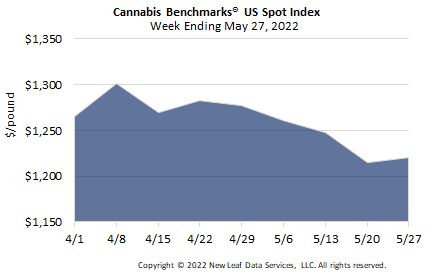

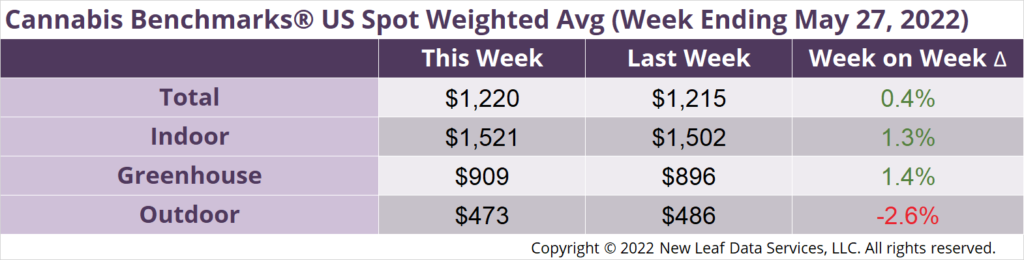

The U.S. Cannabis Spot Index increased 0.4% to $1,220 per pound.

The simple average (non-volume weighted) price increased $14 to $1,475 per pound, with 68% of transactions (one standard deviation) in the $659 to $2,292 per pound range. The average reported deal size increased to 2.4 pounds. In grams, the Spot price was $2.69 and the simple average price was $3.25.

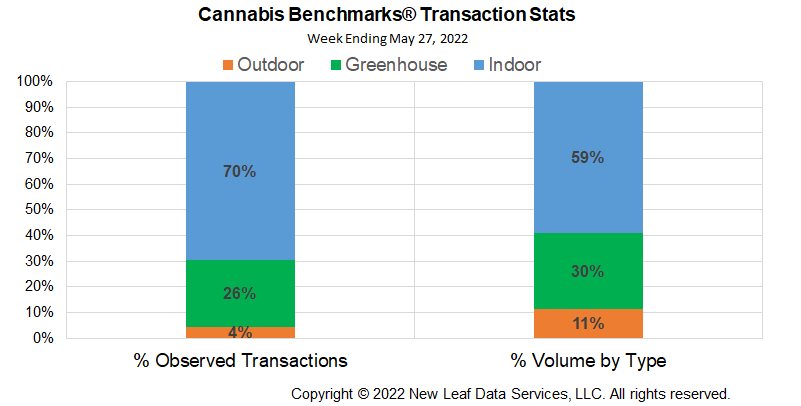

The relative frequency of transactions for indoor flower was unchanged. Greenhouse flower transaction frequency rose 1% and that of outdoor flower was unchanged.

The relative volume of indoor flower fell 2%, while that of greenhouse flower rose 2%. Outdoor flower’s relative volume fell 1%.

