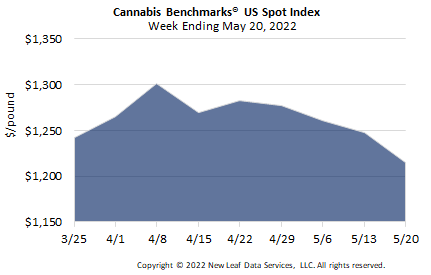

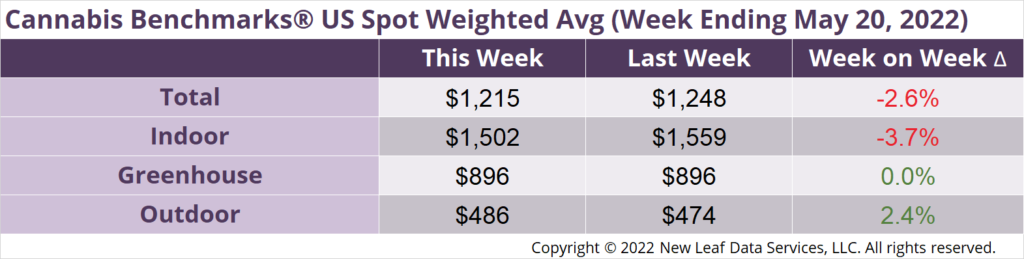

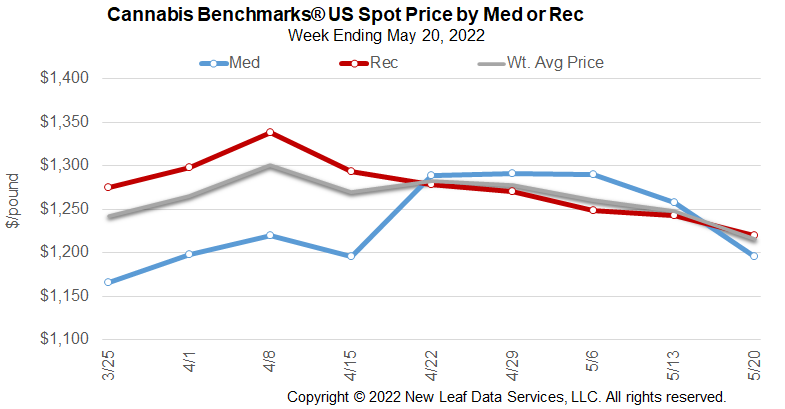

The U.S. Cannabis Spot Index decreased 2.6% to $1,215 per pound.

The simple average (non-volume weighted) price decreased $44 to $1,461 per pound, with 68% of transactions (one standard deviation) in the $653 to $2,270 per pound range. The average reported deal size increased to 2.4 pounds. In grams, the Spot price was $2.68 and the simple average price was $3.22.

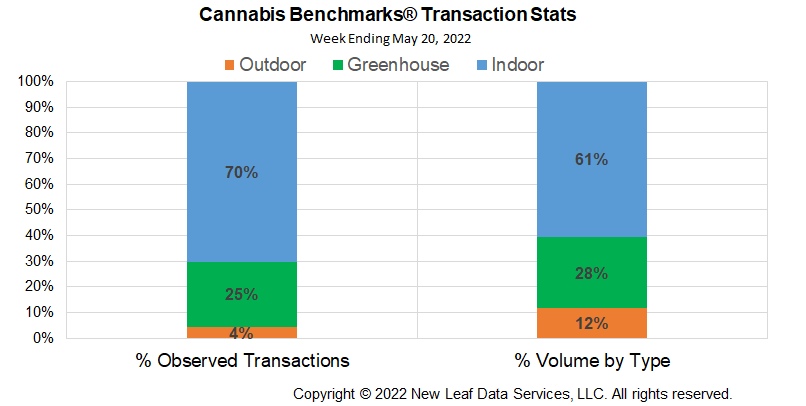

The relative frequency of transactions for indoor flower fell 2%, while that of greenhouse flower rose 1%. Outdoor transaction frequency was unchanged.

The relative volume of indoor flower rose 1%, while that of greenhouse flower was unchanged. The relative volume of outdoor flower rose 1%.

The U.S. Spot market is working off a mini-rally that took price from $1,177 per pound in the first week of March 2022 up to $1,301 in the week of April 8, 2022. Price has already worked off two-thirds of that gain, strongly suggesting a quick trip back to the March 2022 low of $1,177. The price action in March likely reflected purchases ahead of 4/20 and the subsequent losses likely represent discounting ahead of the 4/20 holiday and a return to trend following the event-driven price movement.

The recent sell-off across newer markets was one subject discussed with Leise Rosman, a Montana cannabis entrepreneur with an extensive background in consulting across the country. She floated the notion that price action in new states is likely due, at least in part, to venture-backed firms aggressively shedding inventory to start paying off loans taken out in 2019.

Businesses in states newer to the legal cannabis business undertook large canopy build-outs, along with standing up production and retail facilities. Rosman suspects large operators need to raise funds to start paying off venture loans and noted that once operators start unloading inventory to raise money – sell-offs on the order of Massachusetts, Michigan, Illinois, Arizona, and Oklahoma – it creates a cascade of selling among bigger firms.

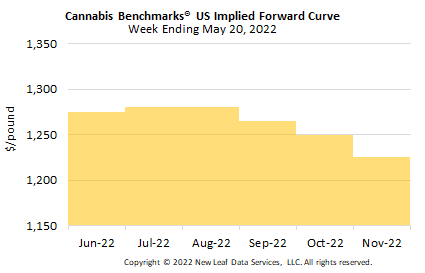

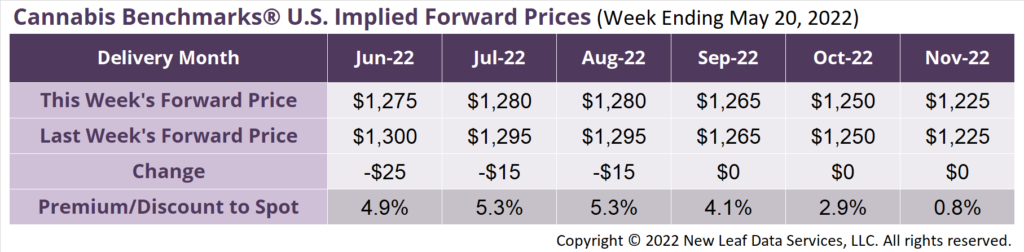

June 2022 Implied Forward assessed down $25 to $1,275 per pound.

The average reported forward deal size was 78 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 43%, 41%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 87 pounds, 76 pounds, and 58 pounds, respectively.

At $1,275 per pound, the June 2022 Implied Forward represents a premium of 4.9% relative to the current U.S. Spot Price of $1,215 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Michigan

Monthly Sales Set New Record – Top $195 Million

Oklahoma

March Sales down 25% Y-o-Y on Spot Price Erosion

Arizona

Adult Use Share of Total Market Increases as Overall Sales Decline

Alaska

March Sales Up 18%; Flower Demand Jumps