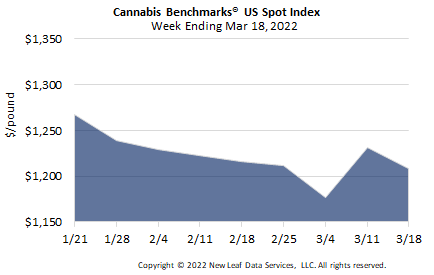

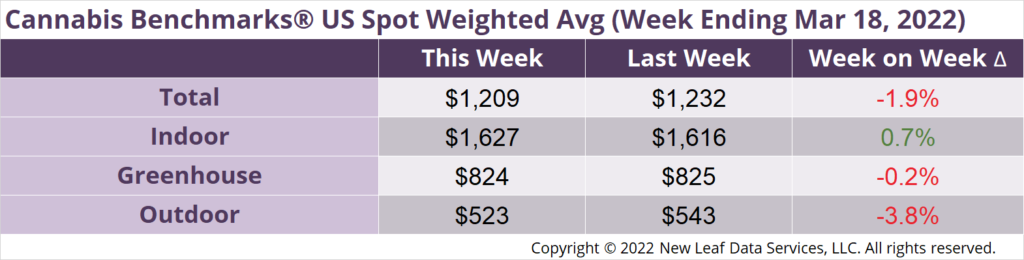

The U.S. Cannabis Spot Index decreased 1.9% to $1,209 per pound.

The simple average (non-volume weighted) price increased $2 to $1,496 per pound, with 68% of transactions (one standard deviation) in the $662 to $2,331 per pound range. The average reported deal size was nominally unchanged at 2.5 pounds. In grams, the Spot price was $2.67 and the simple average price was $3.30.

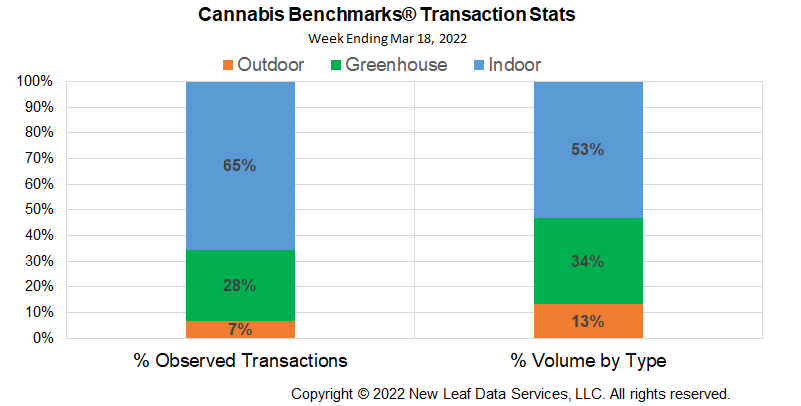

The relative frequency of transactions for indoor flower fell 2%, while greenhouse deal frequency rose 1%, as did outdoor transaction frequency.

The relative volume of indoor flower fell 2%; that of greenhouse flower rose 1% and that of outdoor flower rose 2%.

U.S. Spot price fell about $23 this week, dragged lower by not just legacy markets, but also by younger markets in high population states. In fact, Oregon’s Spot jumped $22 this week, making for a nearly $90 gain over the past two weeks due to seasonal demand factors. Oregon prices are still technically in a downtrend, however, with the 10-week average weekly loss at -$15.24.

Washington State gained nearly $6.50 per pound, with a narrowing 10-week average weekly loss of -$8.28. California’s Spot slipped about $11.50, even as the 10-week average loss narrowed to just under $7 per pound. Colorado’s Spot lost almost $33 per pound as the 10-week average loss jumped to nearly $8.50 per pound.

Illinois’ Spot fell about $20 per pound and has shed over $260 per pound in the past three weeks, bringing the 10-week average weekly loss to -$32 per pound. Michigan’s Spot has been pummeled over the past 10 weeks, falling over $750 per pound and pushing the 10-week average weekly loss up over $75 per pound. Massachusetts’ Spot has also come under pressure in the past eight weeks, losing over $900 per pound with large volume deals at lower prices pulling down prices. The 10-week average weekly loss in Massachusetts is up over $94.

