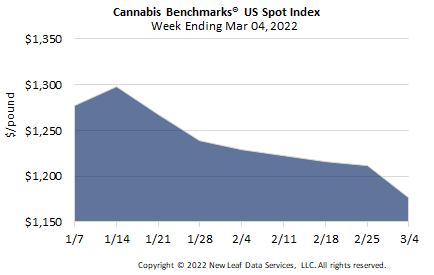

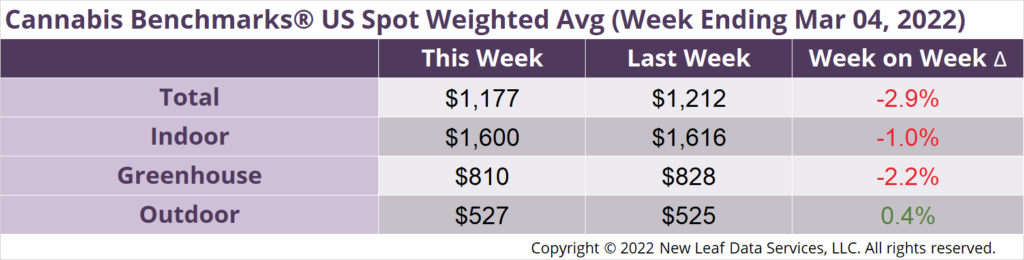

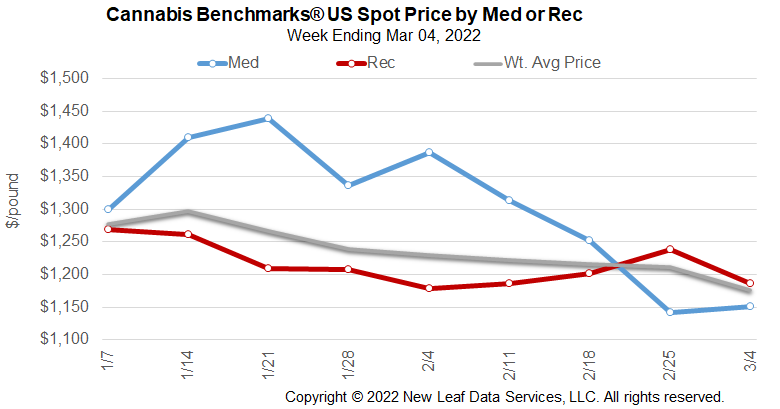

The U.S. Cannabis Spot Index decreased 2.9% to $1,177 per pound.

The simple average (non-volume weighted) price decreased $31 to $1,465 per pound, with 68% of transactions (one standard deviation) in the $643 to $2,287 per pound range. The average reported deal size was nominally unchanged at 2.5 pounds. In grams, the Spot price was $2.59 and the simple average price was $3.23.

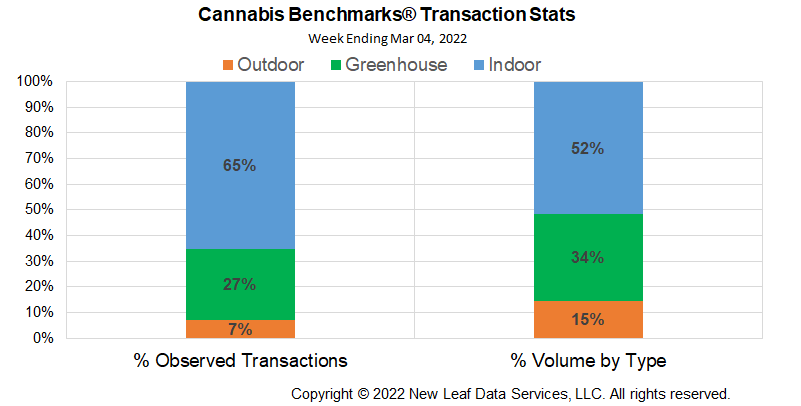

The relative frequency of transactions for indoor flower was down about 1%, while those of greenhouse and outdoor flower were essentially unchanged this week.