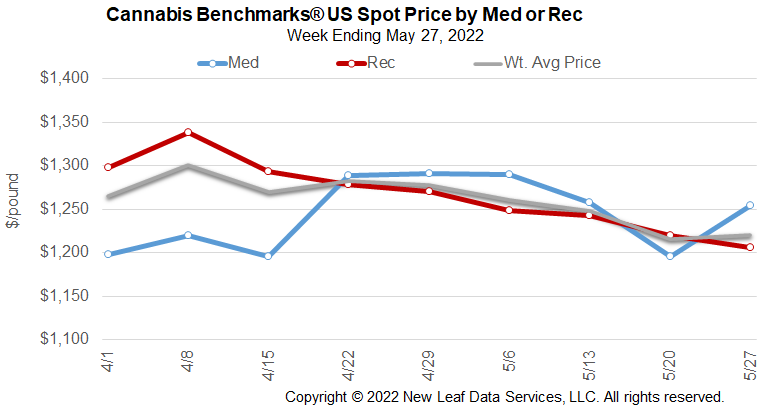

U.S. Spot price ticked up by $5 this week to $1,220 per pound, reflecting stabilizing prices in some of the more expensive markets in the country. The top five most expensive cannabis markets in the U.S. are Illinois, Alaska, Maine, New Mexico, and Massachusetts. Michigan fell out of the top price running in November 2021 as the state brought in its first sizable outdoor harvest. New Mexico is now the fourth most expensive market tracked by Cannabis Benchmarks with its adult use market open, consumer demand ramping up, and the absence, for now, of significant amounts of outdoor-grown product.

In April 2021, Massachusetts was the priciest cannabis market in the country. It managed to stay in the top two until December 2021 when prices started softening a bit, trading just over $3,400 per pound. The third week in January 2022 marked the beginning of cascading losses, taking price down $140 in just one week. Price fell over 28% from January to the second week in March, going from the second to the fourth most expensive market tracked by Cannabis Benchmarks in a matter of six weeks. Given the sell-off started just after the new year, one guesses it was a money raising event, a clearing out of inventory and / or a bold attempt at market position.

Alaska retained the number two spot in the top five. While the Alaskan market does have some outdoor product, it is not a significant factor in the state’s Spot price. Contacts in the The Last Frontier state say out-of-state product weighs on local price, as does heavy competition between high THC brands.

Michigan lost its spot as the fifth most expensive wholesale market in December 2021 when price fell below $2,100 per pound, just as New Mexico demand pushed prices up in the months leading up to the April 2022 opening of the state’s adult use market. Prices have steadied somewhat in Michigan, but recent remarks out of the state suggest there is some trepidation ahead of this year’s outdoor grown crop hitting the market in October and November 2022.

Finally, U.S. Spot has remained steady, well below the top five priciest markets as legacy state volume weighs the index down.

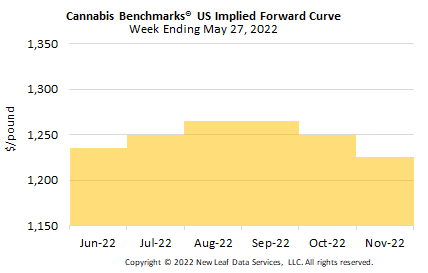

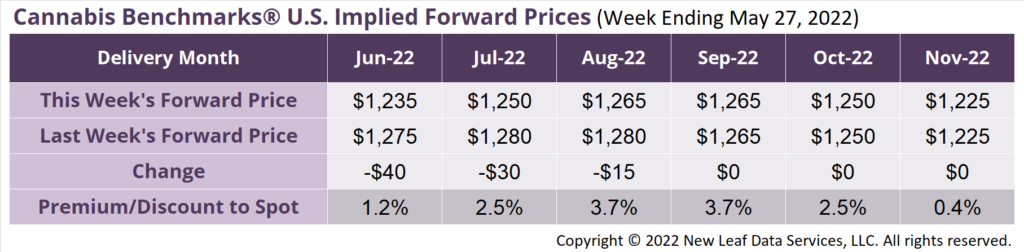

June 2022 Implied Forward assessed down $40 to $1,235 per pound.

The average reported forward deal size was 80 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 43%, 42%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 90 pounds, 77 pounds, and 58 pounds, respectively.

At $1,235 per pound, the June 2022 Implied Forward represents a premium of 1.2% relative to the current U.S. Spot Price of $1,220 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

Entering the “Consequences” Phase – Interview

New York

144 Conditional Cultivator Licenses Awarded So Far

Michigan

Michigan’s Rapidly Evolving Cannabis Market – Interview

Oklahoma

OMMA – Get Compliant with METRC or Get Enforcement