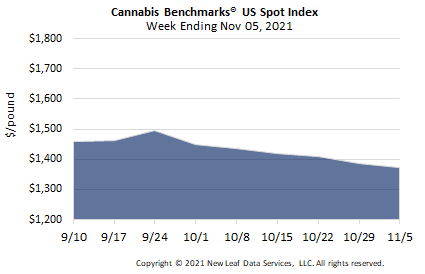

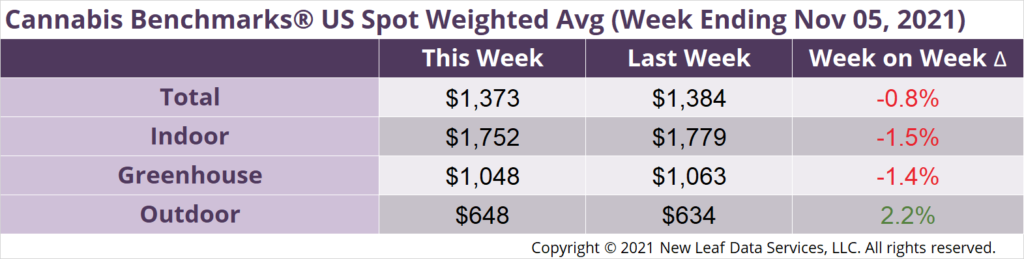

U.S. Cannabis Spot Index decreased 0.8% to $1,373 per pound.

The simple average (non-volume weighted) price decreased $11 to $1,662 per pound, with 68% of transactions (one standard deviation) in the $827 to $2,497 per pound range. The average reported deal size was nominally unchanged at 2.3 pounds. In grams, the Spot price was $3.03 and the simple average price was $3.66.

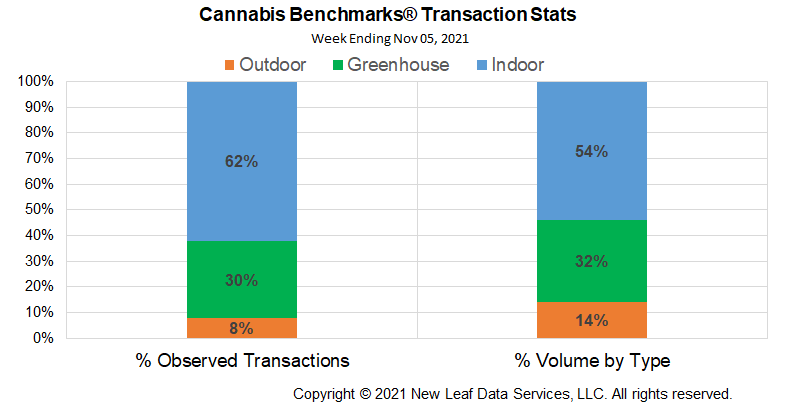

The relative frequency of transactions for indoor flower was up 1% this week while that of deals for greenhouse flower fell 2%. The transaction frequency for outdoor flower was up 1% this week.

The relative volume of indoor product was up 1%, while that of greenhouse flower fell 1%. The relative volume of outdoor product was unchanged this week.

The U.S. Spot downtrend shows no signs of reversing, with price falling over $122 per pound over the past six weeks, encompassing much of the harvest season. There is little in the way of chart based support – a lower level at which price traded previously. The nearest support level is more than $50 away at $1,322 per pound, after which support lies at $1,227, $1,137, and $991 per pound.

