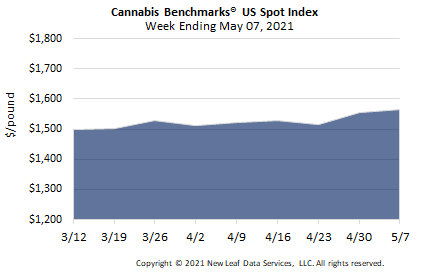

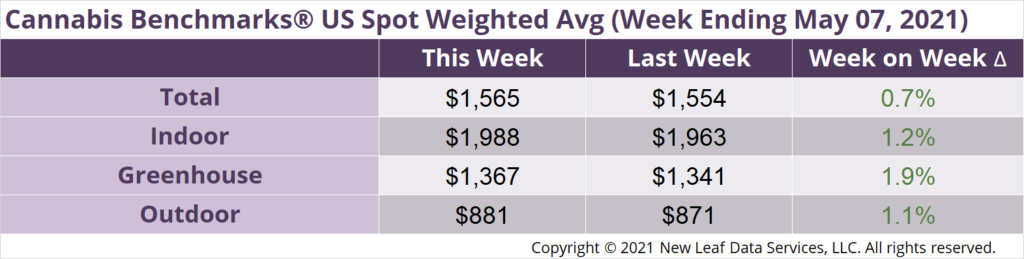

U.S. Cannabis Spot Index up 0.7% to $1,565 per pound.

The simple average (non-volume weighted) price decreased $9 to $1,762 per pound, with 68% of transactions (one standard deviation) in the $1,008 to $2,515 per pound range. The average reported deal size was nominally unchanged at 2.2 pounds. In grams, the Spot price was $3.45 and the simple average price was $3.88.

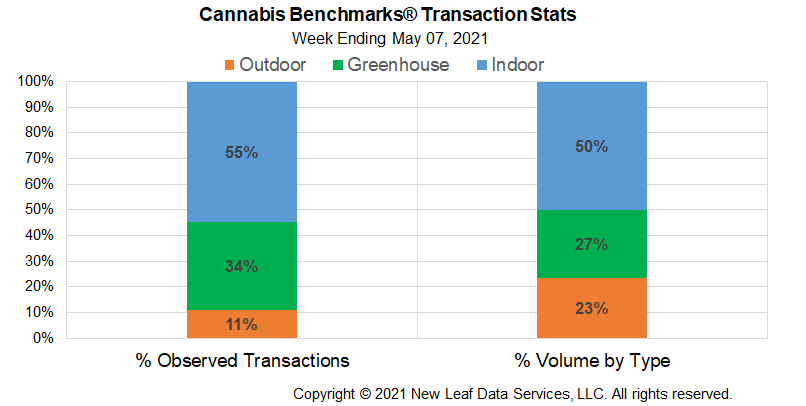

The relative frequencies of trades for each grow type were largely stable from last week.

The relative volumes of greenhouse and outdoor flower both expanded by less than 1% each this week, with that for warehouse product contracting correspondingly.

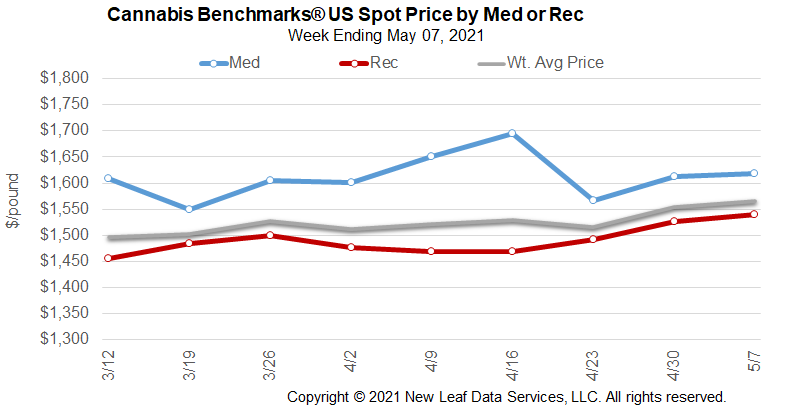

As we noted last week, the U.S. Spot Index last month broke with behavior observed in prior years, as April’s monthly average composite price rose from March. New data out of several states this week shows that demand continued to be robust in April and outpaced March’s monthly sales in the states under discussion. While the 4/20 holiday falls in April, historical data shows total sales for the month frequently come in lower than March’s.

However, the trend of a downturn in monthly sales in April was bucked in Oregon, as well as in the younger markets of Massachusetts and Illinois, which continue to see demand expand and reach new records nearly every month. Wholesale flower prices in Oregon and Massachusetts were also on the rise in April, after they leveled off or declined late in 2020 and early this year.

Some U.S. and state officials are postulating that daily life may return to normalcy in the coming months as rates of vaccination against COVID-19 increase. How that might impact legal cannabis demand is somewhat uncertain. More options for consumers to spend their disposable income as states across the country move to lift restrictions suggests that spending on cannabis could be squeezed. However, the persistence of robust monthly sales figures posted out of states with diverse market conditions has so far refuted that notion. Similarly, very high unemployment and income uncertainty for millions of Americans last year did not dent booming demand for legal cannabis, which appears as if it could be part of the new post-COVID “normal.”

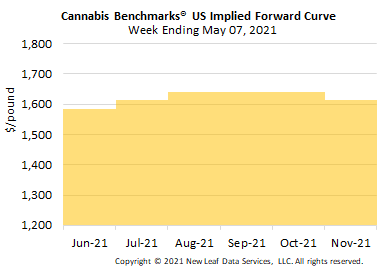

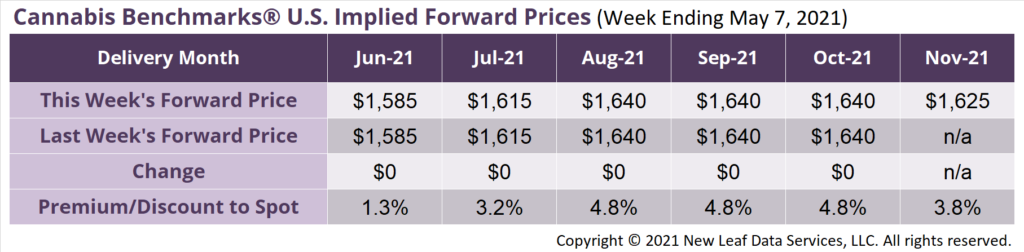

November 2021 Implied Forward initially assessed at $1,625 per pound.

The average reported forward deal size was 51.6 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 54%, 33%, and 13% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 64 pounds, 40 pounds, and 27 pounds, respectively.

At $1,585 per pound, the June Implied Forward represents a premium of 1.3% relative to the current U.S. Spot Price of $1,565 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

Sales Reach Another Record High in April, but Annual Growth Rates Have Slowed Compared to 2020

Massachusetts

Adult-Use Sales Reach New Peak in April, Clearing $100M for the Second Straight Month

Illinois

Total Adult-Use & Medical Sales Climb to Over $150M in April

Nevada

February Demand Contracts Month-Over-Month, Even As Las Vegas Tourism Increased Notably