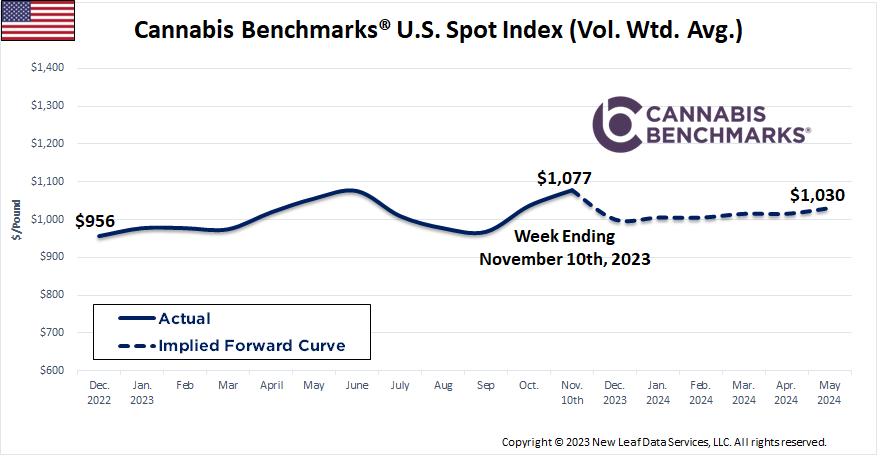

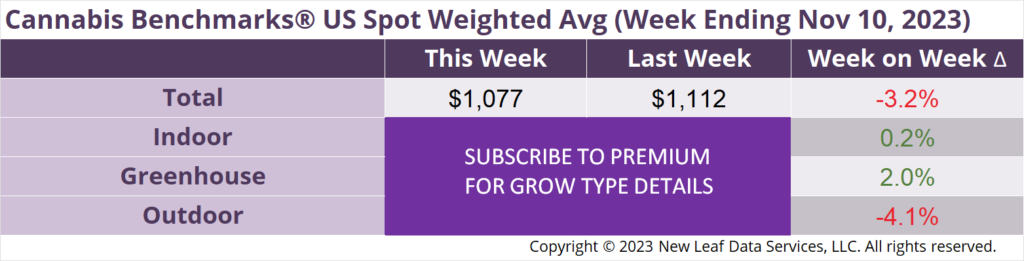

The U.S. Cannabis Spot Index decreased 3.2% to $1,077 per pound.

In grams, the Spot price was $2.37.

After climbing through October and into the first week of this month, the U.S. Spot Index turned downward this week on a decline in the national price for outdoor-grown flower. While the U.S. wholesale price index has been experiencing an atypical rise in recent weeks, that movement was driven mainly by increasing prices for indoor flower and any uptrend in the price for outdoor flower was modest. The national price for outdoor product remains down from its year-to-date peak of $502 per pound in the first week of July and has not made a serious move to approach that level in the last four months.

Looking at states with significant outdoor production, any positive price movement that had been observed in September and October has moderated or reversed in recent weeks. Colorado’s spot wholesale outdoor flower price rose through September into late October, but has in the last two weeks seen modest declines. Outdoor flower prices in Oregon have been quite volatile, including falling to near their all-time low in late September then spiking in October. It has ticked down in each of the last two weeks, with this week’s price representing a 5.3% decrease from the late October peak. California’s spot outdoor flower price has been in an overall downtrend since early July.

Both southern Oregon and southern Colorado – where outdoor cultivation operations are primarily located in those states – saw quite warm, dry Octobers this year, which may have allowed growers to run their crops a bit longer and delayed the bulk of the harvest coming to market. As we reported last week, Oregon’s full-term autumn crop came in quite large, with a significant increase over last year’s despite reports of pullbacks by outdoor producers.

Moving east, Michigan and Massachusetts also permit outdoor cultivation in their state markets. Michigan has seen its overall spot wholesale flower price begin to decline in recent weeks after ascending gradually from late August to late October. The state should report October data imminently, providing a view into how this year’s outdoor crop affected supply-demand dynamics in the state. We’ve noted previously that growth in demand has outpaced that of supply this year, resulting in tightening inventories and pushing up prices. The outdoor harvest may reverse this trend, at least temporarily.

Massachusetts’ spot wholesale flower price is down from a late August spike and has since mid-September tracked between $1,300 and $1,400 per pound. This week’s price assessment is off 11.9% from the late August peak.

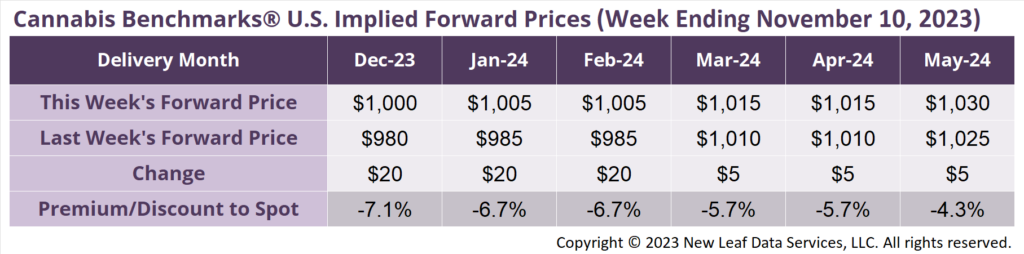

December 2023 Implied Forward assessed up $20 to $1,000 per pound.

At $1,000 per pound, the December 2023 Implied Forward represents a discount of 7.1% relative to the current U.S. Spot Price of $1,077 per pound.

Steady Sales Revenue Obscures Expanded Sales Volume in Recreational and Medical Markets

Demand Slumps in October as Wholesale Prices Turn Downward

Adult Use Legalization Approved by Voters, Demand Likely to be Robust When Market Opens

Rulemaking to Implement Social Equity Legislation Will Allow for More Retailers