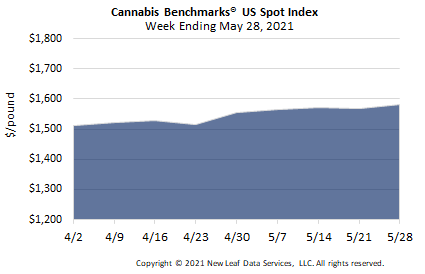

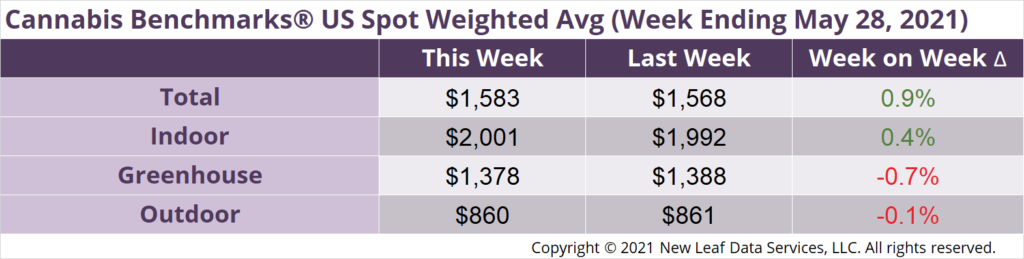

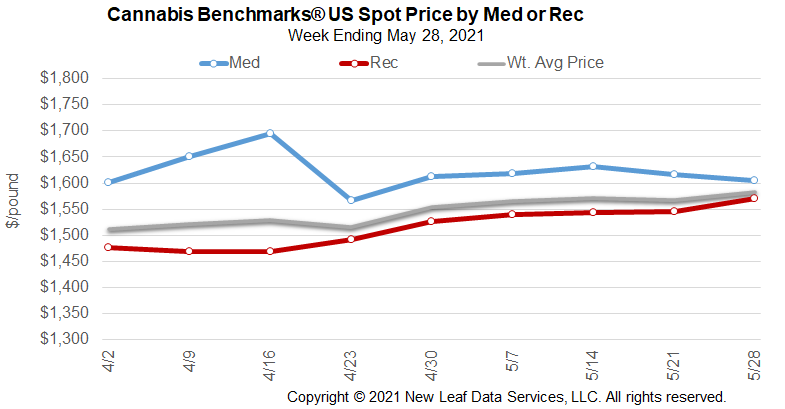

U.S. Cannabis Spot Index up 0.9% to $1,583 per pound.

The simple average (non-volume weighted) price increased $11 to $1,813 per pound, with 68% of transactions (one standard deviation) in the $1,045 to $2,580 per pound range. The average reported deal size increased to 2.4 pounds. In grams, the Spot price was $3.49 and the simple average price was $4.00.

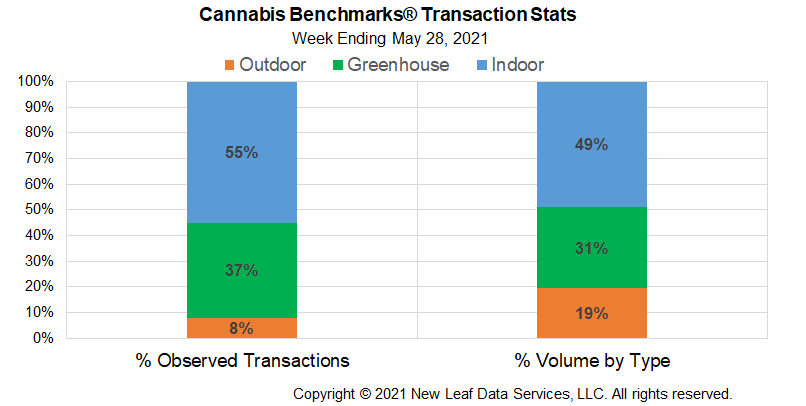

The relative frequency of transactions for outdoor flower decreased by almost 3%. The relative frequencies of deals for indoor and greenhouse product increased by about 2% and 1%, respectively.

