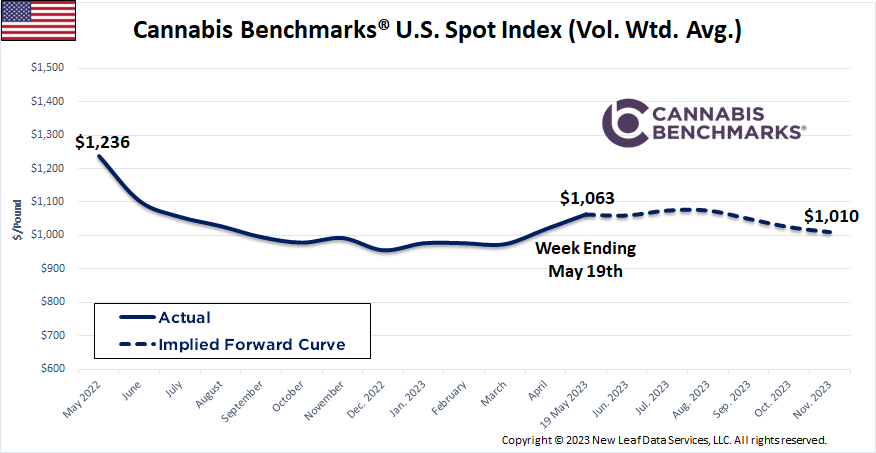

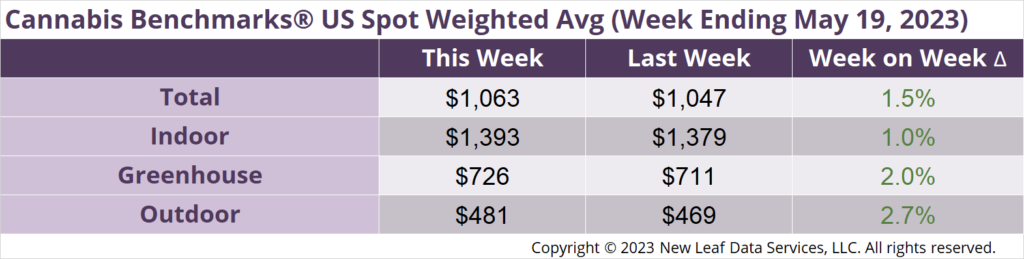

The U.S. Cannabis Spot Index increased 1.5% to $1,063 per pound.

In grams, the Spot price was $2.34.

U.S. SPOT UPDATE & STATE MARKET OVERVIEW

U.S. wholesale spot price climbed $16 per pound this week behind big net gains out of New England and more modest gains in the Midwest. Legacy states netted $14 on the week and the Sand States slipped $25, while New England netted +$138 and the Midwest tacked on a net of +$30.

While there is little in the way of true financialization in the nation’s cannabis markets due to the lack of banking – and while inflation continues to weigh on consumers even as debt burdens weigh on the cannabis industry – the fact is U.S. wholesale spot price is recovering after forming a base in the mid-$950s per pound this year.

The future is not knowable, but from a technical and macro perspective it’s fair to say the cannabis market is recovering pricing power. When the market came off the Covid boom and overshot on the downside, it became clear prices were heading for illicit market levels, not with intentionality but due to persistent oversupply. Legacy states and a handful of others, while not having eradicated the illicit market, are priced at, near, or even under illicit market prices. The rule that substantially like commodities must eventually be priced alike is coming to fruition in this newest of marketplaces.

Commodification of markets means like products are priced alike through competition – including illicit markets – and while there are substantial price spreads between and within regions, they are only artificially supported by state policies meant to protect new markets. Cannabis prices will eventually converge within states, then regions and across the country, such that a product bought in New England can be replaced in California at the substantially the same price. Pricing differences will persist in differentiated markets – those markets with bespoke or extremely well-marketed products – but will only form a fraction of the overall cannabis market.

The majority of the market, whether it be flower or oil, will be priced the same from Oregon to New England as very expensive cultivation and production move to regions with less expensive production costs. At the end of the day, the owners of the means of production will join with the owners of the means of capitalization to make the cannabis industry more efficient and to increase consumer uptake.

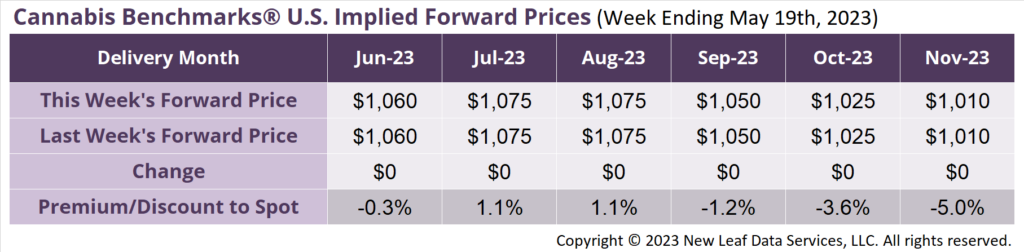

June 2023 Implied Forward unchanged at $1,060 per pound.

At $1,060 per pound, the June 2023 Implied Forward represents a discount of 0.3% relative to the current U.S. Spot Price of $1,063 per pound.

April Sales Slip Slightly; Production Continues to Outpace Demand at Solid Clip

Wholesale Prices Remain Steady as March Sales Off 6% YoY

Demand Stagnant in 1st Year of Adult Use Sales; Possible Tourism Boost this Summer

Strong Sales Continue Despite Small Monthly Decline in April