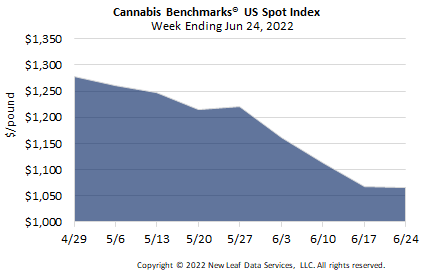

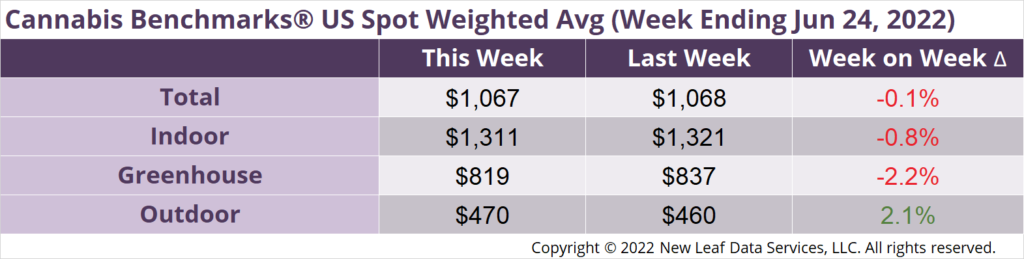

The U.S. Cannabis Spot Index decreased 0.1% to $1,067 per pound.

The simple average (non-volume weighted) price increased $9 to $1,371 per pound, with 68% of transactions (one standard deviation) in the $590 to $2,152 per pound range. The average reported deal size decreased to 2.5 pounds. In grams, the Spot price was $2.35 and the simple average price was $3.02.

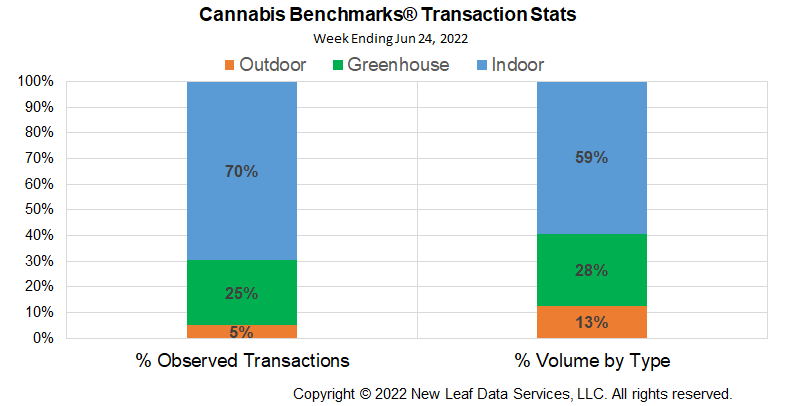

The relative transaction frequency of indoor product was up 1%, while that of greenhouse product fell 1%. Outdoor transaction frequency was unchanged on the week.

The relative volume of indoor flower rose 1%, that of greenhouse flower fell 1%, and that of outdoor flower was unchanged.

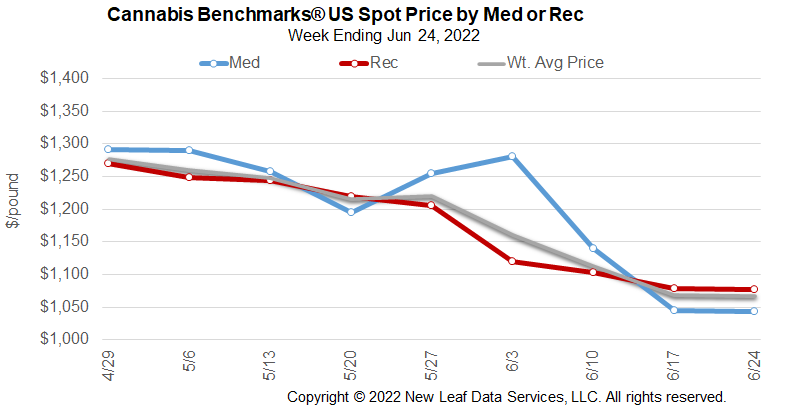

The Cannabis Benchmarks U.S. Spot Index barely moved this week. The national wholesale flower price lost $1 to end the week at $1,067 due to a mixed performance among legacy and high population states with younger markets.

