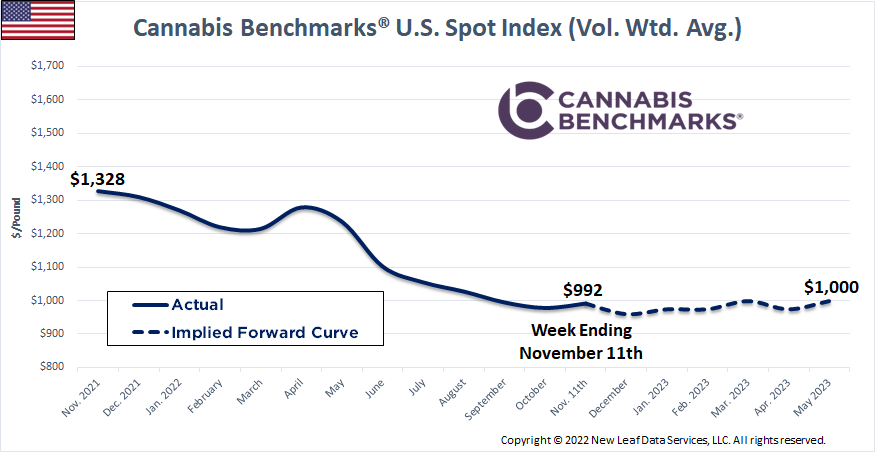

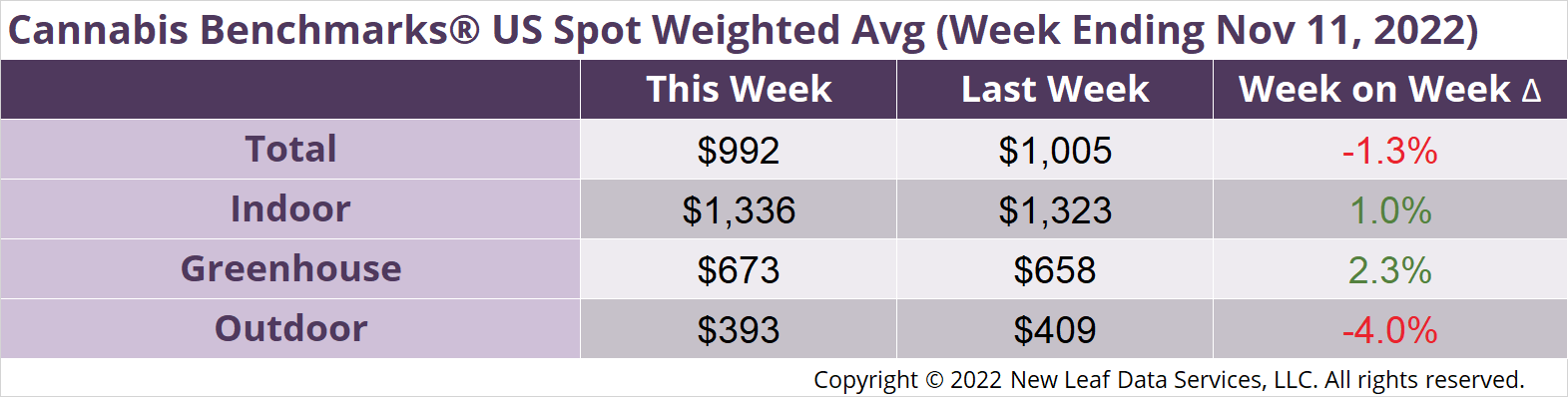

The U.S. Cannabis Spot Index decreased 1.3% to $992 per pound.

The simple average (non-volume weighted) price increased $3 to $1,385 per pound, with 68% of transactions (one standard deviation) in the $531 to $2,238 per pound range. The average reported deal size was nominally unchanged at 2.4 pounds. In grams, the Spot price was $2.19 and the simple average price was $3.05.

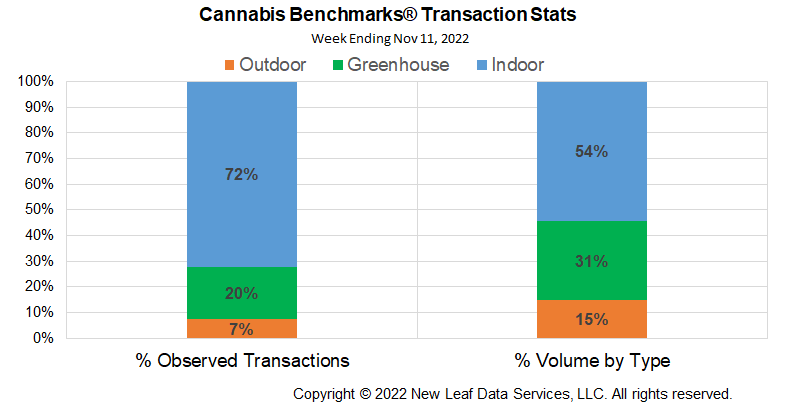

The relative transaction frequency of indoor product was unchanged this week, while that of greenhouse product fell 1%. Outdoor transaction frequency was unchanged.