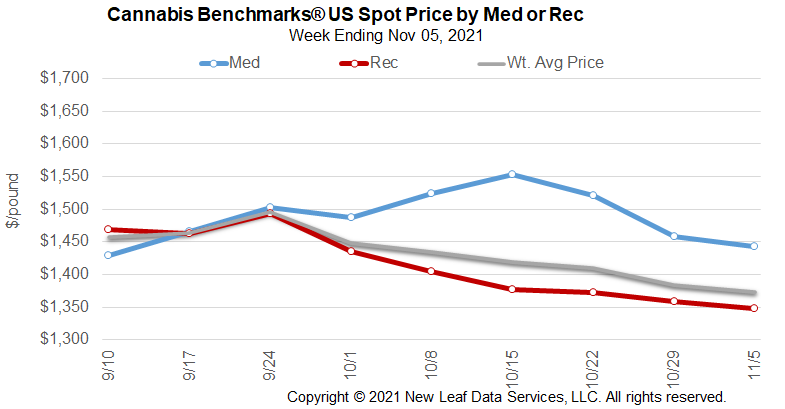

The convergence of legacy state spot prices within a $24 range might help establish a range, but if Washington, Colorado, and Oregon continue to decrease, prices may accelerate on the downside, driving up volatility and potential downward price spikes. That said, downward price spikes often end downtrends with bargain hunters coming in at historical lows and buying up inventory, thus reversing downtrends. However, given segregated state markets and the lack of options for trading cannabis contracts financially, buyers must have somewhere to go with the product and a severe glut could very well lead to a lull in physical trading and the persistence of depressed prices before the downtrend is eventually reversed.

The convergence of state spot prices has taken place during harvest season when more and newer product becomes available, even while growers with older product continue to chase price lower. Outdoor grown product prices for Western states reflect the same price pressure dynamics. A longer view on price suggests a bifurcated market with outdoor grown prices maintaining convergence while indoor product prices continue to remain relatively elevated.

Ultimately, cannabis as a commodity may reflect outdoor grown prices only, leaving traders with the choice to ratio hedge against higher priced product. Ratio hedging within the same market, but with different quality or quantity product, is done by trading a higher quantity of contracts for the lower priced commodity – in this case outdoor flower – to correctly represent the value of the higher priced one – indoor grown product in this example – while also taking into consideration not only contract price but price volatility. Practically speaking, if outdoor grown product trades at one third the price of indoor grown product, one would need to trade three pounds of outdoor grown to every one pound of indoor grown product.

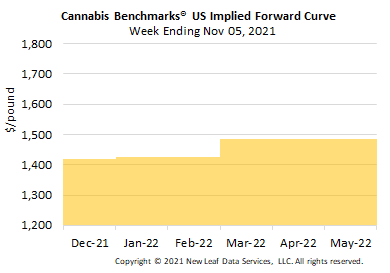

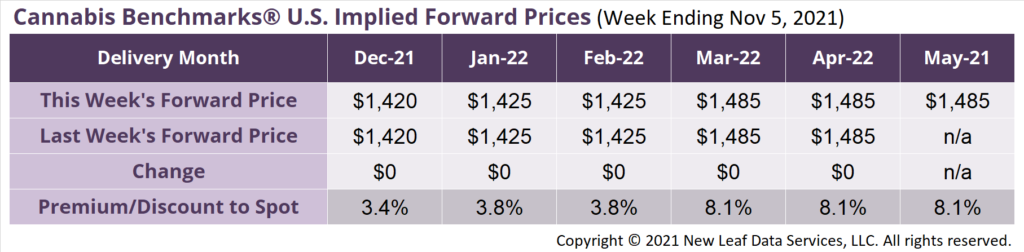

May 2022 Implied Forward initially assessed at $1,485 per pound.

The average reported forward deal size was unchanged at 66 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 39%, 44%, and 17% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 98 pounds, 50 pounds, and 34 pounds, respectively.

At $1,420 per pound, the December Implied Forward represents a premium of 3.4% relative to the current U.S. Spot Price of $1,373 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

Year-on-Year Sales Down 7% in October

Illinois

Adult Use Cannabis Sales and Prices Climb

Massachusetts

Report: More Licensed Testing Labs May Lead to Lower Prices

New York

Report: No Adult Use Cannabis Licenses until 2023