The relative volume of indoor flower fell over 2%; that of greenhouse flower was up 1% and that of outdoor flower rose 2%.

U.S. Spot price fell $35 this week with legacy states and, more recently, high population states with younger markets steering the index. California Spot slipped $40 per pound on a 20-week average loss of $15.74. Washington State shed $9 with 20-week average losses narrowing to just over $8. Oregon Spot rose $21 per pound, also on a contracting 20-week average loss of $16.72. Colorado’s 20-week average losses have been narrowing as well over the past two months, falling below $6 per week with Spot gaining $7 this week.

High population states that are relatively new to the adult use market continue to see price pressure, with growers increasingly making bulk deals at lower rates, thus dragging down spot prices. Michigan shed $47 per pound this week, pushing the 20-week average loss to $53. Massachusetts Spot fell $45 per pound on a 20-week average loss of $53. Even Illinois is seeing a bit of price erosion, falling $29 per pound this week.

While each state has its own supply / demand profile, even newer states are beginning to see significant price erosion and, country-wide, prices are mostly lower than last year. Wholesale prices are likely to continue lower, with outdoor flower prices pulling down overall prices in legacy markets. Prices in new states will be weighed down mostly by increasing numbers of and expanding growers nailing down production methods even as supply is outpacing demand.

Longer term, prices across the country are bound to converge even though state supply and demand profiles differ. Markets seek efficiency in production and distribution methods that will drive prices together. At the end of the day, it is all one commodity for the purposes of the overall market and therefore should not be priced differently across the country.

Cannabis Benchmarks U.S. Spot Index reflects price information collected from across the country and will set a price standard that can be used to hedge every product across the supply chain. When the market is traded legally on an exchange, the likely contract will reflect the collected prices – the index – of prices across the country, creating an efficiency the current market lacks. One way to think about legally traded cannabis is to look at other indexes: the S&P 500, for example, represents 500 differently priced stocks and is arguably the most efficient way to trade the stock market, as it encompasses diversification with standards for inclusion therein. Ultimately, an index of spot prices traded on a futures exchange will allow for hedging cannabis prices so growers – and everyone else across the supply chain – can lower business risk and plan for the future in a more efficient fashion.

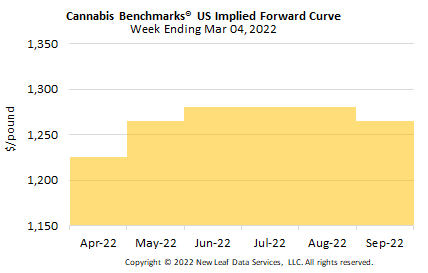

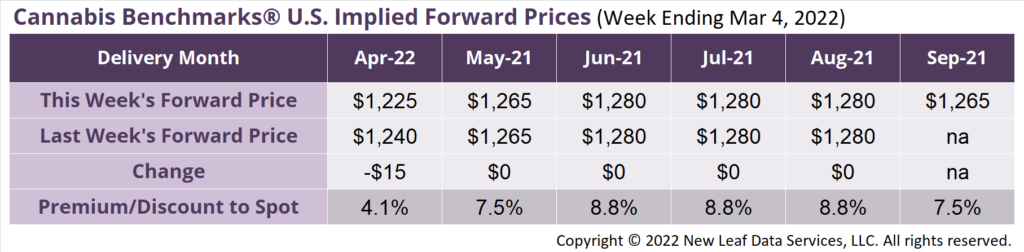

September 2022 Implied Forward initially assessed at $1,265 per pound.

The average reported forward deal size increased 7 pounds to 75 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 32%, 52%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 90 pounds, 70 pounds, and 59 pounds, respectively.

At $1,225 per pound, the April 2022 Implied Forward represents a premium of 4.1% relative to the current U.S. Spot Price of $1,177 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

February Sales Slip Again

Nevada

November Sales Fall on Lower Prices

Illinois

Adult Use Sales Down in February, Demand Softens

California

Proposed Bills May Circumvent Federal Regulation