. Cannabis Spot Index up 1.4% to $1,570 per pound.

The simple average (non-volume weighted) price increased $3 to $1,796 per pound, with 68% of transactions (one standard deviation) in the $953 to $2,638 per pound range. The average reported deal size increased to 2.3 pounds. In grams, the Spot price was $3.46 and the simple average price was $3.96.

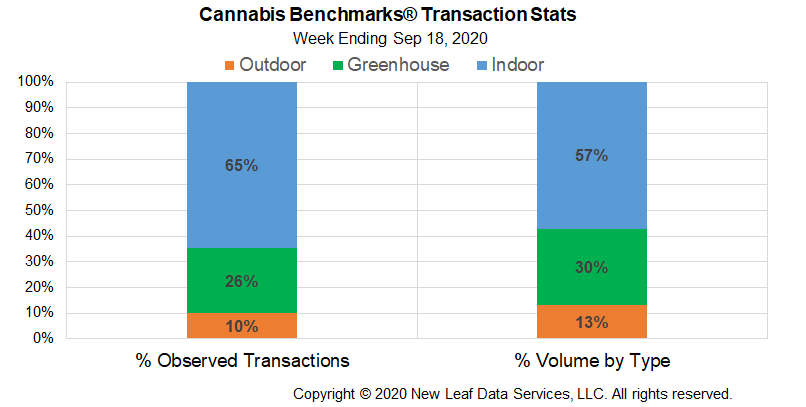

The relative frequency of trades for greenhouse flower decreased by almost 3% this week. The relative frequencies of transactions for indoor and outdoor product increased by about 2% and 1%, respectively.

The relative volume of warehouse product expanded by 2%. The relative volumes of greenhouse and outdoor flower contracted by 1% each.

New sales data out of several states this week affirms what we noted in last week’s report: the robust demand for legal cannabis that has manifested during the pandemic persisted in August, despite the cessation of federal relief to individuals and businesses.

Oregon, Michigan, and Illinois officials all reported strong revenues, with a new record for total adult-use and medical sales established in the latter market. In Oregon and Michigan, however, August revenues were down a bit from the month prior, suggesting that retail demand may be reaching a momentary peak. Looking back to July, Colorado regulators this week reported record-breaking sales for that month.

While demand remains very strong, the unprecedented wildfires burning on the West Coast have put the size and quality of the autumn harvest in question. Reports out of California this week state that fires have forced evacuations in the state’s famed Emerald Triangle.

On top of fires destroying grow sites or product becoming unmarketable due to damage from smoke and other debris, disruptions in the supply chain will almost certainly occur. In Oregon, reports of cannabis businesses of all types being destroyed have surfaced, including testing labs and processors that are necessary for product to flow from farm to retail. Consequently, even if enough marketable product to meet demand is generated ultimately, temporary “shortages” could develop as market participants work to move inventory through damaged supply chains.

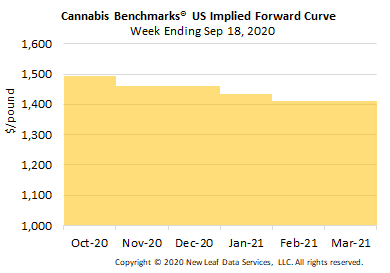

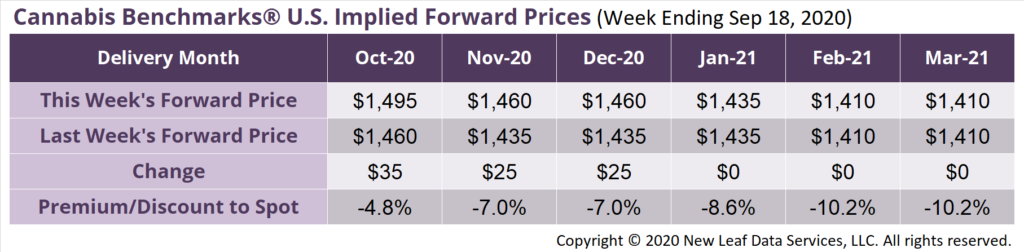

October Forward assessed up $35 to $1,495 per pound.

The average reported forward deal size was 27 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 38%, 37%, and 25% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 30 pounds, 23 pounds, and 30 pounds, respectively.

At $1,495 per pound, the October Forward represents a discount of 4.8% relative to the current U.S. Spot Price of $1,570 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Wildfires Reportedly Pushing Toward Emerald Triangle, Some Farmers Forced to Evacuate

Colorado

July Sales Rise to New Record; Total Adult-Use and Medical Revenues Top $225 Million

Oregon

Sales Dip Slightly in August, Suggesting Demand Possibly Reaching a Plateau

Michigan

Total Sales Down Slightly in August to Under $109 Million on Decrease in Medical Market, Slowing Growth in Adult-Use Sector

Illinois

Combined Adult-Use and Medical Sales Exceed $95 Million in August, a New Record