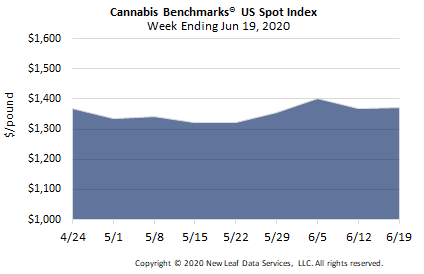

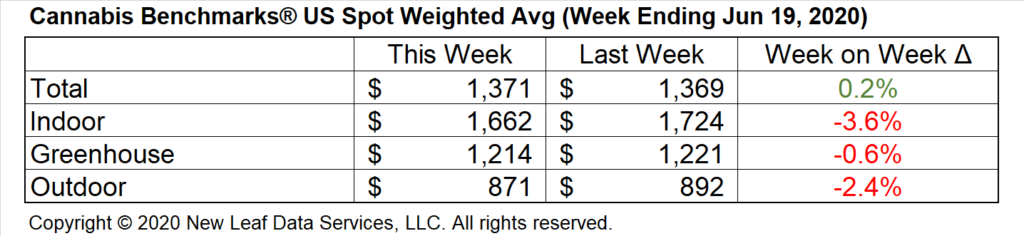

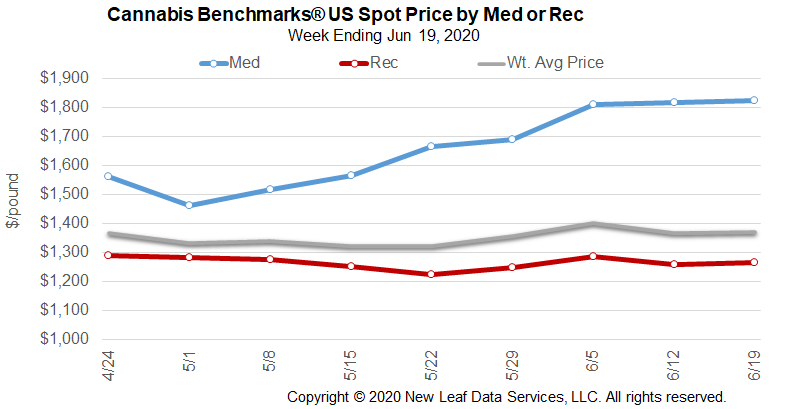

U.S. Cannabis Spot Index up 0.2% to $1,371 per pound.

The simple average (non-volume weighted) price decreased $23 to $1,546 per pound, with 68% of transactions (one standard deviation) in the $835 to $2,257 per pound range. The average reported deal size decreased to 2.1 pounds. In grams, the Spot price was $3.02 and the simple average price was $3.41.

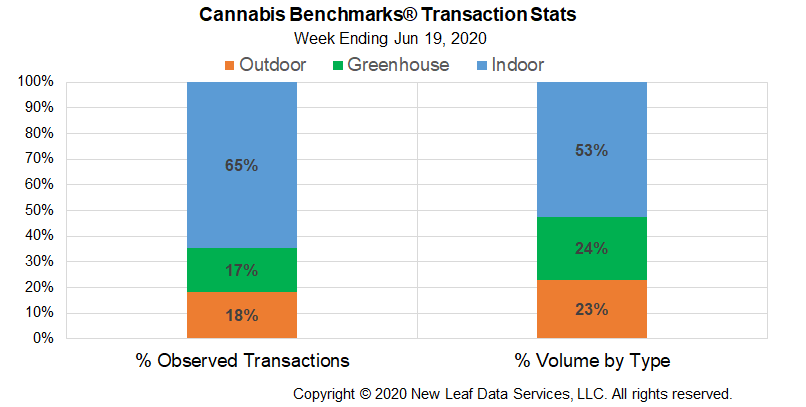

The relative frequency of trades for indoor flower increased by 2% this week. The relative frequency of transactions for outdoor product decreased by the same proportion, while that for deals for greenhouse flower was unchanged.

