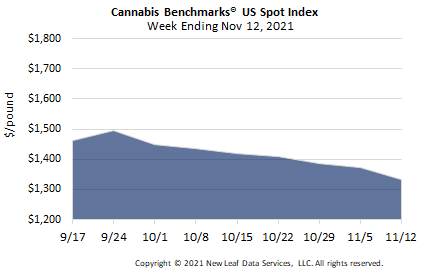

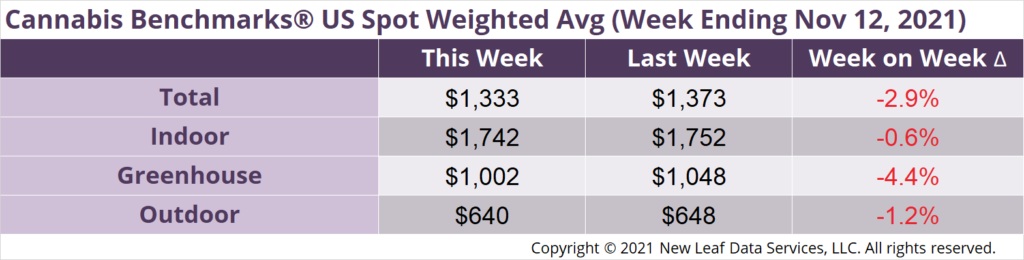

U.S. Cannabis Spot Index decreased 2.9% to $1,333 per pound.

The simple average (non-volume weighted) price decreased $13 to $1,649 per pound, with 68% of transactions (one standard deviation) in the $826 to $2,472 per pound range. The average reported deal size increased to 2.4 pounds. In grams, the Spot price was $2.94 and the simple average price was $3.64.

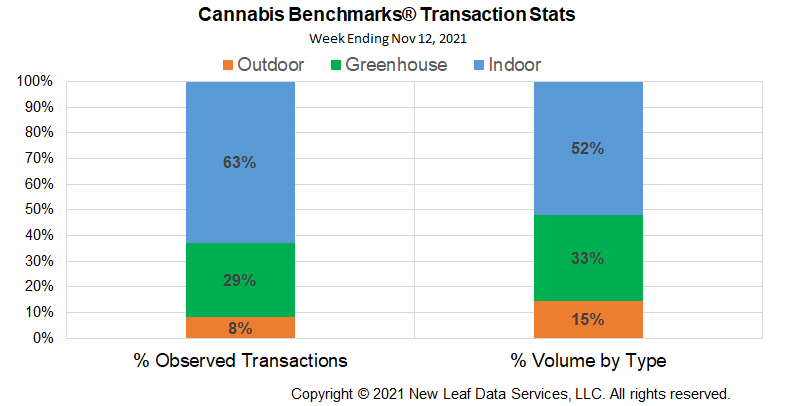

The relative frequency of transactions for indoor flower rose 1% this week, while that of deals for greenhouse flower fell 1%. The transaction frequency for outdoor flower was unchanged this week.

The relative volume of indoor product fell 2%, while that of greenhouse flower rose 1%. The relative volume of outdoor product rose 1% this week.

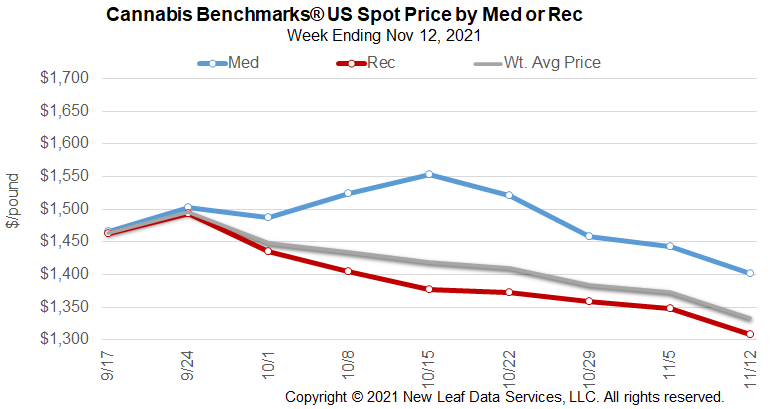

The downtrend in the U.S. Spot has intensified over the past several weeks as legacy state spot prices have been driven lower, owing largely to oversupply in California, Colorado, and Oregon. California Spot is down almost $430 per pound from late July, Oregon is down over $288, while Colorado has shed some $153 from late July, pulling U.S. Spot down $258 per pound.

The convergence of legacy state prices and their subsequent divergence highlights the weakness in California’s market, as price crosses over both Oregon and Colorado prices. The most severe price pressures are coming from massive oversupply of outdoor grown flower, with what looks to be an abundant harvest this year added to inventory held back from last year and that generated this summer.

Growers in Oregon and California have opined on oversupply, but ultimately do not see canopies shrinking in a meaningful way despite current market conditions. In fact, northern California has pinned their prices hopes on marketing product across the U.S. and ultimately around the world, with decades of growing experience and, even now, brands that are recognized across the country. Oregon cultivators are similarly hoping for federal legalization to occur in a timely manner so that the excess supply generated in the state can be exported east.

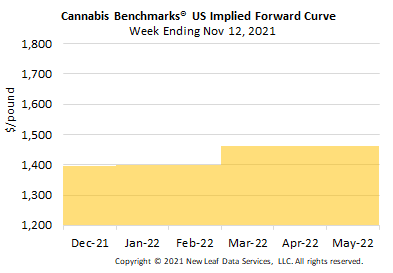

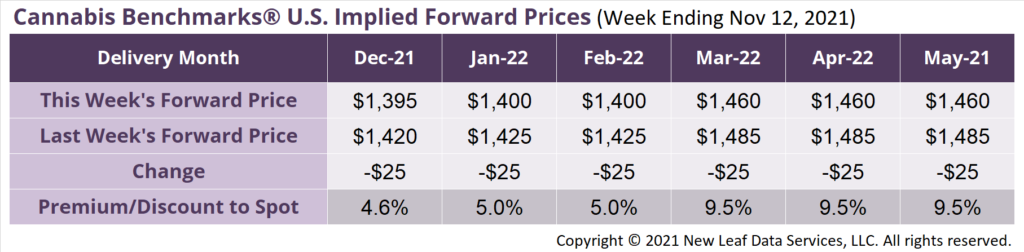

December 2021 Implied Forward assessed down $25 to $1,395 per pound.

The average reported forward deal size was nominally unchanged at 66 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 39%, 45%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 96 pounds, 51 pounds, and 34 pounds, respectively.

At $1,395 per pound, the December Implied Forward represents a premium of 4.6% relative to the current U.S. Spot Price of $1,333 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

National

Inflation Hits 30 Year High; Energy Prices Surge Impacts Consumers & Producers

Colorado

2021 Sales Will Exceed 2020’s, But Recent Monthly Tallies Down Year-on-Year

Maine

Monthly Adult Use Sales sub $10 Million – Again

Oklahoma

Medical Sales Fell in September, Number of Grower Licenses Still Increasing