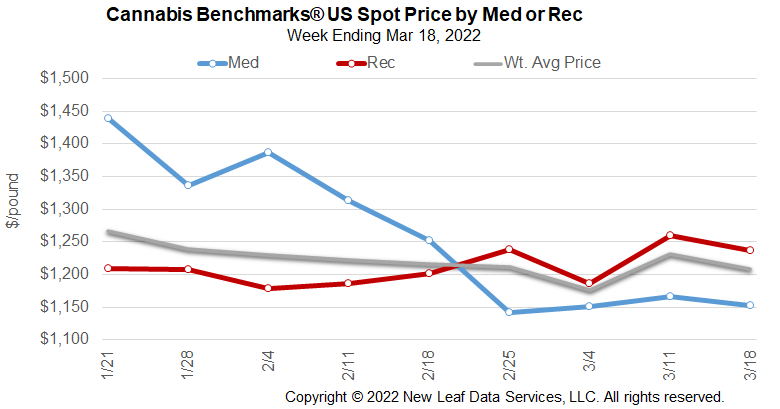

While legacy market prices have mostly been grinding lower since summer 2021 in a post-pandemic shake-out, newer markets in high population states have undergone rapid transformations, with prices over $4,000 per pound now firmly in the rear view. When new states start meeting consumer demand, prices tend to drop from scarcity highs to more sustainable levels. Some newer markets – Michigan, for example – bury scarcity under a flurry of new licensees, sometimes uncapped licensing, and new cannabis entrepreneurs’ quick uptake of production and distribution methods honed in legacy states. The new cannabis market cycle appears to be scarcity, abundance, followed by overabundance and ultimately stasis, where demand is met with ample production, but not oversupply.

Legacy states have learned hard lessons in basic economics such that oversupply has become a more or less permanent condition. California and Oregon are attempting to address what have been called “failing cannabis markets” through taxation changes that directly affect cannabis businesses’ bottom lines and more sophisticated schemes like license moratoriums, respectively. For more on Oregon’s license moratorium, see our interview in the state’s Spot section below.

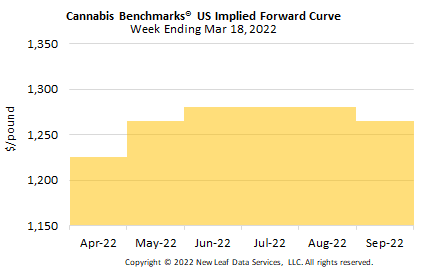

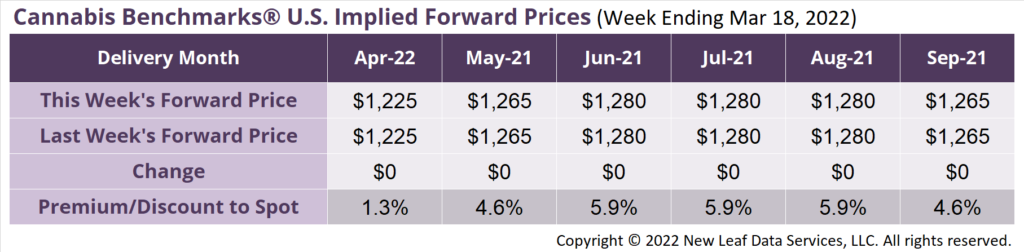

April 2022 Implied Forward unchanged at $1,225 per pound.

The average reported forward deal size was nominally unchanged at 77 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 33%, 52%, and 15% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 91 pounds, 72 pounds, and 61 pounds, respectively.

At $1,225 per pound, the April 2022 Implied Forward represents a premium of 1.3% relative to the current U.S. Spot Price of $1,209 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Oregon

License Moratorium Not About Price, It’s About New Blood

Arizona

January ‘22 Cannabis Sales Drop 9.6% M-o-M

Michigan

Sales Up Even as Cannabis Prices are Down

Massachusetts

Adult Use Cannabis Sales Defy Price Rout Headline