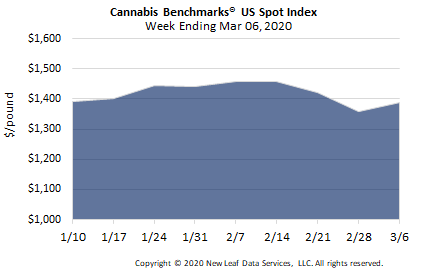

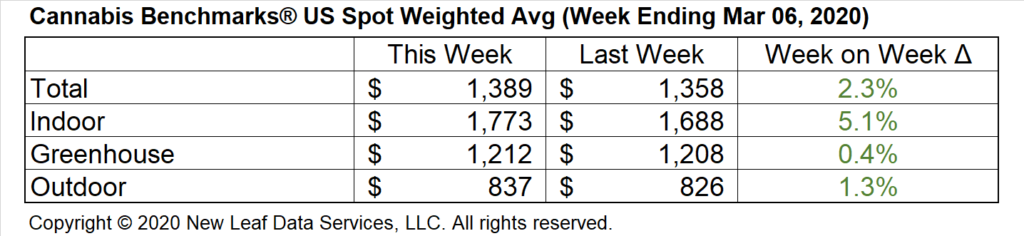

U.S. Cannabis Spot Index up 2.3% to $1,389 per pound.

The simple average (non-volume weighted) price decreased $6 to $1,572 per pound, with 68% of transactions (one standard deviation) in the $838 to $2,306 per pound range. The average reported deal size decreased to 2.0 pounds. In grams, the Spot price was $3.06 and the simple average price was $3.47.

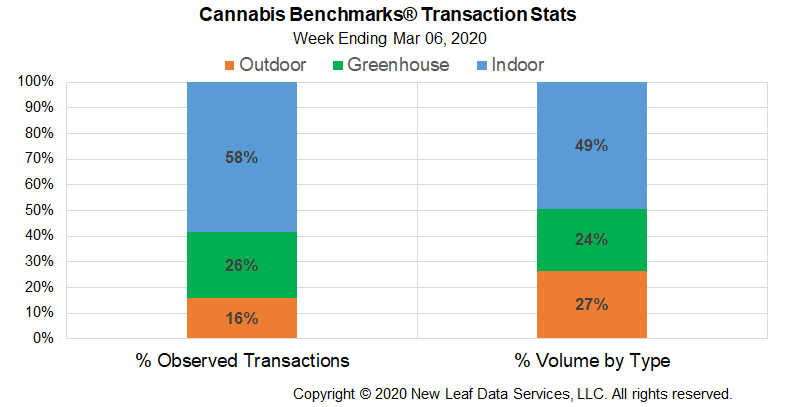

The relative frequency of trades for indoor flower decreased by 4% this week. The relative frequency of deals for greenhouse product increased by the same proportion, while that for transactions for outdoor flower was unchanged.

Warehouse product’s share of the total reported weight moved nationally contracted by 3% this week. The relative volume of greenhouse flower expanded by the same proportion, while that for outdoor flower was unchanged.

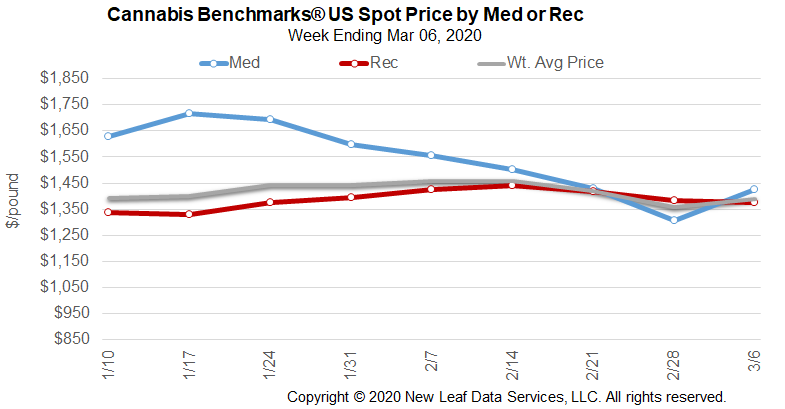

The U.S. Spot Index rose by 2.3% this week to settle at $1,389 per pound. National prices for outdoor flower stabilized this week after declining since mid-January. The U.S. volume-weighted average for indoor product also bounced back this week after declines in the latter portion of February.

On the state level, four of the five largest markets saw upticks in the Spot rates, with Colorado the only exception. Oregon is the state with the most up-to-date, detailed market data available at this point, which shows roughly 800,000 pounds of unsold flower and trim still in the hands of growers and processors. While wholesale prices in the state rose despite similar surpluses at this time last year, we expect that sales growth – which approached 25% year-over-year in 2019 – will subside this year.

Looking ahead, high wholesale flower prices in Illinois, Massachusetts, and Michigan could lift the U.S. Spot. However, adult-use sales slipped month-over-month in Illinois in February, likely due mainly to inadequate supply. Given the slower rollouts taking place in those states – relative to the preceding Western markets that generally had larger medical cannabis systems to build on – it is at this point an open question as to whether trading volumes in the newer markets will expand to rival those of the West Coast states and Colorado this year.

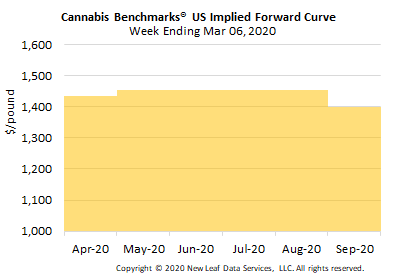

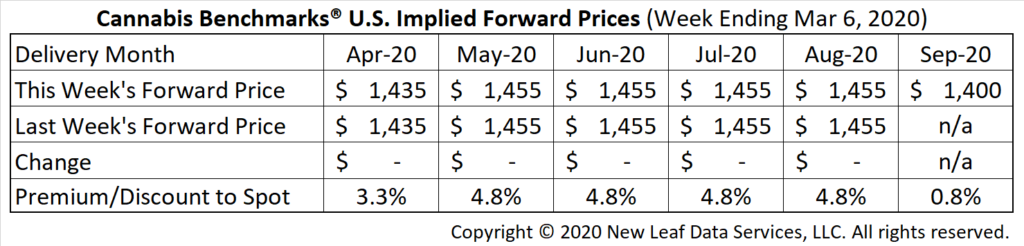

September Forward initially assessed at $1,400 per pound.

The average reported forward deal size was 39 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 50%, 33%, and 17% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 43 pounds, 33 pounds, and 37 pounds, respectively.

At $1,435 per pound, the March Forward represents a premium of 3.3% relative to the current U.S. Spot Price of $1,389 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Headlines From This Week’s Premium Report:

Oregon

Cultivators Held Over 55% of Over 1 Million Pounds of Unsold Flower & Trim as of early February

Nevada

Total Legal Cannabis Sales Topped $700 Million in 2019, Up 21% YoY

Michigan

Licensed Businesses No Longer Able to Purchase Extracts and Other Manufactured Products from Caregivers, Now Limited to Flower and Trim Only

Illinois

February Retail Sales in Adult-Use Sector Down 11% MoM, Likely Due to Limited Supply