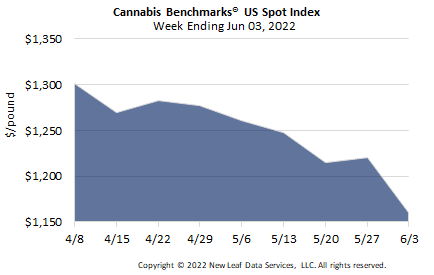

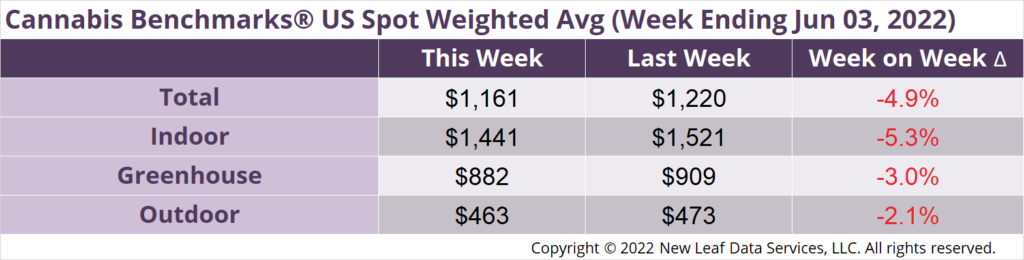

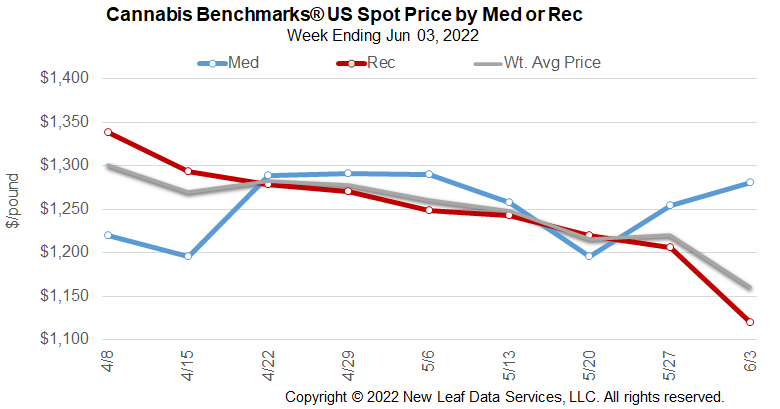

The U.S. Cannabis Spot Index decreased 4.9% to $1,161 per pound.

The simple average (non-volume weighted) price decreased $56 to $1,419 per pound, with 68% of transactions (one standard deviation) in the $618 to $2,220 per pound range. The average reported deal size increased to 2.5 pounds. In grams, the Spot price was $2.56 and the simple average price was $3.13.

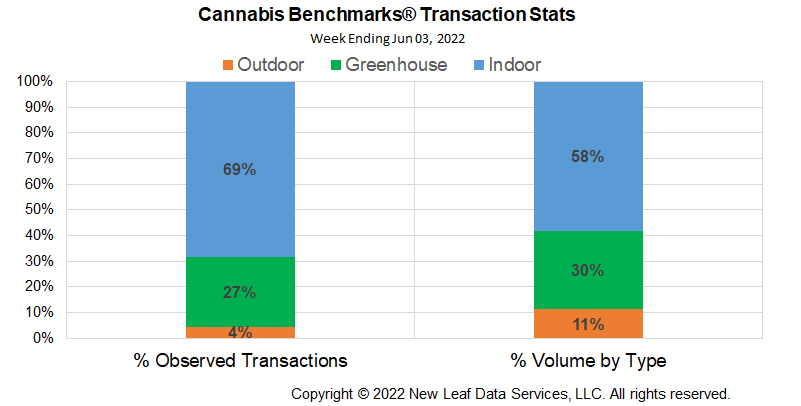

The relative frequency of transactions for indoor flower fell 1%, while that of deals for greenhouse flower rose 1%.Outdoor flower’s transaction frequency was unchanged.

