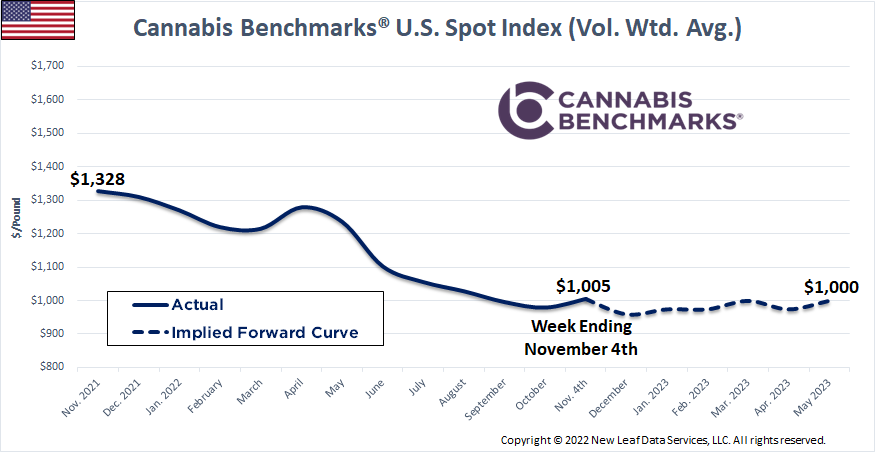

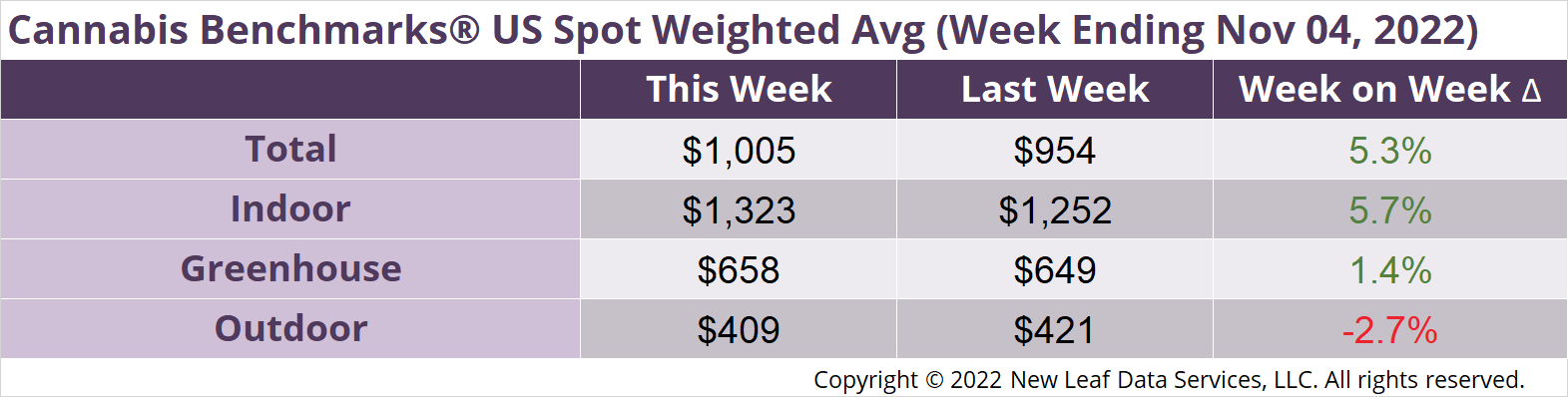

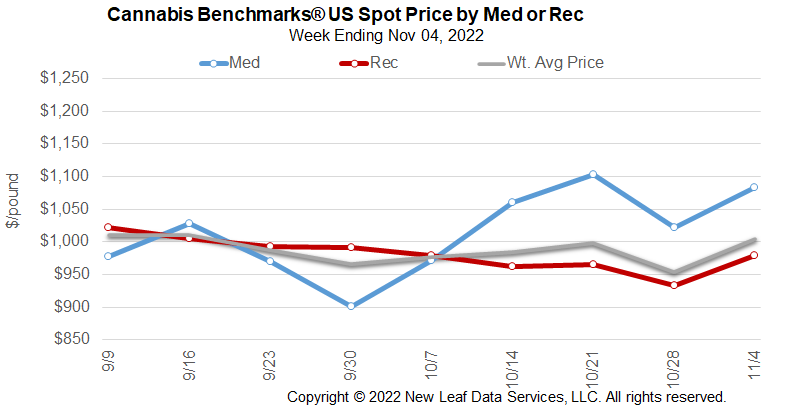

The U.S. Cannabis Spot Index increased 5.3% to $1,005 per pound.

The simple average (non-volume weighted) price increased $81 to $1,382 per pound, with 68% of transactions (one standard deviation) in the $532 to $2,231 per pound range. The average reported deal size was nominally unchanged at 2.4 pounds. In grams, the Spot price was $2.22 and the simple average price was $3.05.

