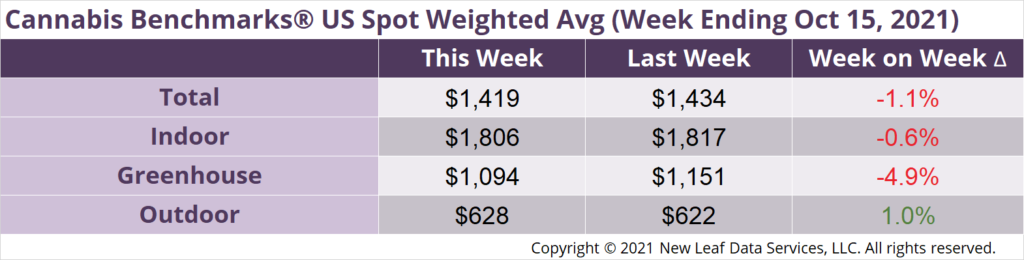

U.S. Cannabis Spot Index decreased 1.1% to $1,419 per pound.

The simple average (non-volume weighted) price decreased $9 to $1,682 per pound, with 68% of transactions (one standard deviation) in the $837 to $2,527 per pound range. The average reported deal size was unchanged at 2.2 pounds. In grams, the Spot price was $3.13 and the simple average price was $3.71.

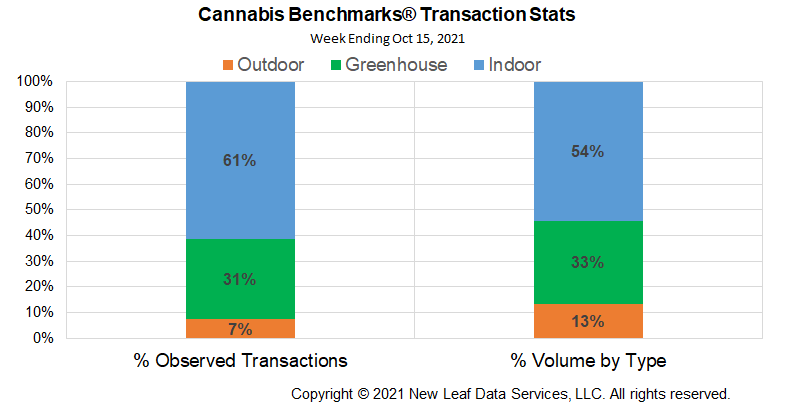

The relative frequency of transactions for indoor flower rose over 1%, greenhouse was down about 2% and outdoor was unchanged over the week.

The relative volume of indoor product was unchanged this week. The relative volume of greenhouse flower rose about 2% and the relative volume of outdoor product fell by roughly 1%.

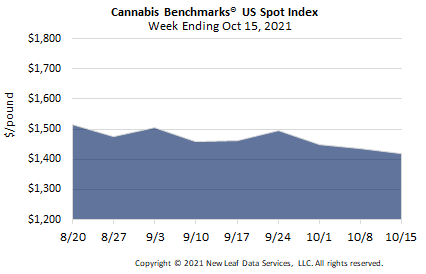

U.S. Spot prices continued their sharp downturn as legacy states suffering from oversupply issues weigh on the index price. California, Oregon, Washington, and Colorado are in what is considered a “bear market,” a downtrend that has breached all near term price supports. The oversupply in these markets is exacerbated by illicit production. Some legal growers have complained unlicensed growers continue to undermine legal prices in-state and across state lines.

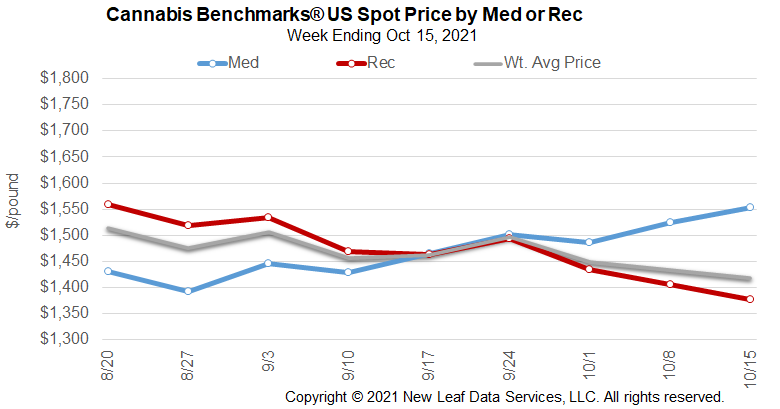

From a technical perspective, the U.S. Spot fell through the two year average price – $1,497 per pound – in early September; that level is now resistance and, not coincidentally, in a pivot price area, where price consolidates at the pivot before starting the next leg down. Support below current price is down at $1,402 per pound, a “retracement level” often used in futures markets.

What can pull U.S. spot prices out of the downtrend? A fundamental change in either supply or demand. Yet, there looks to be no scarcity in legacy markets, especially with demand plateauing. Some growers have not expressed interest in cutting back on supply, having turned their hopes to federal legalization instead. While legacy states’ prices will not directly benefit from new populous states coming on line over the next couple of years, the U.S. Spot Index trend could reverse as new states undergo a demand spiral. New York’s 19.5 million residents, plus New Jersey’s 9.5 million and Connecticut’s 3.5 million, will rival California in demand dynamics, putting upward pressure on the U.S. Spot in the first year or two after sales begin.

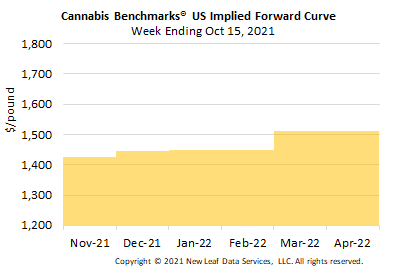

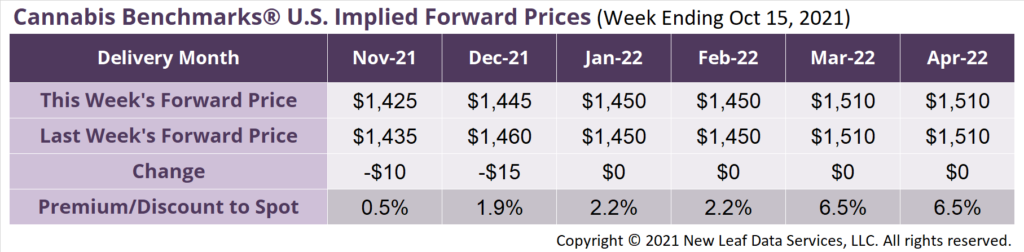

November 2021 Implied Forward down $10 to $1,425 per pound.

The average reported forward deal size was 65 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 37%, 45%, and 17% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 101 pounds, 47 pounds, and 36 pounds, respectively.

At $1,425 per pound, the November Implied Forward represents a premium of 0.5% relative to the current U.S. Spot Price of $1,419 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Monterey County Supports Growers with Tax Adjustment

Colorado

Combined Adult Use and Medical Sales on Pace to Top 2020 Total

Arizona

Adult Use Sales Continue to Lag Behind Medical

Oklahoma

Retailers Competition Weighs on Price