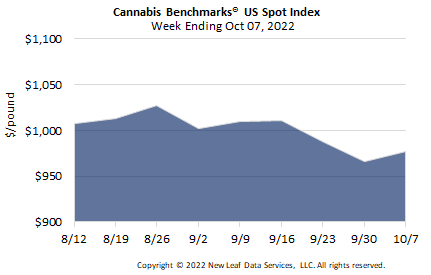

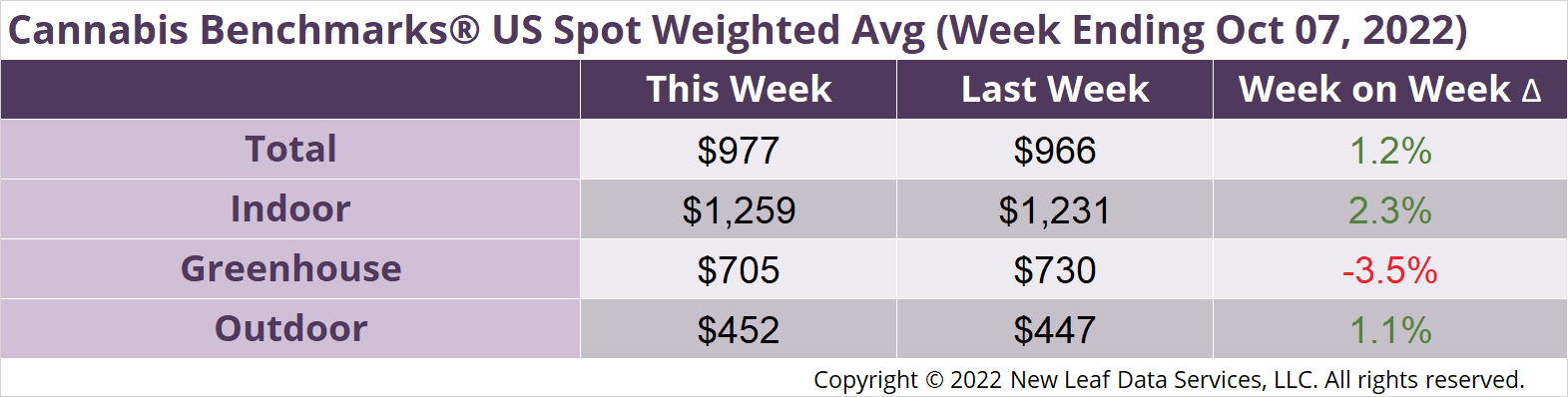

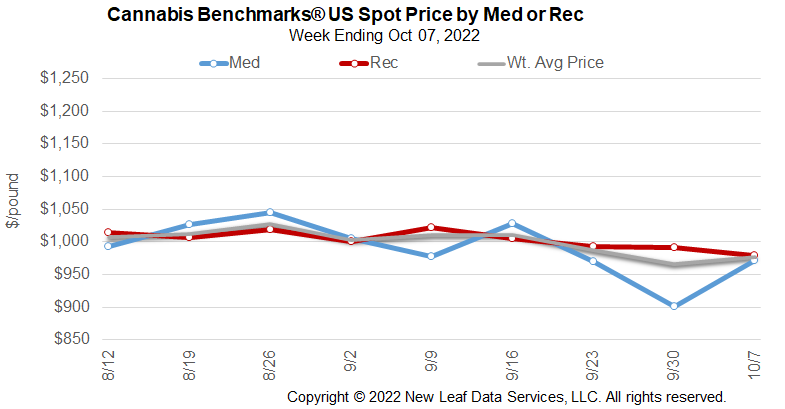

The U.S. Cannabis Spot Index increased 1.2% to $977 per pound.

In grams. The simple average (non-volume weighted) price increased $4 to $1,209 per pound, with 68% of transactions (one standard deviation) in the $531 to $1,887 per pound range. The average reported deal size decreased to 2.7 pounds. In grams, the Spot price was $2.15 and the simple average price was $2.67.