The relative volume of indoor product fell 3%, while that of greenhouse product fell 1%. Outdoor flower’s relative volume rose 3%.

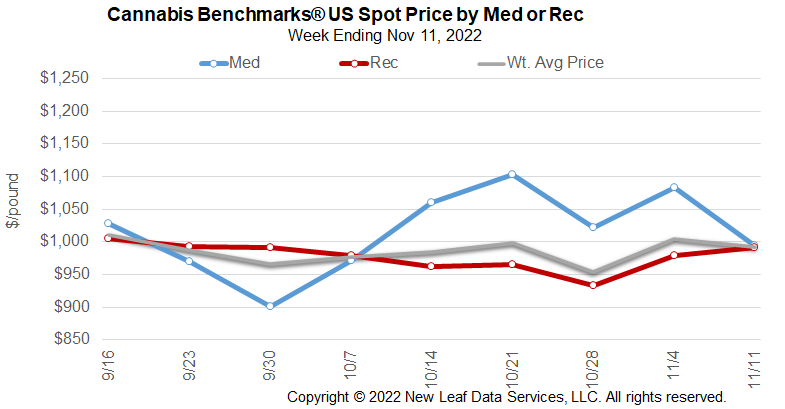

The U.S. Spot Index slid $13 this week as far-flung states both populous and new to the market saw price pressures. The U.S. spot volume weighted price hit an all-time low in the mid-$900s per pound at the end of last month, as Croptober 2022 kicked into high gear, but jumped over $1,000 last week as demand for fresh cannabis put a bid under prices in some states. This week the U.S. spot slipped below the $1,000 handle again.

California spot reached yet another new all-time low. Oregon spot fell through four-month trendline support last week. While Oregon’s October outdoor harvest shrunk by 28%, reports of late planting suggest there may be more harvests to come in November, which would put more pressure on price. New Mexico spot dived $232 lower, a result of more licenses, more competition, and low-priced outdoor product hitting the market. Massachusetts spot fell $69 per wholesale pound amid talk of companies shedding assets and seeking debt restructuring, on top of the state’s outdoor crop making its way to market.

As the cannabis industry develops, states in close proximity and with similar regulatory schemes are starting to see prices move in tandem. Competition between states is likely to become a driving force in cannabis pricing over the next year or two, due in large part to a very mobile populace, illicit trade, and competitive markets. As more states open for business, supply will no longer be an issue in large population centers on the East Coast and prices among those states will converge at lower levels. Ultimately, price differences across the country will shrink as supply continues to grow with more states coming online and few consumers more than a two hour drive from legal and / or competitively priced cannabis.

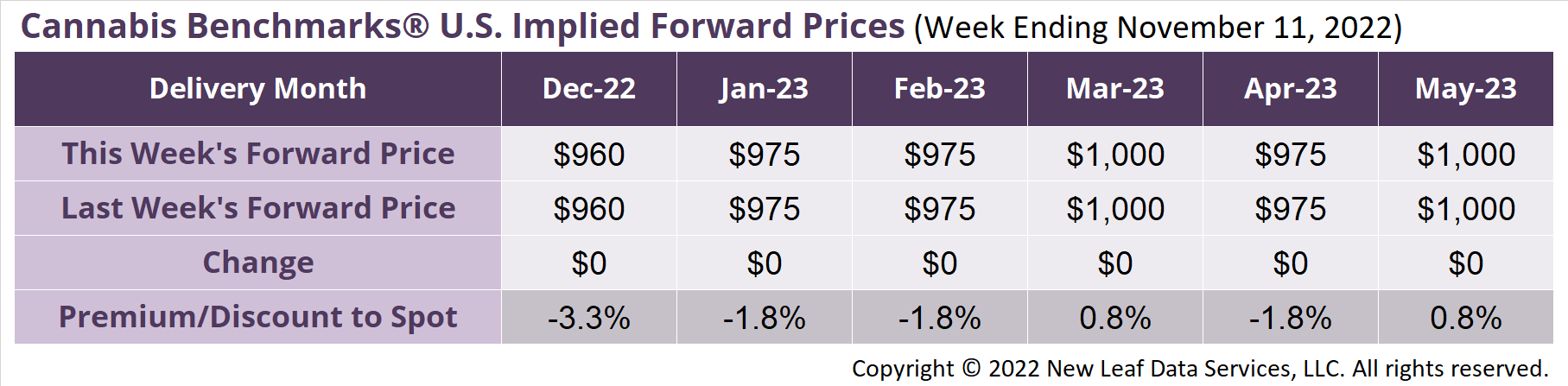

December 2022 Implied Forward unchanged at $960 per pound.

The average reported forward deal size was 75 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 46%, 42%, and 13% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 79 pounds, 73 pounds, and 72 pounds, respectively.

At $960 per pound, the December 2022 Implied Forward represents a discount of 3.3% relative to the current U.S. Spot Price of $992 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.