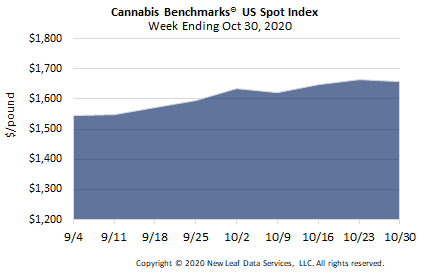

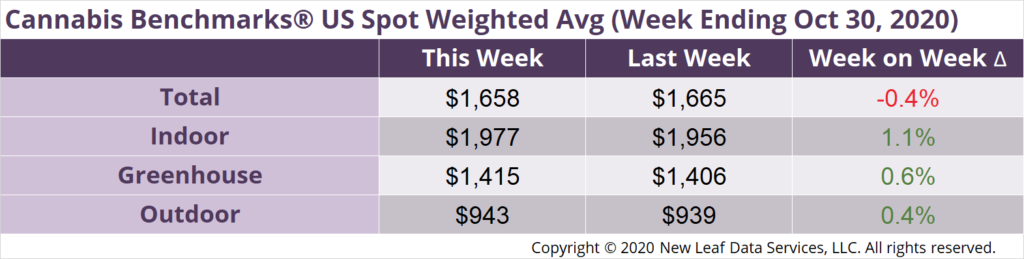

U.S. Cannabis Spot Index down 0.4% to $1,658 per pound.

The simple average (non-volume weighted) price decreased $9 to $1,870 per pound, with 68% of transactions (one standard deviation) in the $1,105 to $2,636 per pound range. The average reported deal size was nominally unchanged at 2.2 pounds. In grams, the Spot price was $3.66 and the simple average price was $4.12.

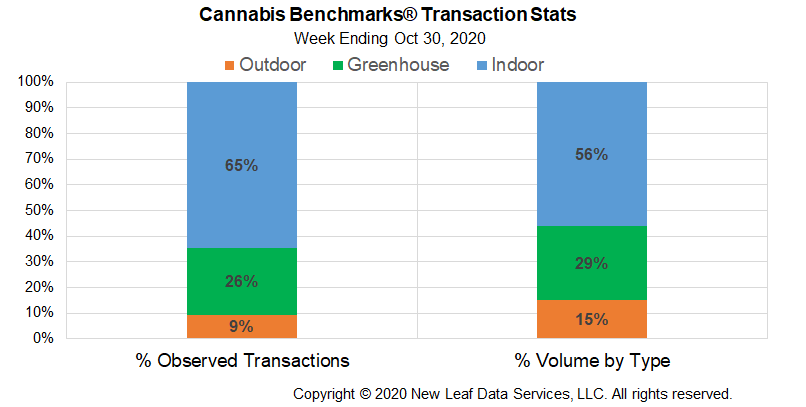

The relative frequencies of trades for each grow type were essentially unchanged from last week.

The relative volume of outdoor flower grew by about 3% this week. The relative volumes of indoor and greenhouse product contracted by about 2% and 1%, respectively.

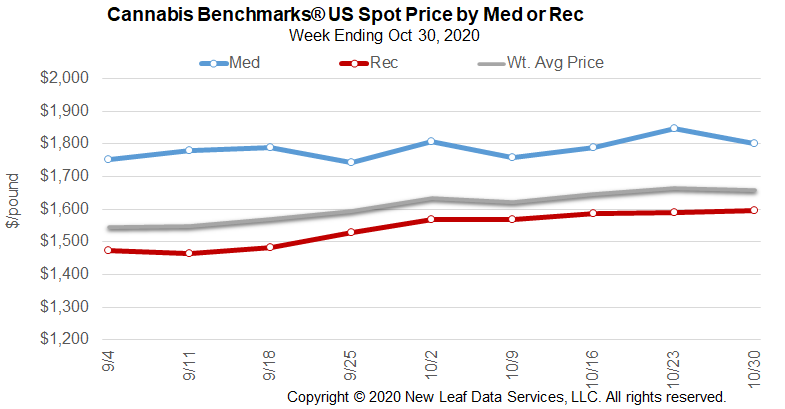

The U.S. Spot Index averaged $1,645 per pound this month, up 5.2% from September. October 2020’s national mean composite price is the highest observed since April 2017; it also represents a year-over-year increase of 14.9% relative to October 2019. The U.S. Spot and state-level Spot Indices for most major markets have been trending upward for much of the time that the COVID-19 pandemic has been with us. This week’s national composite rate is up by 22.2%, or roughly $300, from March 27, by which time most of the sizable state markets covered in our reporting had enacted stay-at-home orders.

We have noted that there is some uncertainty regarding this year’s fall outdoor harvest due to the wildfires that ravaged the West Coast. It should also be pointed out that indoor production will likely see a boost with the help of cooler weather. Summer heat can strain climate control systems and negatively impact yield and product quality; and this summer saw record-breaking temperatures in numerous regions of the country, including the major markets on the West Coast and in Colorado, as well as in Arizona.

Recent demand trends show sales plateauing in recent months, albeit at elevated levels. Increased supply from both outdoor and indoor growers may help moderate wholesale price increases. However, with the coronavirus surging across the country, increased restrictions and possibly even new shutdowns could result in consumers diverting disposable income from disallowed activities to cannabis, behavior that was likely a big contributor to earlier sales growth.

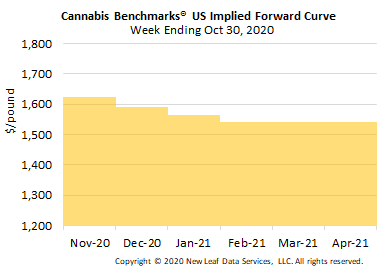

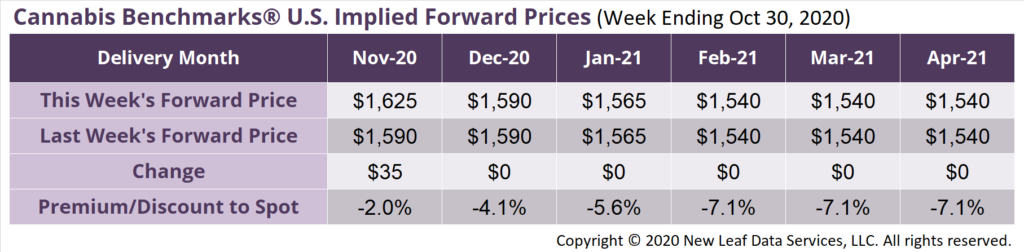

November Forward closes up $35 to $1,625 per pound.

The average reported forward deal size increased to 23 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 39%, 38%, and 24% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 27 pounds, 17 pounds, and 24 pounds, respectively.

At $1,625 per pound, the November Forward represents a discount of 2% relative to the current U.S. Spot Price of $1,658 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

Report from Regulators Show Concentrates Commanded Increasing Market Share, Industry Consolidation Advanced in 2019

Oregon

Rise in Wholesale Prices this Year Proportionally Smaller than in 2019, Despite Record Sales

Washington

January 1, 2021 Deadline for Product Labels to Be Approved Under New Rules Approaching

Massachusetts

Additional Comment Period on Establishment of Adult-Use Delivery Licenses Opened by Officials

Legalization Updates

Arizona, Montana, Mississippi, New Jersey, and South Dakota Voters to Decide on Adult-Use and Medical Cannabis Legalization Initiatives Next Week