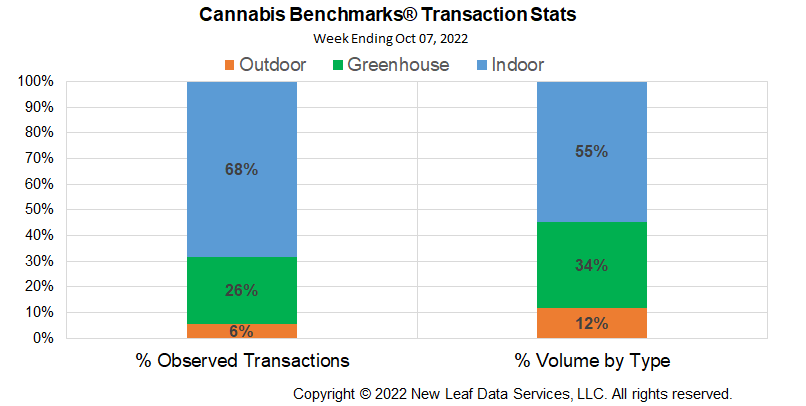

The relative transaction frequency of indoor product was unchanged this week, as were those of greenhouse and outdoor product.

The relative volume of indoor product rose 1%, as did that of greenhouse flower. Outdoor flower’s relative volume fell 1% this week.

The U.S. Spot price inched up $11 this week amid what can only be described as an epic sell-off in cannabis prices across much of the nation. The Cannabis Benchmarks Spot Index is down 27.6% this year and is down 39.3% since August 2021 when, as far as the market for cannabis prices is concerned, elevated pandemic demand ended.

Legacy states mostly found the pandemic demand ended in June (Washington State and Colorado) or July (California and Oregon) if the peak prices in those markets for 2021 is any guide. In fact, historic events often define markets in their time, but analysts driven by technical indicators look through the other end of the telescope, seeing market movement as a predictor of events.

For example, the largest cannabis ETF, MSOS, jumped 30% yesterday after President Joe Biden’s announcement of pardons and a review of cannabis’ schedule 1 status, but technicians would say the bottom of the current sell-off in this cannabis stock ETF was reached on Friday, September 30, 2022, when the market reversed higher and was followed by more gains on Monday. President Biden’s announcement came at the close of the market yesterday, but traders were still able to push MSOS up 30% in the last few seconds of trading and in the aftermarket. While MSOS will undoubtedly give back some of yesterday’s gains, the market technicians that acted on the reversal last Friday are the biggest winners.

The question now is – can cannabis prices get off the floor? While there is not ample evidence the cannabis price crash is over, some states are showing a bit of life to the topside. Oregon spot cannabis prices created a bottom of sorts in mid-June and have since added $131 to the spot price. Of course markets are not all about technicals – statistics, retracements, chart formations – they are often about the dovetailing of technicals with fundamentals. Oregon has some fundamentals going on but it is not yet clear where the market will shake out, as discussed in the interview with a state cannabis industry group leader found in this week’s Premium Report.

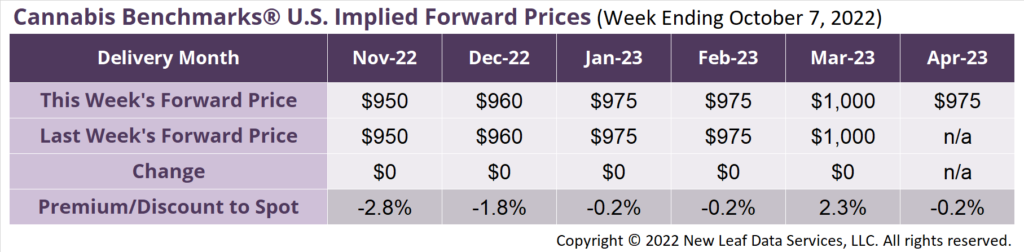

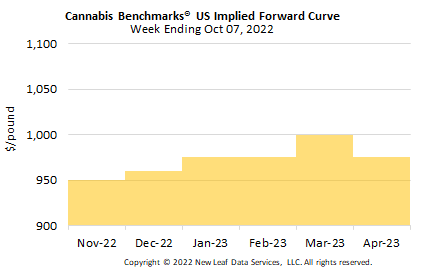

April 2023 Implied Forward initially assessed at $975 per pound.

The average reported forward deal size was 74 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 52%, 34%, and 14% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 81 pounds, 69 pounds, and 64 pounds, respectively.

At $950 per pound, the November 2022 Implied Forward represents a discount of 2.8% relative to the current U.S. Spot Price of $977 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.