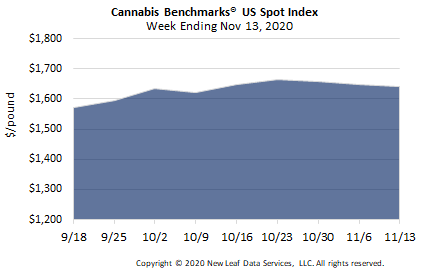

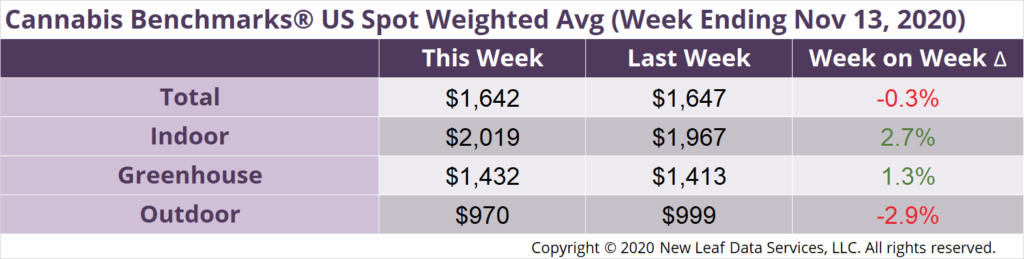

U.S. Cannabis Spot Index down 0.3% to $1,642 per pound.

The simple average (non-volume weighted) price decreased $3 to $1,856 per pound, with 68% of transactions (one standard deviation) in the $1,131 to $2,581 per pound range. The average reported deal size decreased to 2.2 pounds. In grams, the Spot price was $3.62 and the simple average price was $4.09.

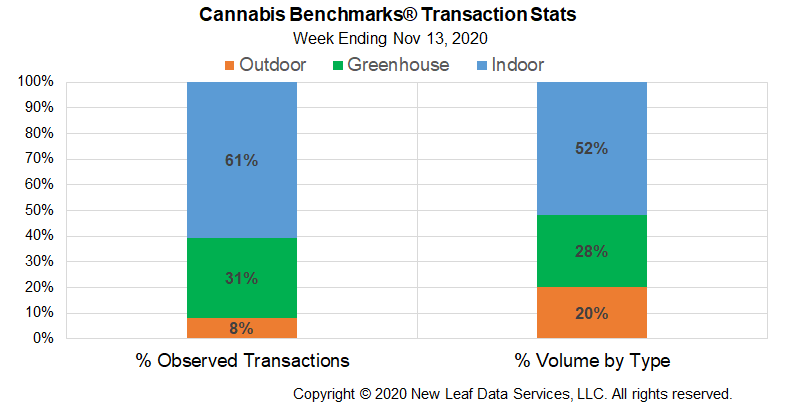

The relative frequency of trades for greenhouse flower expanded by over 4%. The relative frequencies of deals for indoor and outdoor product decreased by about 3% and 1%, respectively.

The relative volume of warehouse flower contracted by almost 4% this week. The relative volumes of greenhouse and outdoor product expanded by about 1% and 3%, respectively.

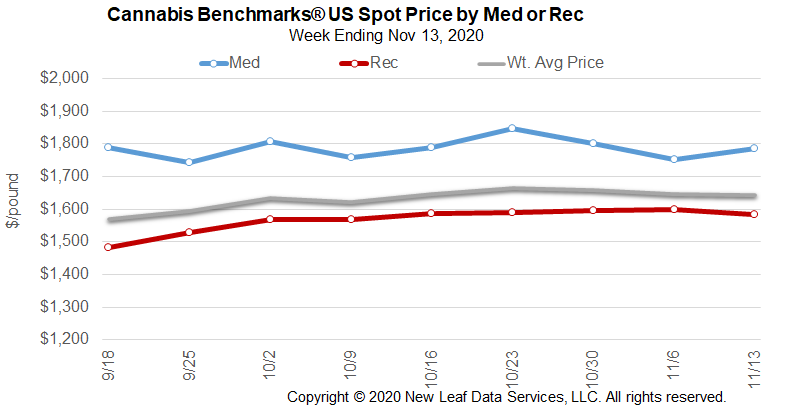

New data out of several state markets published this week shows that strong demand is persisting. However, it also appears that some previously established seasonal sales trends – namely, declining retail revenue figures from September through October – are reasserting themselves after the COVID-19 pandemic altered consumer purchasing behavior earlier this year.

Colorado saw a downturn in sales in September. Previously red-hot sales growth in Oklahoma’s medical market has cooled; another decline was reported in October, but retail revenues remain quite high compared to pre-COVID.

Other sizable markets are exhibiting more idiosyncratic sales movement. October’s revenue figures out of Illinois represent another record high as the state’s young adult-use market continues to expand. Late-reported data for July and August out of Nevada shows that sales jumped to historic peaks after slumping earlier in the pandemic. Expanded tourism combined with previous increases in local demand to catapult revenue to unprecedented levels.

Overall, while some states are still seeing sales increases and upward movement of wholesale prices, it appears that cooling demand growth in recent months has provided some breathing room for producers, particularly in more established state markets. The state Spot Indexes of California, Colorado, Oregon, and Washington have all leveled off in recent weeks.

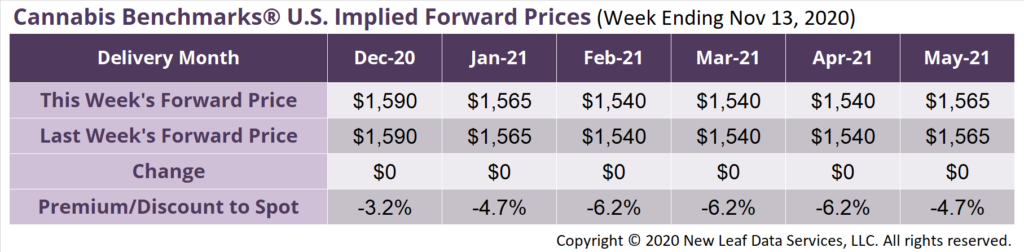

December Forward unchanged at $1,590 per pound.

The average reported forward deal size increased from 23 to 27 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 43%, 34%, and 24% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 33 pounds, 17 pounds, and 28 pounds, respectively.

At $1,590 per pound, the December Forward represents a discount of 3.2% relative to the current U.S. Spot Price of $1,642 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Colorado

September Sales Settle Above $200M for Third Straight Month, but Represent a Decline from August

Nevada

Summer Sales Bounce Back After COVID-Induced Spring Slump, Reach Record Highs in Both July and August

Illinois

October Medical Cannabis Sales Rise to Over $33M, Bringing Monthly Total to Over $108M, Another New Record

Oklahoma

Medical Cannabis Sales Down Slightly for Fourth Straight Month, Fall to Just Above $75M in October