The relative volume of indoor flower fell 1%, while those of greenhouse and outdoor flower were unchanged.

“Green shoots” refer to the environmental signs that winter is fading and spring is on the way. In economics, signs of recovery in a weak economy are often referred to as “green shoots.” Typically, signs of recovery are taken from GDP inputs – pieces of data about consumption, investment, government spending, and the net of imports and exports.

The California cannabis market is starting to show “green shoots,” and, while not a perfect replication of GDP calculation, there are signs of economic recovery in the cannabis sector in government spending, consumption, and investment.

Bills currently under consideration in the California legislature that affect government receipts – lowering the cannabis excise tax from 15% to 5%, eliminating the cannabis cultivation tax, and the cannabis equity tax credit – fit in the government spending category.

A Los Angeles County Health study shows steady year-on-year increases in the number of people using cannabis – a broadening consumer base. The California Department of Taxation and Fee Administration show broad increases in per capita expenditures year-on-year, despite significant price erosion. Both demonstrate increasing consumption.

The number of local governments that allow legal cannabis operations continues to expand – with San Bernardino County supply coming on line over the past few years and dozens of cities pushing to open doors to businesses in the next few years – representing opportunities for investment.

While Cannabis Benchmarks does not collect data on the illicit market, there is anecdotal evidence suggesting the California cannabis market has a robust “export” business. Exports surely exceed imports, representing an increase in overall GDP.

So, while California cannabis prices are causing some degree of pain in local markets, from a broad perspective the cannabis industry is showing “green shoots” in each GDP input. Viewed through a long lens, the California cannabis market is continuing to grow, with government spending, consumption, investment, and yes, exports, suggesting the industry has all the inputs in place to begin a broad-based recovery in the world’s largest legal cannabis market.

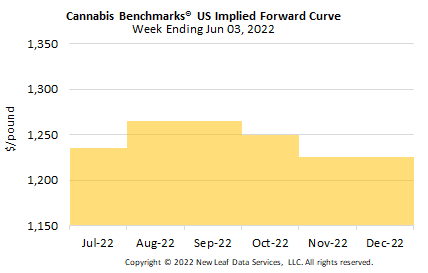

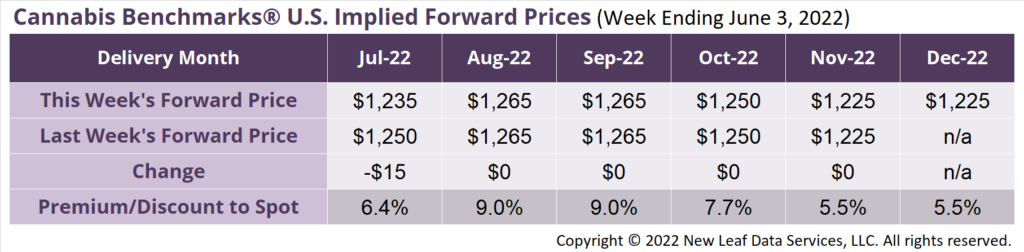

December 2022 Implied Forward initially assessed at $1,225 per pound.

The average reported forward deal size increased from 80 to 86 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 45%, 36%, and 19% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 92 pounds, 89 pounds, and 68 pounds, respectively.

At $1,235 per pound, the July 2022 Implied Forward represents a premium of 6.4% relative to the current U.S. Spot Price of $1,161 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Sales Off 10% from Q4 2021 to Q1 2022; Amount of Wholesale Flower Entering Market Down Over 40,000 Pounds

Tax Department Adjusts Excise Tax Markup Rate Down as Cannabis Tax Reform Bills Advance

New York

144 Conditional Cultivator Licenses Awarded So Far

Oregon

May 2022 Sales Down 15% YoY; Harvest Volume Up from a Year Ago

New Jersey

Report: Additional Adult Use Retailers Open, One Near Philadelphia