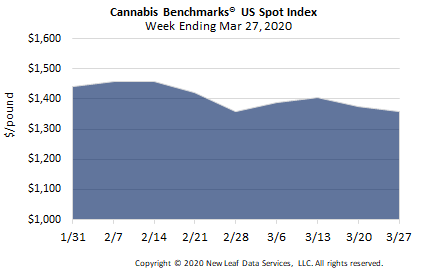

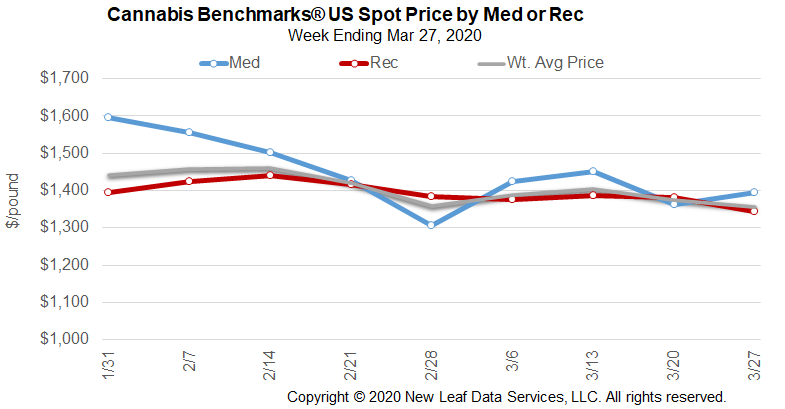

U.S. Cannabis Spot Index down 1.3% to $1,357 per pound.

The simple average (non-volume weighted) price decreased $26 to $1,565 per pound, with 68% of transactions (one standard deviation) in the $799 to $2,330 per pound range. The average reported deal size increased to 2.2 pounds. In grams, the Spot price was $2.99 and the simple average price was $3.45.

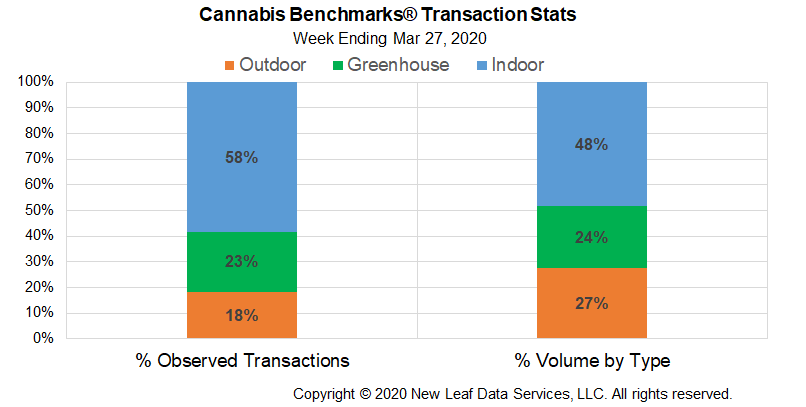

The relative frequency of trades for greenhouse flower increased by over 2% this week. The relative frequency of deals for indoor product decreased by the same proportion, while that for transactions involving outdoor flower was unchanged.

Warehouse flower’s share of the total reported weight moved contracted by over 2% this week. The relative volume of greenhouse product expanded by the same proportion, while that for outdoor flower was unchanged.

The COVID-19, or coronavirus, crisis continued to reshape legal cannabis markets in the U.S. this week. For the most part, cannabis businesses up and down the supply chain have been declared “essential” by regulators and remain open even under shelter-in-place or stay-at-home orders issued by state and local officials. However, in many cases operations have been compelled to alter their practices significantly, while some state and local regulators have shown a willingness to shutter adult-use cannabis businesses for public health concerns.

Early indications from California suggested that stay-at-home, shelter-in-place, and similar orders result in a surge of sales ahead of their effective period, but could result in a steep drop in demand if residents comply with the directives. Requirements to carry out sales “curbside” or via delivery now in effect in numerous states may also slow down the pace of sales, due to each customer taking longer to serve, and result in lower revenues generally.