Narrowing spot price losses in legacy states is a sign that volatility is draining from the market as seasonal demand starts to pick up. Lower volatility typically means the downside is losing steam and subsequent small moves higher can form the basis of a rebound in price.

Fundamental factors are keeping legacy state cannabis markets from making much headway with oversupply in the outdoor market, which is creating price contagion in the indoor and greenhouse markets. Anecdotally, there is evidence the market is also weighed down by large cannabis operators selling into falling markets, though recent price action suggests sales to raise money for business expenses are dissipating in states like Massachusetts, Illinois, and Michigan.

From an economic perspective, cannabis purchases are largely discretionary – items we like, but do not have to have. With topline inflation – food and energy prices – pressing consumers, the pullback in discretionary spending is the rational response. Pandemic related wage increases were 8% according to the U.S. Department of Labor. Inflation was running at 8.6% in May. The back of the envelope calculation is a 0.6% loss in wages year-on-year. Personal consumption expenditures have been increasing due to inflation, not wage increases, and because of “base effects” – measuring against pandemic-induced loss of wages – subsequent measures may be lower in the coming months.

As the U.S. economy starts to shrink in response to higher interest rates, falling wages, and lower consumer spending, some businesses will not weather the triple whammy of these effects. The aftermath of such economic stressors has typically included the shuttering of businesses and shrinking of inventories as inefficient businesses fall in the wake of economic stressors. After the cannabis industry weathers the vicissitudes of the larger economy, it is likely the industry will emerge more efficient, thus stronger and better able to navigate subsequent economic headwinds.

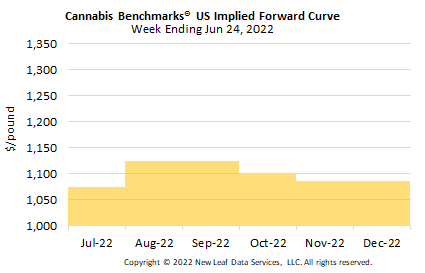

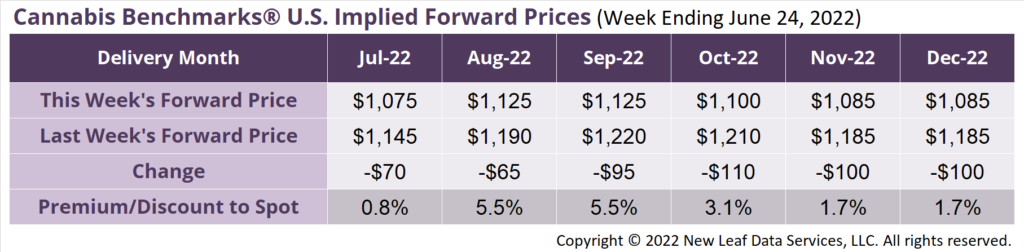

July 2022 Implied Forward assessed down $70 to close at $1,075 per pound.

The average reported forward deal size decreased to 84 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 46%, 37%, and 18% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 88 pounds, 88 pounds, and 67 pounds, respectively.

At $1,075 per pound, the July 2022 Implied Forward represents a premium of 0.8% relative to the current U.S. Spot Price of $1,067 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Large Cultivation Licenses to Become Available in 2023

Michigan

May Sales Down Slightly, Retain Most of April Surge

Arizona

Sales Soften in April as Indoor Flower Price Dives

Washington

State Economists Project Cannabis Demand to Steady at Below Pandemic Levels