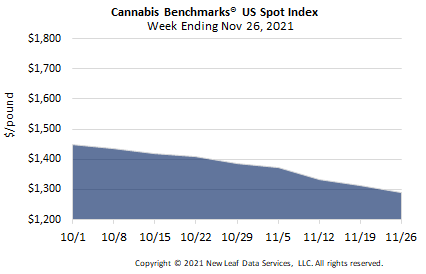

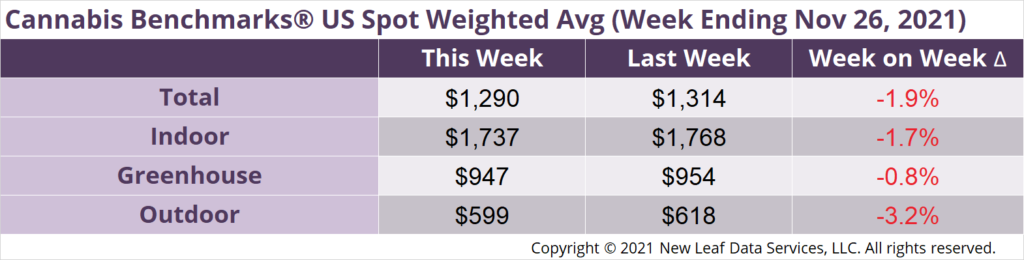

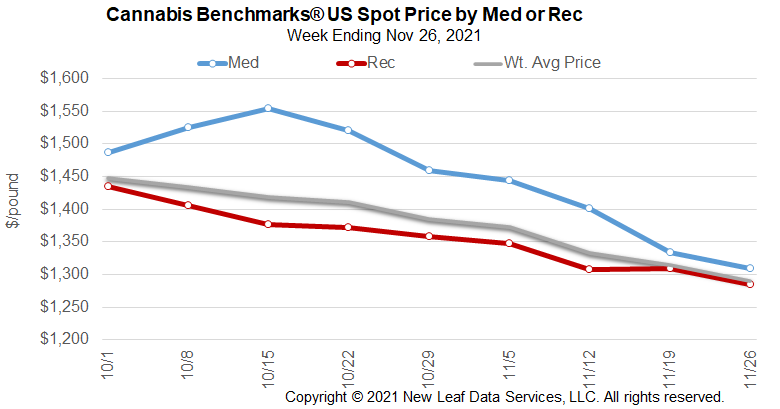

The U.S. Cannabis Spot Index decreased 1.9% to $1,290 per pound.

The simple average (non-volume weighted) price decreased $22 to $1,634 per pound, with 68% of transactions (one standard deviation) in the $826 to $2,443 per pound range. The average reported deal size was nominally unchanged at 2.5 pounds. In grams, the Spot price was $2.84 and the simple average price was $3.60.

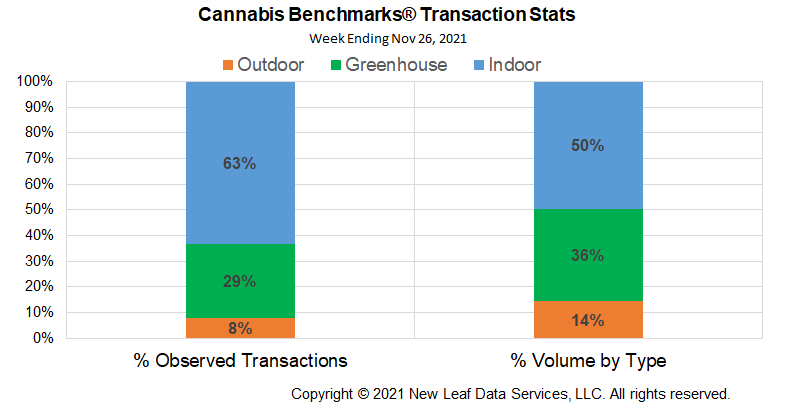

California Spot prices, which wield significant influence over the U.S. Spot, have undergone a dramatic sell-off in 2021. Outdoor flower is the largest volume product type with plenty of supply to fulfill demand, including the growing demand for extracted products.

Significantly less greenhouse than outdoor product is available, but because the category is bifurcated – some product is very high quality and some product is akin to outdoor-grown – price follows the lesser quality product. Greenhouse flower prices tanked in 2021 in large part due to significant supply generated by light-deprivation operations this past summer.

Indoor-grown product prices remained fairly steady through much of the year, but began to sell off in earnest in September. The sell-off may have been triggered by a larger quantity made available by more growers eager to fulfill high-end demand; price may also have been pulled lower by the more significant losses in greenhouse and outdoor product.

In fact, the deterioration of outdoor flower’s price started earlier than that of greenhouse product, and greenhouse price deterioration began before that of indoor flower. Within markets with similar, but not necessarily identical commodities, price contagion can spread throughout similar products without respect to particular quality.

One takeaway is that a bifurcated market within one growing category has a higher price contagion effect. The other takeaway is that seasonal activity, summer and fall harvests in this instance, has a profound effect on all categories because of a vastly increased supply available of the lowest priced category, thus price contagion spreads upward to the higher priced products. Price contagion does not happen all at once; it spreads across similar, but not identical markets, over time.

When there is a physical market for cannabis products, one way growers will be able to hedge against seasonal fluctuation and price contagion is trading the spread between prices.

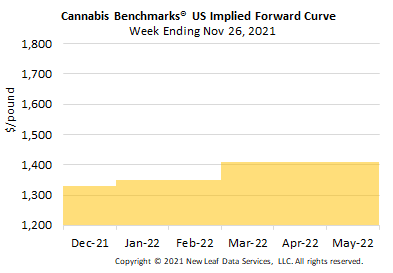

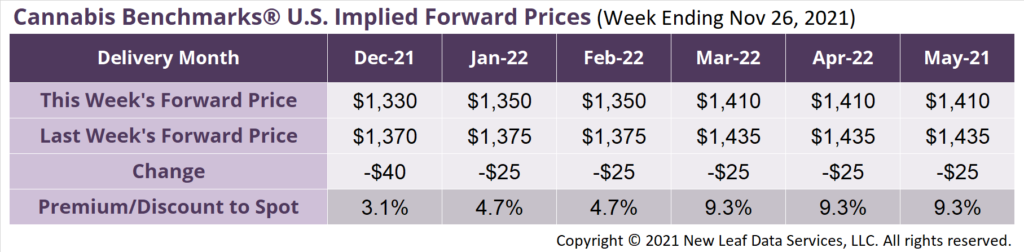

December 2021 Implied Forward closes down $40 at $1,330 per pound.

The average reported forward deal size was nominally unchanged at 68 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 40%, 45%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 99 pounds, 53 pounds, and 34 pounds, respectively.

At $1,330 per pound, the December Implied Forward represents a premium of 3.1% relative to the current U.S. Spot Price of $1,290 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Massachusetts

Spot Prices Stable as Cultivator Numbers Jump

Illinois

Medical Cannabis Program Continues to Draw Patients

Alaska

Product for Extraction Demand Jumps 49% Year-on-Year

Arizona

September Cannabis Sales Fall as Employment Rises