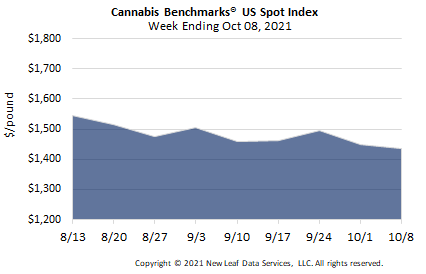

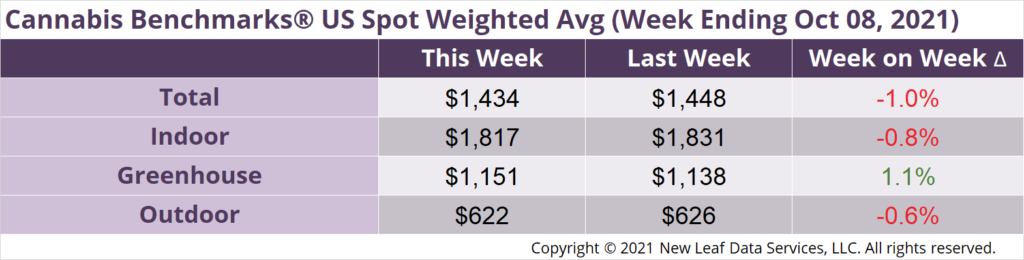

U.S. Cannabis Spot Index decreased 1.0% to $1,434 per pound.

The simple average (non-volume weighted) price decreased $3 to $1,691 per pound, with 68% of transactions (one standard deviation) in the $849 to $2,533 per pound range. The average reported deal size was 2.2 pounds. In grams, the Spot price was $3.16 and the simple average price was $3.73.

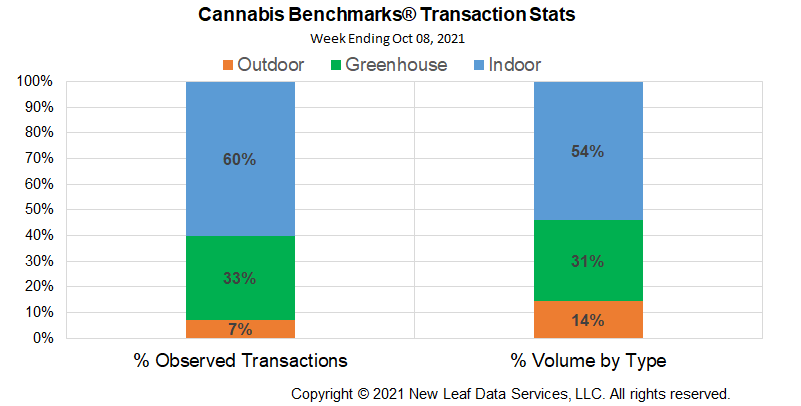

The relative frequency of transactions for indoor flower was unchanged this week, as were those for deals for greenhouse and outdoor flower.

The relative volume of indoor product was unchanged this week. The relative volume of greenhouse flower fell about 2% and the relative volume of outdoor product rose by roughly 1%.

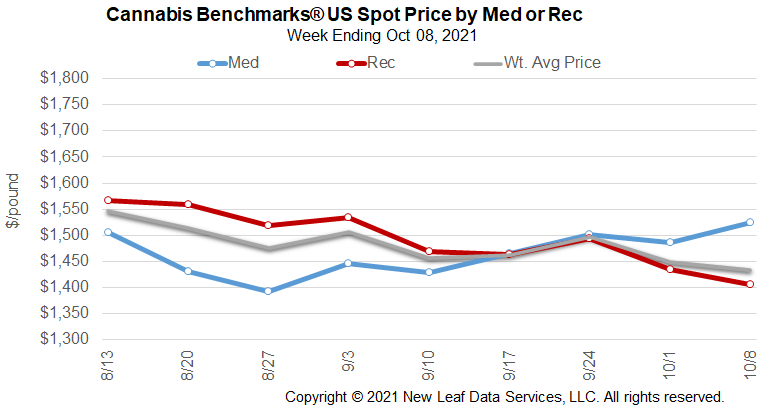

The U.S. Spot is trading at $1,439 per pound, a level not seen since June 2020, as the downturn in Western states with large trading volumes weighs on the index. The national Spot entered into the current downtrend in earnest in August 2021 when it failed to hold levels over $1,600 for the third time this year. Market ‘tops’ are very useful when deciding when to buy or sell product. They provide ‘resistance’ on the topside so that buyers might purchase large quantities of product below the $1,600 figure, while sellers might sell product as it approaches the $1,600 level. More speculative market buyers will ‘chase the market’ if price rallies through triple-top resistance above $1,600.

On the downside, sellers might see the current sell-off as reason to dump inventory as price races lower each week. One effect of dumping product on a falling market is that eventually the market ‘clears;’ that is, sellers have sold the inventory they needed to sell and the downward pressure eases. Bargain hunters will come in and buy the market back up and price equilibrium, and a price range, will be established.

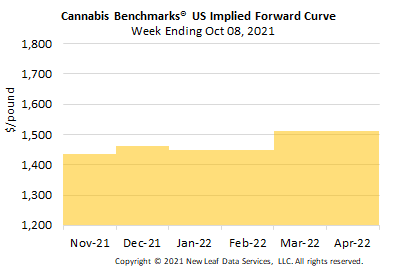

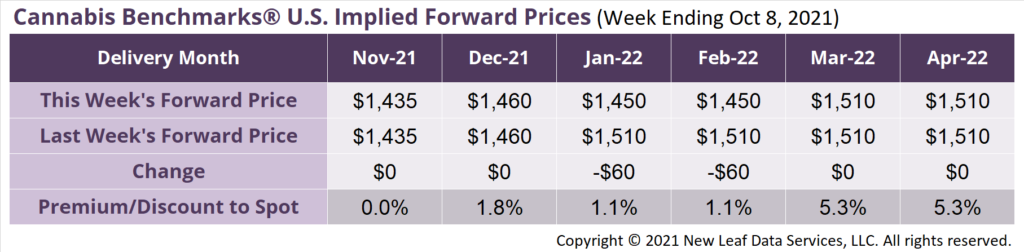

November 2021 Implied Forward unchanged at $1,435 per pound.

The average reported forward deal size was 62 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 38%, 44%, and 17% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 93 pounds, 48 pounds, and 29 pounds, respectively.

At $1,435 per pound, the November Implied Forward is nominally flat relative to the current U.S. Spot Price of $1,434 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

New State Report Details Soaring Sales in 2020

Oregon

Robust Supply and Stagnating Sales Continue to Weigh on Price

Nevada

Sales Turn Higher in July

Illinois

September Sales Slip but Still Top $121 Million