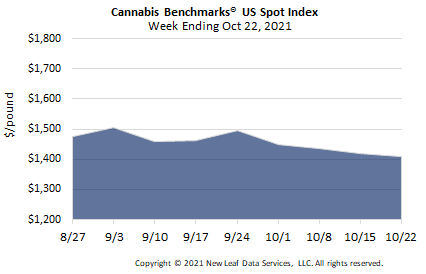

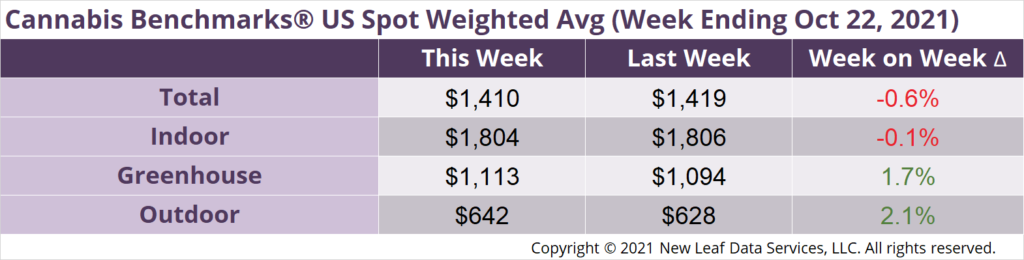

U.S. Cannabis Spot Index decreased 0.6% to $1,410 per pound.

The simple average (non-volume weighted) price decreased $3 to $1,679 per pound, with 68% of transactions (one standard deviation) in the $833 to $2,524 per pound range. The average reported deal size was unchanged at 2.2 pounds. In grams, the Spot price was $3.11 and the simple average price was $3.70.

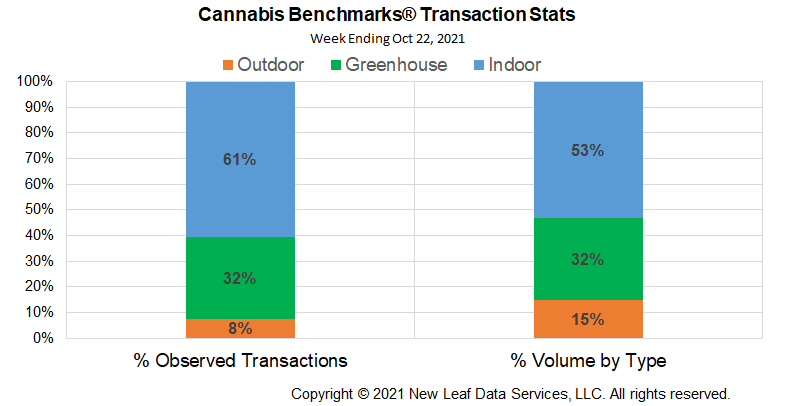

The relative frequency of transactions for indoor flower was largely unchanged this week; that for deals for greenhouse product rose about 1%, as did that for trades for outdoor flower.

The relative volume of indoor product fell 1%, as did that for greenhouse flower. The relative volume of outdoor product rose by 2% this week.

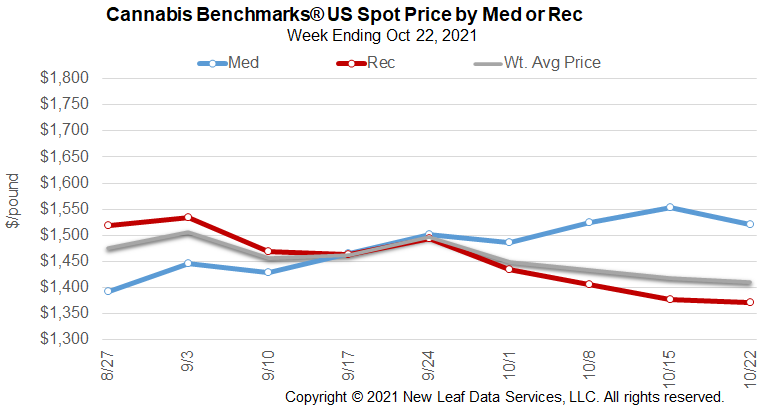

U.S. Spot Price remains under pressure with western states undergoing a significant sell-off over the past 10 to 12 weeks, even as states in other regions maintain prices at two and three times the rates seen in California, Oregon, and Washington. The eastern markets, many of which have only medical programs to date or are relatively new to the adult use market, see less volume than legacy markets in the West, but still exert enough pull on the national Spot Index to keep it above the recent convergence of western state prices.

Convergence happens when like commodities are priced differently and the market exerts pressure on prices to move them into concert with one another. In traditional crop markets, arbitrage opportunities arise very rarely and are immediately closed; buyers swoop in to buy the less expensive commodity and sell it into a like market until it is no longer profitable to do so because prices have converged.

The West Coast states are all in a downtrend that has become so persistent it has pulled the U.S. Spot Index sharply lower, yet the spread between the Cannabis Benchmarks U.S. Spot Index and those of western states has widened. The widening spread between the national price and West Coast prices suggests at least one western state may start to trade sideways, instead of downward.

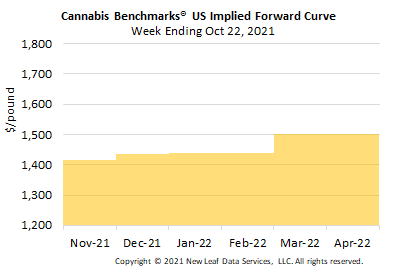

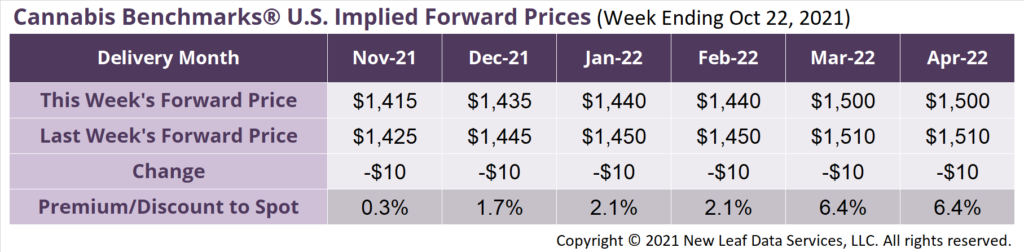

November 2021 Implied Forward down $10 to $1,415 per pound.

The average reported forward deal size was 65 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 38%, 45%, and 17% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 98 pounds, 47 pounds, and 36 pounds, respectively.

At $1,415 per pound, the November Implied Forward represents a premium of 0.3% relative to the current U.S. Spot Price of $1,410 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

National

U.S. Spot Index Price Under Pressure

West Coast

California, Oregon, Washington Cannabis Spot Prices Converge

Massachusetts

Year-to-Date Adult Use Sales Top $1 Billion

Alaska

Flower Demand Fading, Extracted Products on the Rise