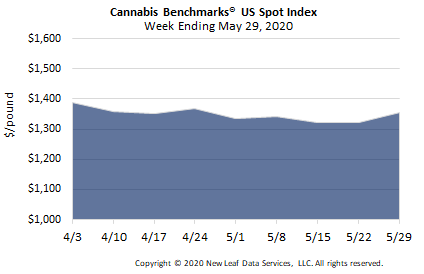

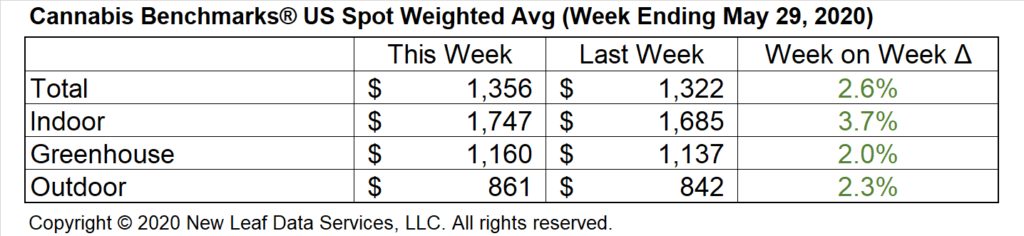

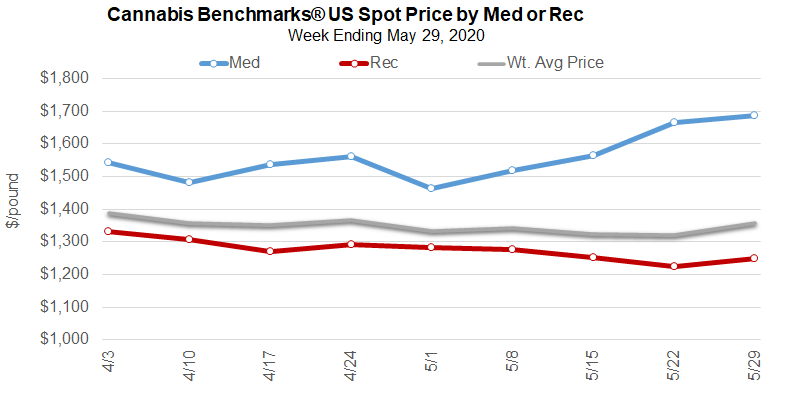

U.S. Cannabis Spot Index up 2.6% to $1,356 per pound.

The simple average (non-volume weighted) price increased $91 to $1,616 per pound, with 68% of transactions (one standard deviation) in the $836 to $2,396 per pound range. The average reported deal size increased to 2.4 pounds. In grams, the Spot price was $2.99 and the simple average price was $3.56.

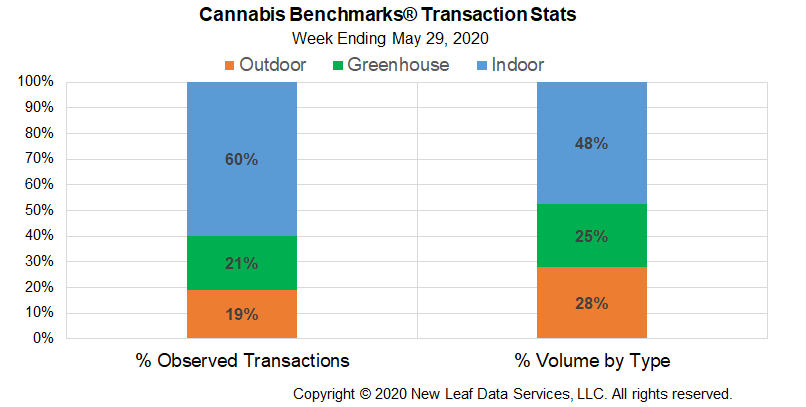

The relative frequencies of trades for each grow type were largely stable from last week.

Indoor flower’s share of the total reported weight moved nationally shrank by 1% this week. Greenhouse product’s relative volume increased by the same proportion, while that for outdoor flower was unchanged.

For the month of May, the U.S. Spot Index averaged $1,336 per pound. May is the third consecutive month to see a downturn in the national composite price, despite reports of strong demand and elevated sales out of several states during the COVID-19 pandemic, which began impacting day-to-day life in the U.S. dramatically in March.

While strong demand has been observed across several states, including the sizeable markets of Oregon and Arizona, early signs out of Colorado – the nation’s second-largest market after California – suggest that previous sales growth rates slowed in March. We have also discussed how Nevada’s cannabis industry has been especially hard-hit by the measures taken to contain the pandemic. Meanwhile, Massachusetts adult-use retailers, who racked up the sixth-largest revenue total of any state with legal cannabis in 2019, were shuttered completely for two months, with sales only resuming this week.

In other words, while sales out of some larger and mid-sized markets have remained strong, demand in others has been curtailed or appears to have been suppressed somewhat. (April sales out of Colorado, which should be released in June, will provide a clearer picture of the coronavirus’ impact on the state’s cannabis market.)

Additionally, we have not heard reports of any disruptions or slowdowns in supply. No accounts of COVID outbreaks at cannabis cultivation or processing facilities have surfaced to this point, suggesting that production has continued apace during a period of demand fluctuations. Despite reports of occasional runs on cannabis retailers and customers purchasing larger amounts per transaction, wholesale buyers have not evinced anxiety about being able to secure sufficient inventory. The continued prohibition on interstate cannabis commerce may have somewhat insulated each state market from supply chain difficulties that have impacted other industries during the last two unprecedented and unpredictable months.

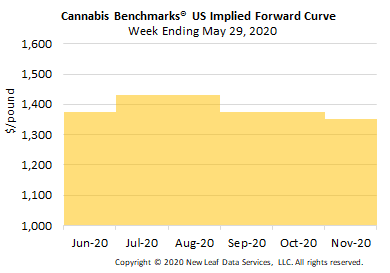

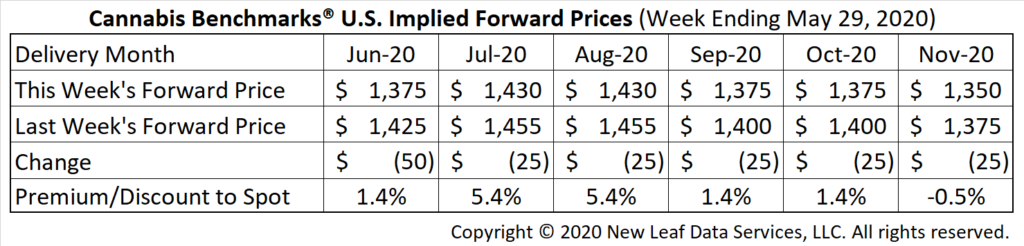

June Forward down $50 to $1,375 per pound.

The average reported forward deal size was 36 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 47%, 37%, and 16% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 42 pounds, 28 pounds, and 35 pounds, respectively.

At $1,375 per pound, the June Forward represents a premium of 1.4% relative to the current U.S. Spot Price of $1,356 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

State Releases Cannabis Tax Collections, but Scope of Market Activity Obscured as Taxpayers Allowed to Remit Payments Late Due to COVID-19

Washington

Officials Resume Rulemaking Activities, Including Proposed Rules for Required Pesticide and Heavy Metals Testing

Nevada

Governor Announces that Casinos May Reopen in Early June, Reintroducing Some Tourist Demand to State’s Cannabis Market

Massachusetts

Adult-Use Retailers Allowed to Open for Curbside Pickup Sales this Week After Two Month Shutdown