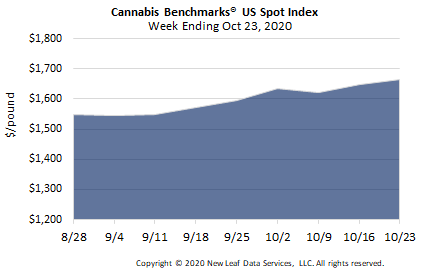

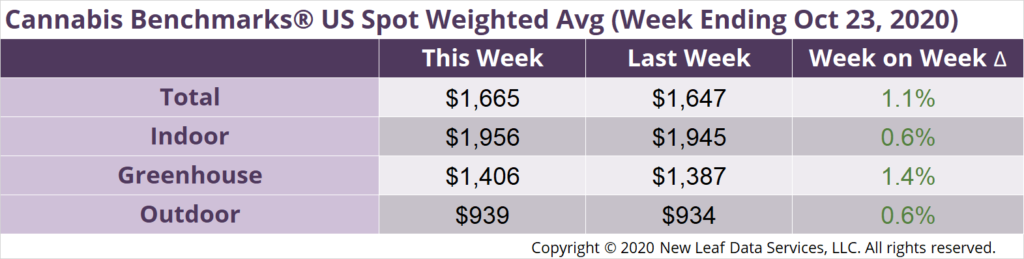

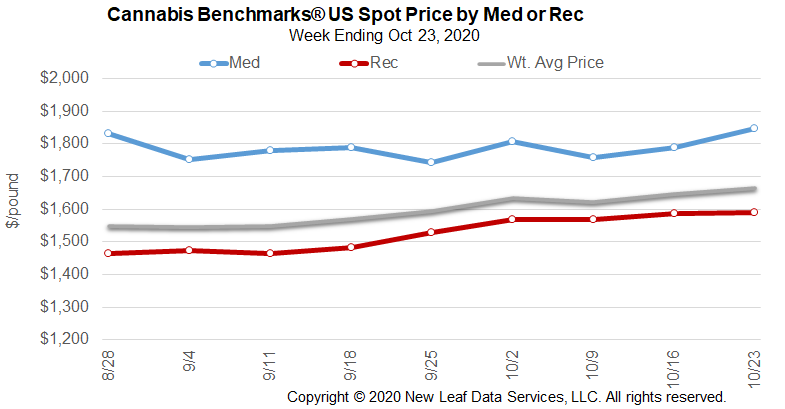

U.S. Cannabis Spot Index up 1.1% to $1,665 per pound.

The simple average (non-volume weighted) price increased $16 to $1,879 per pound, with 68% of transactions (one standard deviation) in the $1,110 to $2,648 per pound range. The average reported deal size was nominally unchanged at 2.2 pounds. In grams, the Spot price was $3.67 and the simple average price was $4.14.

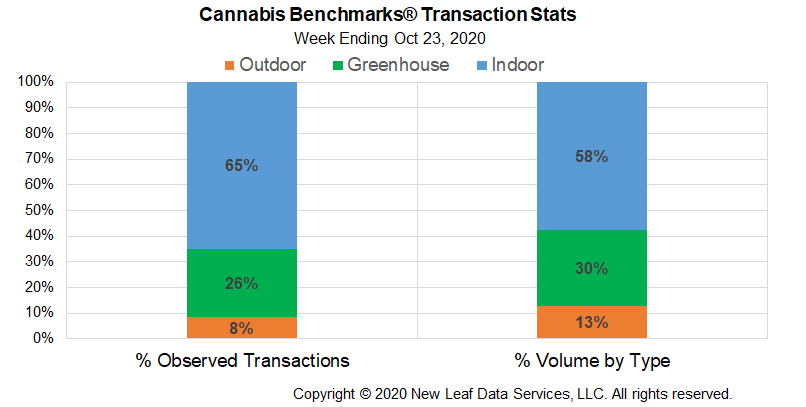

The relative frequency of trades for indoor flower increased by almost 3% this week. The relative frequencies of transactions for greenhouse and outdoor product decreased by about 2% and 1%, respectively.

The relative volumes of each grow type observed to be traded nationally were virtually unchanged from a week ago.

New data out of several states with sizable legal cannabis markets continues to show that the unprecedented sales growth enjoyed by licensed retailers this summer is cooling. Colorado saw an uncharacteristic decrease in monthly retail revenues from July to August, a phenomenon that only occurred once in the previous six years. In Michigan and Oklahoma, September sales ticked downward, the second straight decrease in monthly revenues in both states.

While sales growth appears to be slowing, demand is still elevated significantly relative to last year. Additionally, seasonal sales trends typically see decreasing monthly revenues from September through November. This year, however, the declines seen in September in the states that have reported data for that month are of relatively small proportions, compared to sometimes significant downturns from August to September in prior years. Furthermore, sales are continuing to grow in some states; both Massachusetts and Illinois saw increases in monthly revenues in September, albeit fairly modest ones compared to those documented in the summer.

All this to say, demand remains strong enough to strain supplies in both mature markets and those where production capacity is still developing; this despite the fact that monthly sales records and remarkable sales spikes are no longer occurring nearly every month, in virtually every major state market covered in our reporting, as they were just a few months ago.

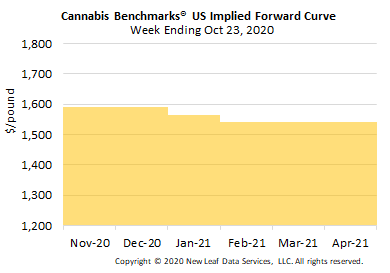

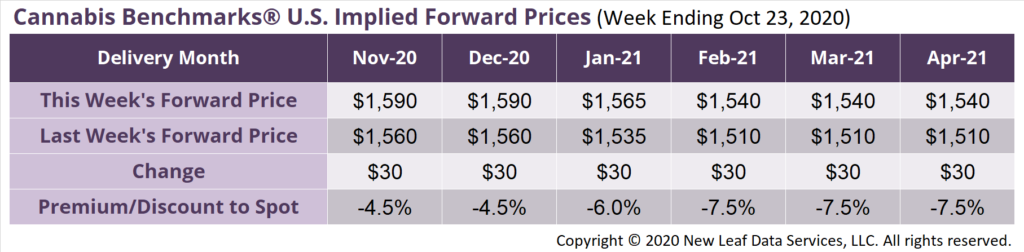

November Forward up $30 to $1,590 per pound.

The average reported forward deal size was nominally unchanged at 22 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 37%, 41%, and 27% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 25 pounds, 18 pounds, and 25 pounds, respectively.

At $1,590 per pound, the November Forward represents a discount of 4.5% relative to the current U.S. Spot Price of $1,665 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

August Sales See Month-Over-Month Decrease for Only Second Time in Seven Years

Michigan

Total September Revenues Slip, Primarily on Decline in Medical Cannabis Sales; Average Daily Sales in Adult-Use Sector Up Compared to August

Massachusetts

Adult-Use Sales Continue to Ascend in September, Approach $80 Million

Illinois

September Medical Cannabis Sales Down, but Total Monthly Retail Revenues Reach $99 Million, a New Record

Oklahoma

Medical Sales Slide for Second Straight Month in September; Active Patient and Business License Numbers Also Begin to Decrease After Previously Explosive Growth