Indoor flower’s share of the total reported weight moved nationally expanded by 6% this week. The relative volumes of greenhouse and outdoor flower contracted by 2% and 4%, respectively.

The fact that elevated sales figures have been largely sustained in legal cannabis markets in the U.S. from March through May indicates that consumers and patients were not just stockpiling product for future use in the early portion of that three-month period. Two possibilities to explain the persistently high levels of demand are increased consumption and new patients/consumers buying from legal sellers, or some combination of the two.

Anecdotal accounts from market participants and patient count data suggest that both could be occurring, as people largely staying home may be more comfortable consuming more frequently, or might be doing so to relieve stress and anxiety. We noted in last week’s report that retailers in Oregon have stated that they are seeing new customers during this time, who are being converted to regular customers. Growth rates in the patient rolls of Arizona and Illinois in recent months show that the pace at which new patients are registering increased in April and May compared to the months prior. We have also noted in our analyses of the still-developing legal adult-use market in Canada, consumers who previously purchased from unlicensed sources may find that buying from a licensed storefront or delivery service offers greater security and convenience during this tumultuous period.

The maintenance of such developments post-COVID could mean that legal cannabis producers and retailers in many markets across the U.S. may see elevated demand going forward. This would coincide with stabilizing production capacity in numerous mature markets, and could also strain supply in newer, developing markets where cultivation is still ramping up. However, as we pointed out last week, significant unknowns remain regarding how the pandemic will play out, in addition to its continued impact on the overall U.S. economy. To this point, however, it appears that legal cannabis has largely weathered the current situation better than many other industries, and already-strong market growth could even be boosted as other sectors see catastrophic impacts.

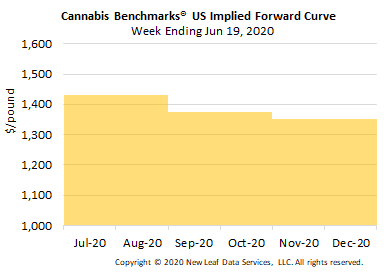

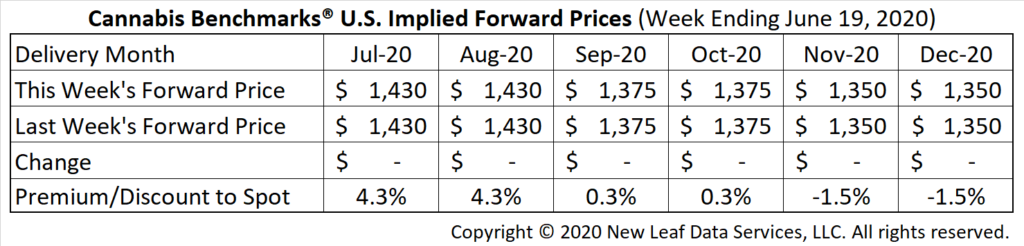

July Forward unchanged at $1,430 per pound.

The average reported forward deal size was 35.5 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 48%, 34%, and 18% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 42 pounds, 28 pounds, and 33 pounds, respectively.

At $1,430 per pound, the July Forward represents a premium of 4.3% relative to the current U.S. Spot Price of $1,371 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

At $1,430 per pound, the July Forward represents a premium of 4.5% relative to the current U.S. Spot Price of $1,369 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Michigan

Medical and Adult-Use Sales Both Jump in May to Reach Combined Total of Almost $85 Million

Arizona

May Sales Vault Over March’s to Set New Record; Daily Sales Data Indicates Expiration of Stay-at-Home Order Led to Increased Customer Traffic at Dispensaries

Illinois

Adult-Use Sales in May Spike Almost 19% MoM; Largest Increase Since Opening of State’s Market Points to Growth in Available Supply

New Mexico

Q1 2020 Sales Data Shows Large Expansion in Patient Purchasing, Likely Due to Bulk Buying in March in Response to COVID