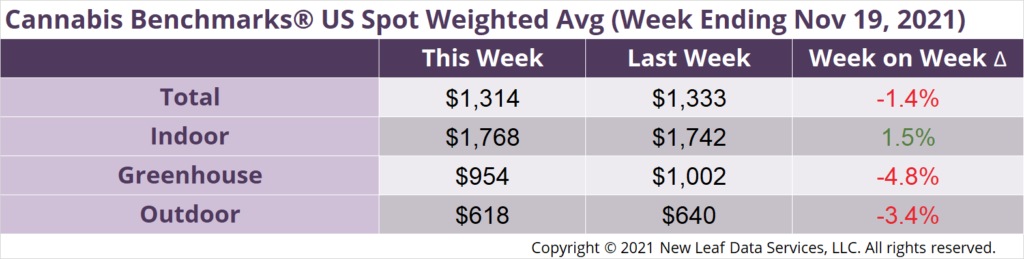

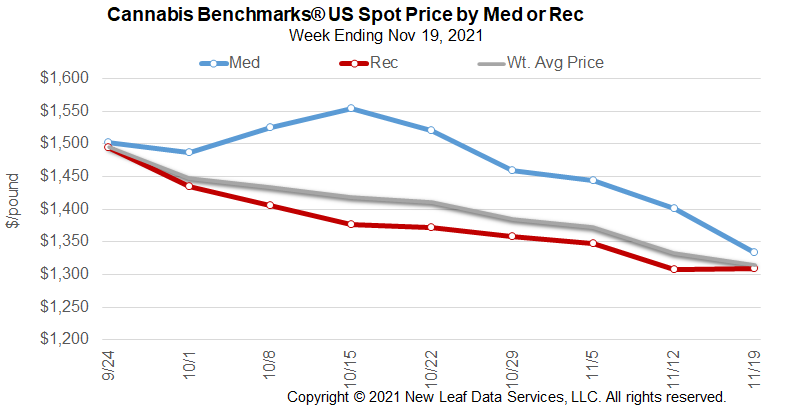

U.S. Cannabis Spot Index decreased 1.4% to $1,314 per pound.

The simple average (non-volume weighted) price increased $7 to $1,656 per pound, with 68% of transactions (one standard deviation) in the $831 to $2,481 per pound range. The average reported deal size increased to 2.5 pounds. In grams, the Spot price was $2.90 and the simple average price was $3.65.

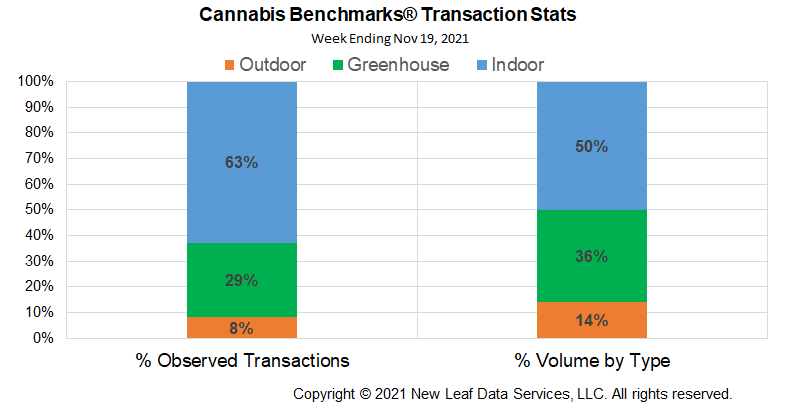

The relative frequency of transactions for each grow type was essentially unchanged from last week.

The relative volume of indoor product fell 2%, while that of greenhouse flower rose 3%. The relative volume of outdoor product contracted by 1% this week.

The gap between U.S. Spot prices and those of Midwestern states is widening, with Illinois and Michigan both fully legalized and supplying consumers in contiguous states, some of which have medical cannabis markets. Michigan’s price is $1,100 over the U.S. Spot and Illinois is trading $1,600 over U.S. spot. There are clear advantages of being the only two amid the 12 states that make up the Midwest to have legalized adult use cannabis. As we covered recently, Illinois officials reported that over 30% of sales revenue came from purchases made by out-of-state consumers last month. This situation is likely to persist as surrounding states do not appear inclined to legalize imminently.

That said, there are more subtle realities at work. Illinois and Michigan are also enjoying the pricing advantage that comes with new markets, including relative scarcity in their adult use systems. Additionally, growers have yet to be disintermediated from their product. That is, the extraction, product manufacturing, packaging, marketing, and other value-added services have yet to disconnect – disintermediate – growers from the pricing process. Indeed, Illinois’ market is dominated by a handful of large multi-state operators that seek to stop price bleed – at least for a time – by vertical integration, owning the means of growing through retail sales. Whether this situation will persist as state markets, and eventually a national one, develop remains to be seen. At the end of the day, legacy markets underwent the divorce of growers from pricing power such that some in California have told us “growers have no say in price.”

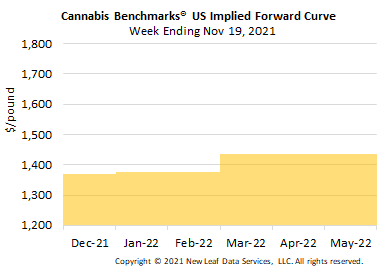

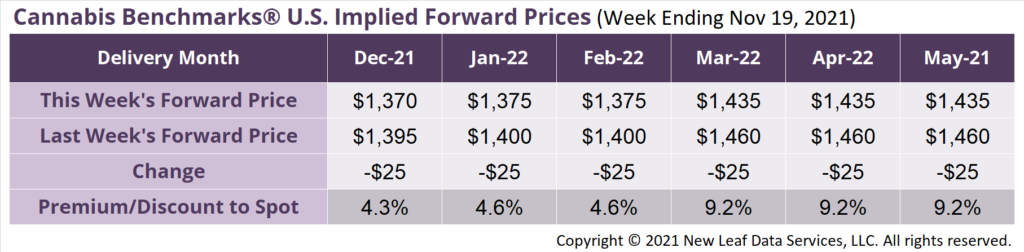

December 2021 Implied Forward assessed down $25 to $1,370 per pound.

The average reported forward deal size increased 2 pounds to 68 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 41%, 44%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 100 pounds, 51 pounds, and 34 pounds, respectively.

At $1,370 per pound, the December Implied Forward represents a premium of 4.3% relative to the current U.S. Spot Price of $1,314 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Massachusetts

Spot Prices Stable as Cultivator Numbers Jump

Illinois

Medical Cannabis Program Continues to Draw Patients

Alaska

Product for Extraction Demand Jumps 49% Year-on-Year

Arizona

September Cannabis Sales Fall as Employment Rises