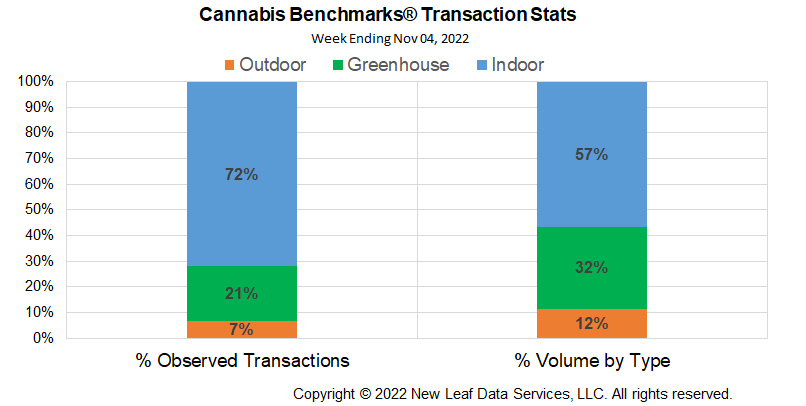

The relative transaction frequency of indoor product rose 1%, while that of deals for greenhouse fell 2% and outdoor flower’s transaction frequency was unchanged.

The relative volume of indoor product rose 2%, while that of greenhouse product fell 2%. Outdoor flower’s relative volume rose 1%.

The Cannabis Benchmarks U.S. Spot Index gained $51 this week, climbing up off its all-time low to trade back over the $1,000 per pound level, buoyed by price gains in high-population states and those newer to adult use legalization.

Legacy state net price movement this week was -$53 per pound. Oregon broke its recent uptrend as price skidded lower by $36. Adding to legacy state losses, Washington State spot price fell by $23 per pound as the downtrend strengthens amid harvest season. Colorado sank just $4 to make a new all-time low basis spot as the state is wrapping up the harvest season. California defied the weekly trend, albeit barely, by tacking on $4 this week in the spot market, although it is clear the downtrend is still securely intact.

Michigan spot jumped $68 this week as it bounces back from the all-time low observed in mid-October. The run on Michigan prices has been brutal and the current reprieve is likely a short term phenomenon with the state staring down the barrel of its largest outdoor crop to date.

The Sand States net price movement this week was -$19 per pound. Oklahoma and Arizona prices converged with the price spread now at just $1. Nevada spot price gained $7 per wholesale pound. New Mexico prices remained firm, but Steve Farmer, a cannabis retailer in the state, said they are starting to see a fair amount of price pressure on the wholesale side. “This market went crazy after rec and has dynamic ongoing price swings,” Farmer told Cannabis Benchmarks. He added, “a lot of new producers are showing up, some with promise. I think we’ll outpace Arizona’s efforts at leveling the market – prices are coming down.”

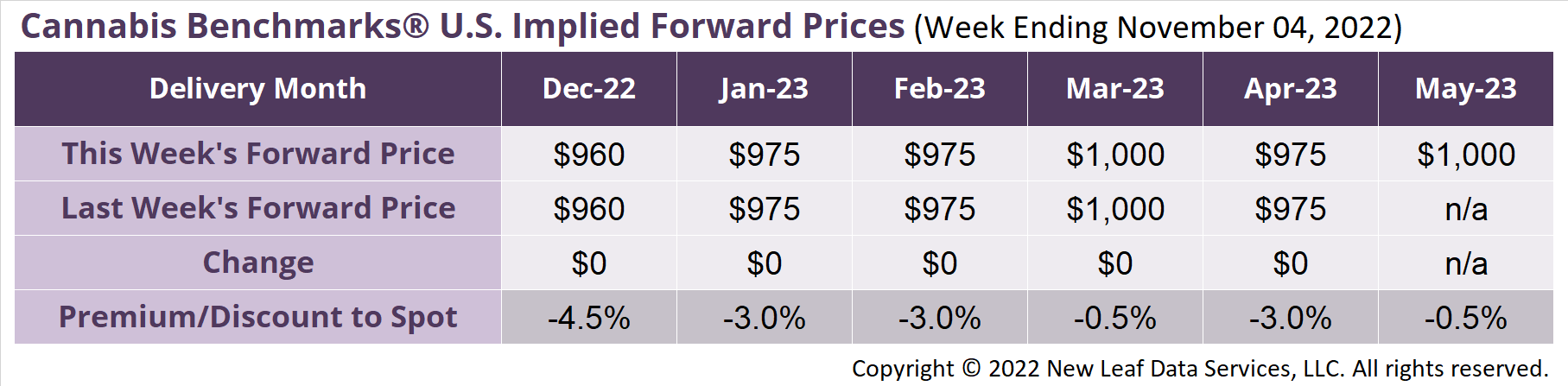

May 2023 Implied Forward assessed at $1,000 per pound.

The average reported forward deal size was 75 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 46%, 41%, and 13% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 79 pounds, 72 pounds, and 72 pounds, respectively.

At $960 per pound, the December 2022 Implied Forward represents a discount of 4.5% relative to the current U.S. Spot Price of $954 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.