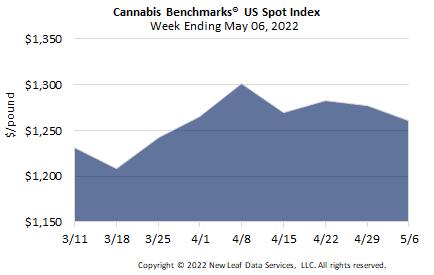

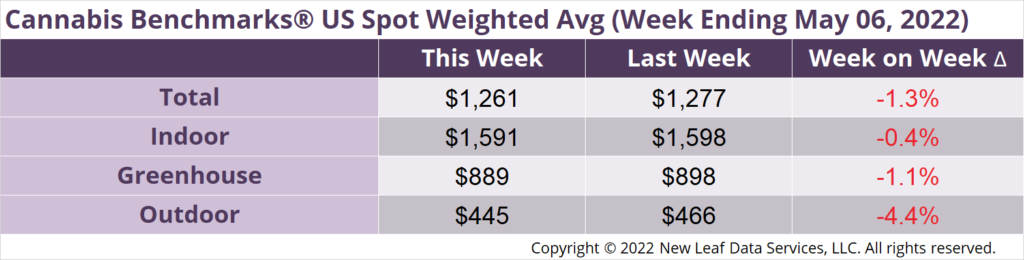

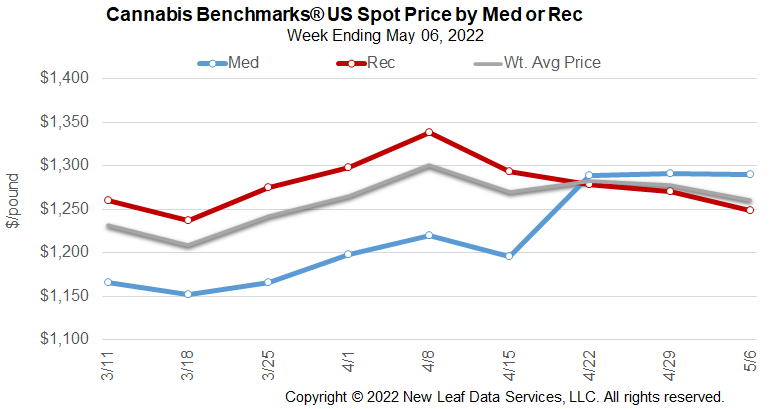

The U.S. Cannabis Spot Index decreased 1.3% to $1,261 per pound.

The simple average (non-volume weighted) price increased $3 to $1,518 per pound, with 68% of transactions (one standard deviation) in the $688 to $2,348 per pound range. The average reported deal size was nominally unchanged at 2.3 pounds. In grams, the Spot price was $2.78 and the simple average price was $3.35.

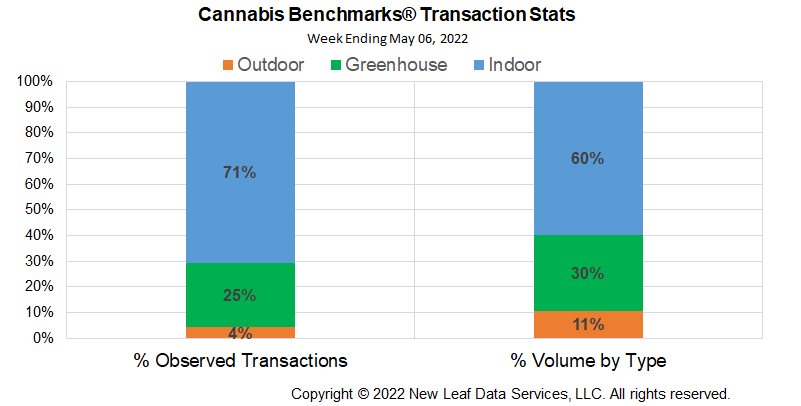

The relative frequency of transactions for indoor flower was unchanged. Greenhouse transaction frequency rose 1% and outdoor transaction frequency fell by 1%.

The relative volume of indoor flower fell 1%, while that of greenhouse flower rose 2%. The relative volume of outdoor flower was unchanged.

U.S. Spot fell nearly $17 this week, weighed down by losses in new states even as some legacy states saw gains. Washington State was up nearly $3 per pound wholesale on a narrowing 10-week average loss of just $0.97 per pound. Oregon leapt up over $39 per pound amid a narrowing 10-week average loss of just $2.41.

New Mexico Spot fell nearly $17 per pound basis spot, with a 10-week average weekly gain of $25.42. Contacts in New Mexico say they are being offered indoor flower at $3,200 per pound wholesale, while some stores have delayed opening due to the high price of indoor product.

Nevada prices made some gains this week amid a sharp sell-off in the wholesale market this year, adding $57.50 per pound. As noted in this week’s Premium Report, Nevada tourist numbers jumped in March, which may account for recent price gains.

Maine Spot price shed over $60 and pushed the 10-week average weekly price change into negative territory at -$5.91 per pound.

Almost all cannabis consumers can either buy in their home state or are just a state away from legal purchases. The widespread availability of cannabis is driving price compression across the country, leading to newer markets seeing prices crater despite still experiencing expanding demand. When all of New England plus New York and New Jersey have fully developed adult use markets – a point which is still at least two years in the future – prices should become competitive almost immediately and price pressures are likely to exceed those of legacy states.

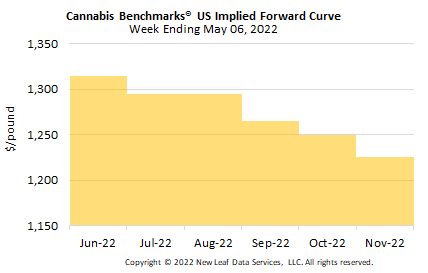

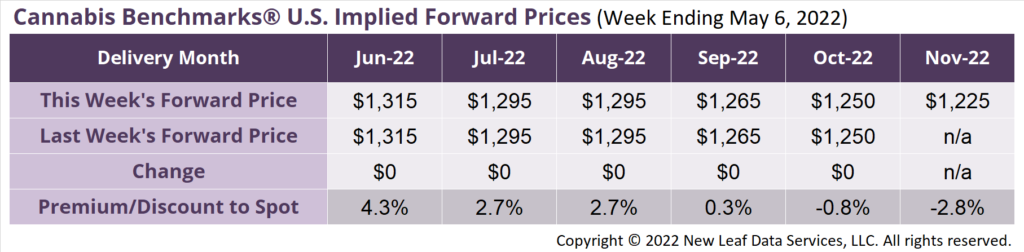

November 2022 Implied Forward initially assessed at $1,225 per pound.

The average reported forward deal size was unchanged at 78 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 41%, 44%, and 14% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 86 pounds, 76 pounds, and 60 pounds, respectively.

At $1,315 per pound, the June 2022 Implied Forward represents a premium of 4.3% relative to the current U.S. Spot Price of $1,261 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Nevada

Sales Down Four Months Running

Illinois

April Sales Surge 14.6% Year-on-Year

Montana

Adult Use Sales Swamping Medical Sales

National

Fed Rate Hike Means More Expensive Financing for Cannabis Businesses