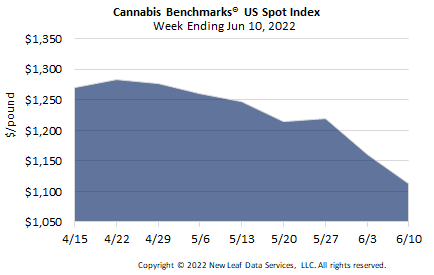

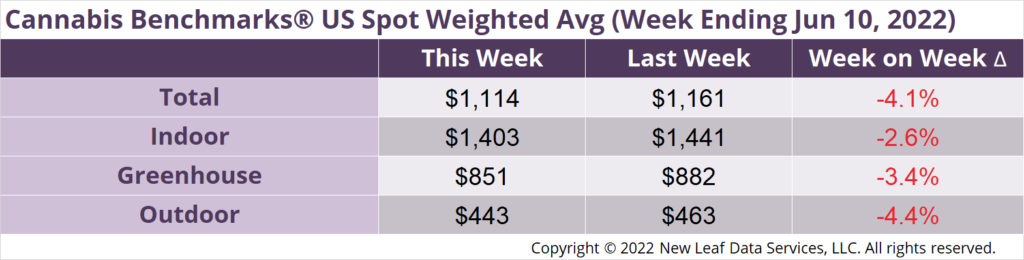

The U.S. Cannabis Spot Index decreased 4.1% to $1,114 per pound.

The simple average (non-volume weighted) price decreased $25 to $1,394 per pound, with 68% of transactions (one standard deviation) in the $612 to $2,176 per pound range. The average reported deal size was nominally unchanged at 2.5 pounds. In grams, the Spot price was $2.46 and the simple average price was $3.07.

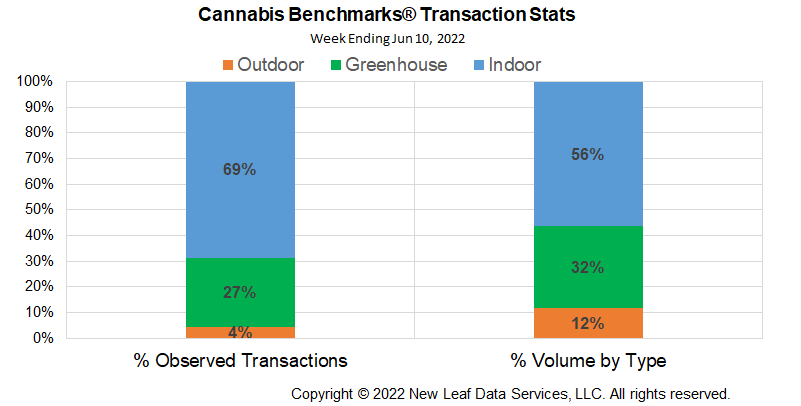

The relative frequencies of transactions for indoor, greenhouse, and outdoor flower were unchanged this week.

The relative volume of indoor flower fell 2%, while that of greenhouse flower rose 2% and that of outdoor flower rose 1%.

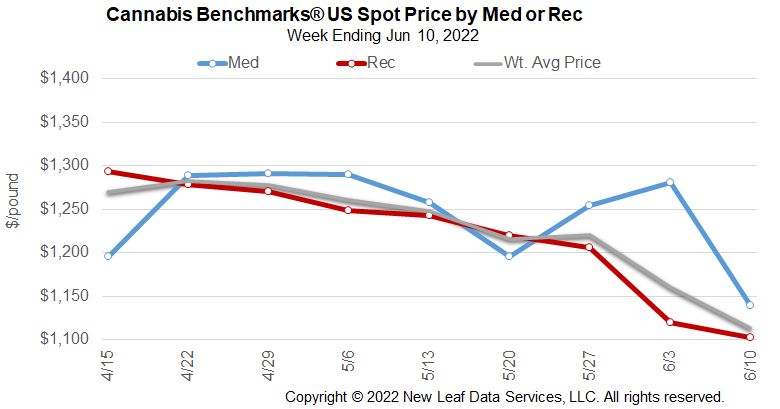

The Cannabis Benchmarks U.S. Spot Index fell $47 this week, the third week in a row of losses that amount to $106 since late May. While some states are seeing small upticks in price or smaller losses, double-digit losses in high population states continue to drag the U.S. Spot lower.

California spot lost $22 this week with outdoor-grown cannabis still under pressure in the mid-to-low $400s, a new record low for the most abundant outdoor stock in the nation.

Massachusetts spot was off $66 this week. The last uptick in Massachusetts spot price was in the week of April 22, 2022 amid the 4/20 holiday, which capped a three-week run of higher weekly prices.

Michigan spot shed $21 this week, also capping a three-week run of higher prices in which spot gained $175. Of note, the spread between indoor and greenhouse prices has blown out to $372 this week from just over $100 in mid-March. Generally speaking, instability in spreads is a forerunner of higher volatility, which typically means lower prices.

The most salient feature of New Mexico’s market is the massive narrowing of the spread between indoor and greenhouse prices. At the beginning of April, when the adult use market opened, the spread between the two grow types was $677; this week it is $67. Narrowing spreads are typically indicative of higher prices.

Nevada spot price has shed $260 per pound since mid-March, but managed to tack on $24 this week. The spread between indoor and greenhouse-grown product has widened to $770 from just over $200 last November. To find out more about Nevada price volatility Cannabis Benchmarks spoke to Brandon Wiegand, President of the Nevada Cannabis Association. The interview is available in this week’s Premium Report.

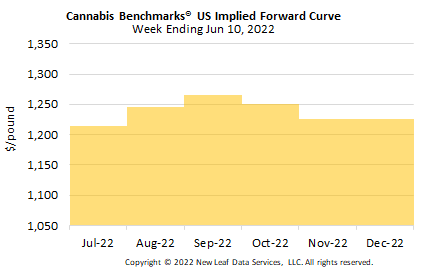

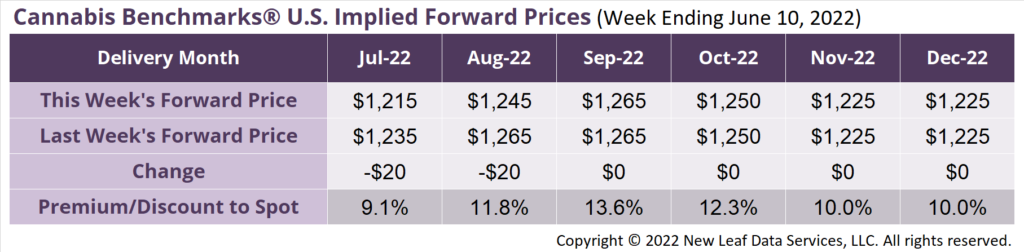

July 2022 Implied Forward assessed down $20 to $1,215 per pound.

The average reported forward deal size was nominally unchanged at 86 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 43%, 38%, and 18% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 92 pounds, 88 pounds, and 68 pounds, respectively.

At $1,215 per pound, the July 2022 Implied Forward represents a premium of 9.1% relative to the current U.S. Spot Price of $1,114 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

Nevada

“Fill My Bowl or Fill My Gas Tank,” Nevadans Decide – Interview

Illinois

May Sales Slip 2.3% Month-on-Month

Maine

Maine Adult Use Sales on a 4 Month Tear

New Mexico

Second Month Not the Charm; Cannabis Sales Slip in May