Notably, the only current official sales data able to be located to this point comes from Oregon. As part of its announcement of temporary rules, noted below, the OLCC stated, “During the period of March 1-18, 2020, OLCC marijuana retailers have seen a 25-30% increase in sales compared to the same period last year.” However, the year-over-year increase noted by Oregon officials for the first two-and-a-half weeks of March is largely consistent with general sales growth observed in the state since last year. For 2019, annual sales increased by 23% compared to 2018, as we detailed in our report for January 24. We also noted last week that February 2020’s sales were up by 30% relative to those recorded in February 2019.

Given this context, it does not appear that the COVID-19 crisis spurred consumer demand for cannabis in Oregon significantly greater than the growth that was taking place already. However, in markets where year-over-year growth has been slowing – such as Colorado and Washington State, as well as Nevada – ramifications of the pandemic and reactions of consumers to stay-at-home orders may have led to different results.

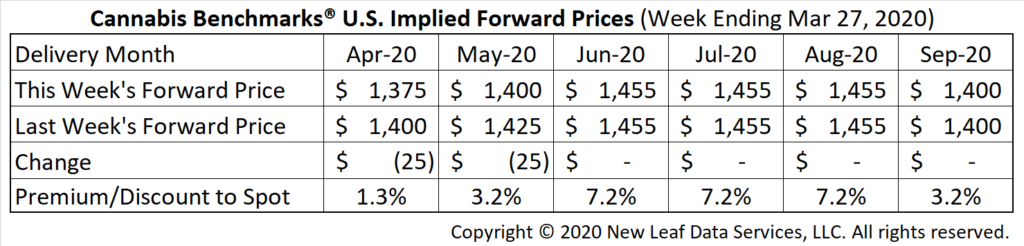

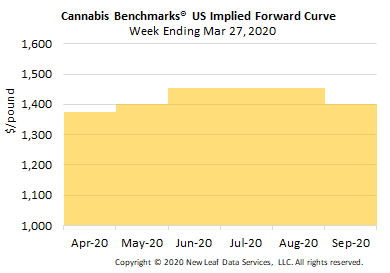

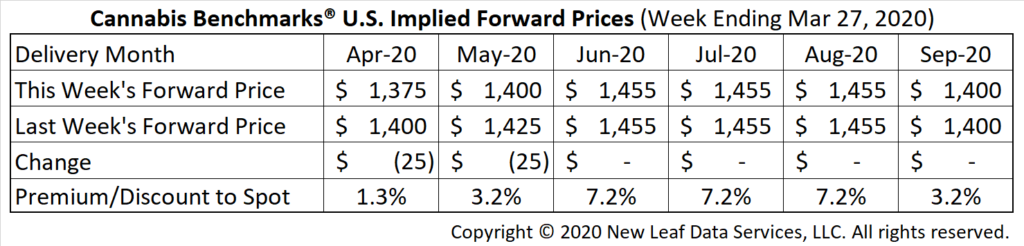

April Forward closes down $25 to $1,375 per pound.

The average reported forward deal size was 37.5 pounds. The proportion of forward deals for outdoor, greenhouse, and indoor-grown flower was 47%, 35%, and 18% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 43 pounds, 30 pounds, and 37 pounds, respectively.

At $1,375 per pound, the April Forward represents a premium of 1.3% relative to the current U.S. Spot Price of $1,357 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Headlines From This Week’s Premium Report:

National

Colorado

Adult-Use Cultivators Will See Lower Tax Rate on Internal Transfers of Flower in Q2

Washington

Tax Payments and Late Payment Penalties Deferred Until Late April for Cannabis Businesses

Nevada

Cannabis Sales Permitted Only by Delivery; Lack of Tourism in Las Vegas Likely to Depress Demand Significantly

Massachusetts

Adult-Use Cannabis Operations Ordered to Cease Operations, Medical Businesses Still Open