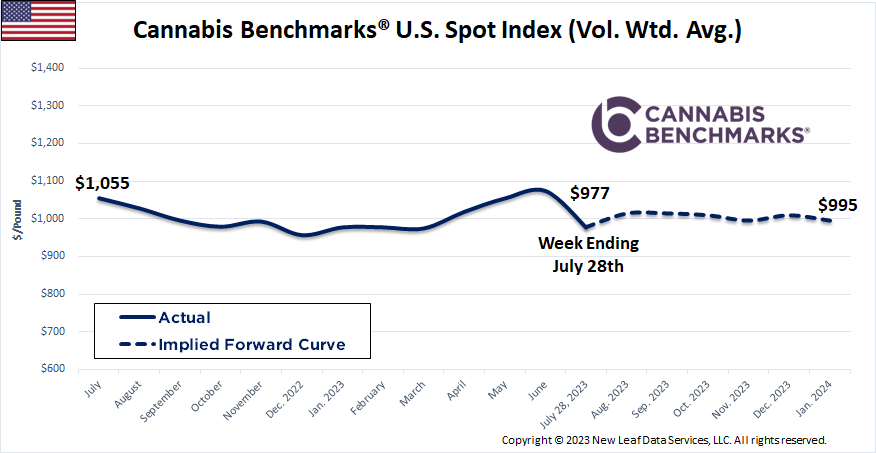

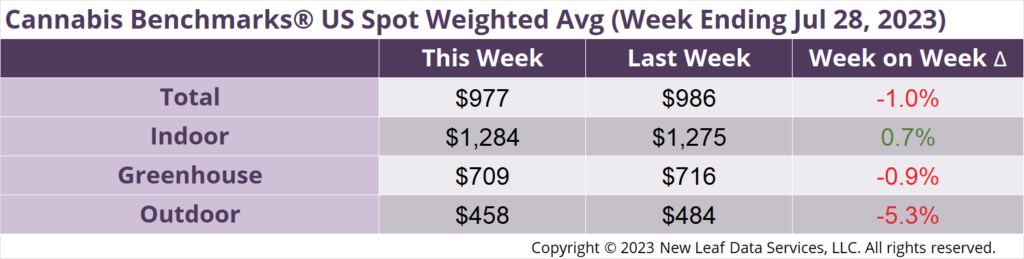

The U.S. Cannabis Spot Index decreased 1.0% to $977 per pound.

In grams, the Spot price was $2.15.

The U.S. Spot Index continued to slide to close July, perpetuating what is now a two-month downtrend in weekly prices after the first five months of the year largely saw rising rates for wholesale flower. Overall for July, the national composite price for wholesale cannabis flower in legal markets averaged $1,009 per pound, off 6.1% from June’s mean spot price of $1,075.

While it is plain that wholesale prices for legal cannabis are in uncharted territory, having surpassed previous historic lows observed in late 2018, historical Cannabis Benchmarks price data suggests that the industry was always headed to where we are today. Prior to the Covid sales boom that began in Spring 2020 and ultimately sent prices to their highest point in three years, prices had already begun to slump in late 2019 after spending the initial three quarters of the year recovering from the destruction that spanned from mid-2016 through 2018.

Sources in multiple states have told this outlet that Covid threw a lifeline to businesses that would have otherwise went under in the wake of the lean years leading up to the pandemic, keeping afloat operations not built to survive on the thin margins that come with the prices seen in late 2018 – early 2019 and the past 12 months or so. That the industry did enjoy record-breaking sales and elevated prices that many previously thought were in the rearview made it easy to forget the tough market environment pre-Covid, especially since it was mostly isolated to the West Coast and Colorado, and has resulted in the current market landscape feeling perhaps more jarring than it should.

Analysis of state-level prices reinforces the assertion that Covid was a temporary disruptor and the legal cannabis industry is seeing prices and market dynamics return to trends that were forming prior to the pandemic. We have discussed the convergence of state spot prices in various regional markets. The West Coast markets and Arizona are currently seeing similar wholesale rates, with convergence occurring in earnest this year. Moving back in time, convergence was beginning in late 2019 and, excepting Washington, also occurred during the Summer 2020 pandemic price spike.

Arizona’s spot price broke from the pack and continued higher in late 2020 due to the opening of the state’s adult use market in early 2021, but returned to trend relatively rapidly, as wholesale prices in the state began to sink in Q4 2021, less than a year after recreational sales began. This episode emphasizes the impact that major regulatory shifts can have on market dynamics and prices.

At this point, however, short of the transition from medical-only to medical and adult use sales or states severely limiting licenses, regulatory and structural differences between markets in a particular region are becoming less material to price. In the case of the West Coast and Arizona, significant discrepancies exist in the four states’ regulatory structures and market landscapes, yet convergence continues apace.

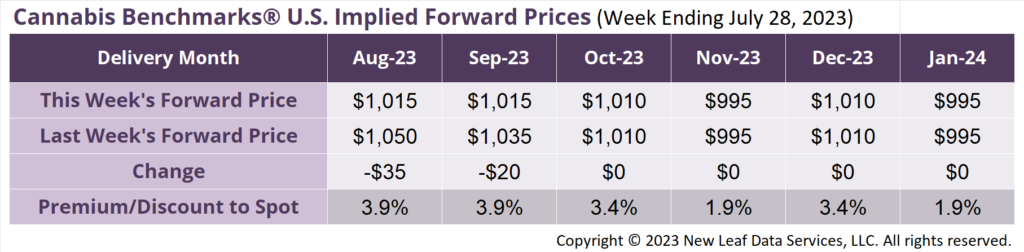

August 2023 Implied Forward assessed down $35 to close at $1,015 per pound.

At $1,015 per pound, the August 2023 Implied Forward represents a premium of 3.9% relative to the current U.S. Spot Price of $977 per pound.

Sales and Wholesale Prices Hold Steady

Long-Awaited Tax Reform Coming Soon

H1 Adult Use Sales Anemic

Report: Curaleaf to Close Cultivation, Claims Ample Supply Amidst High Prices