The relative volume of outdoor flower contracted by 2% this week. The relative volumes of indoor and greenhouse product expanded by 1% each.

Cannabis Benchmarks has followed demand trends in the major markets we cover for several years. As we have documented for in excess of the past year, retail sales in legal cannabis markets across the U.S. boomed beginning in March 2020, as consumers and medical patients accelerated their purchasing from licensed outlets during the COVID-19 pandemic. Additionally, new adult-use systems in populous states like Michigan and Illinois began ramping up after opening in late 2019 and the beginning of 2020, respectively.

Collective monthly retail revenue tallies from the 10 states with the largest markets for which Cannabis Benchmarks provides price assessments – California, Colorado, Oregon, Washington, Nevada, Michigan, Illinois, Massachusetts, Arizona, and Oklahoma – illustrate the dramatic expansion of cannabis demand captured by legal markets from 2020 to 2021. The following figures are derived primarily from official state data, but also include Cannabis Benchmarks estimates, and, in the case of monthly sales figures for California and Washington, research from Hedgeye Risk Management.

In March 2020, combined retail sales from the 10 markets noted above totaled $1.01 billion. A year later, March 2021 saw the legal cannabis systems in the same states generate $1.53 billion in sales, a 51.5% year-over-year increase.

April 2020 saw nine of the 10 states listed above combine to generate $993.2 million in retail revenue (adult-use retailers in Massachusetts were compelled to close in April 2020 as part of the state’s COVID-19 response), a figure that we estimate will rise to about $1.56 billion in April 2021, once sales from all states under discussion are documented. This would represent a 57.1% year-over-year spike.

Many of the aforementioned markets saw sales records established in the early months of the pandemic. The sales data above shows that demand continued to grow to even more elevated levels, where it has stayed. Yet, even as demand expanded dramatically and rapidly, the year-over-year increase in the national composite wholesale flower price in the same period has not matched the magnitude of the sales boom. From March 2020 to March 2021, the monthly average U.S. Spot price rose by 9.2% from $1,381 to $1,508 per pound. The national volume-weighted composite price climbed by 11.7% from April 2020 to April 2021, from $1,367 to $1,527 per pound, a rate of increase that is only about one-fifth of that observed in the retail revenue data.

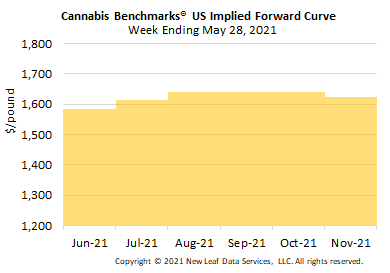

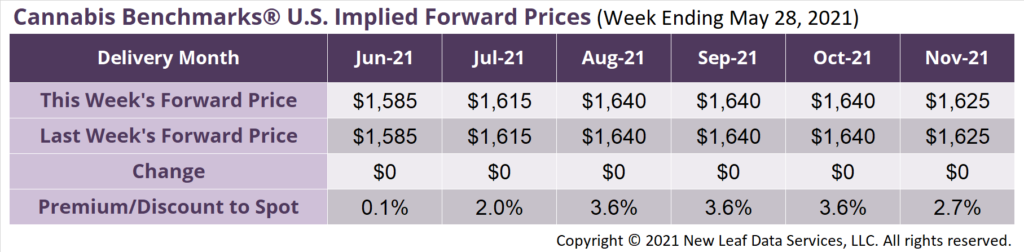

June 2021 Implied Forward closes at $1,585 per pound.

The average reported forward deal size was 51.8 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 52%, 35%, and 13% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 65 pounds, 41 pounds, and 29 pounds, respectively.

At $1,585 per pound, the June Implied Forward represents a premium of 0.1% relative to the current U.S. Spot Price of $1,583 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Report: New Licensed Retailers Begin to Open in Los Angeles

Illinois

Legislation to Create and Issue Additional Retail Licenses Approved by State House of Representatives

New Mexico

Regulators Publish Draft Rules for Adult-Use Producers