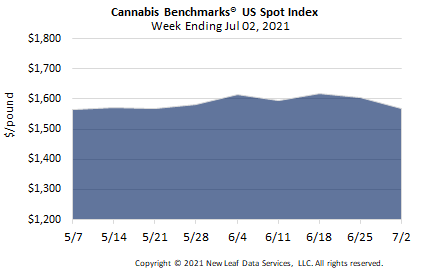

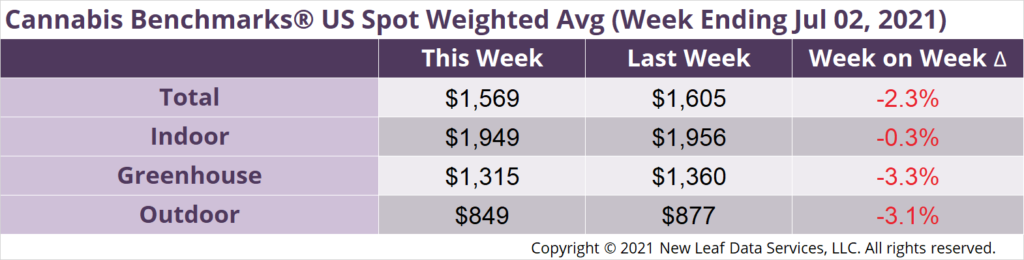

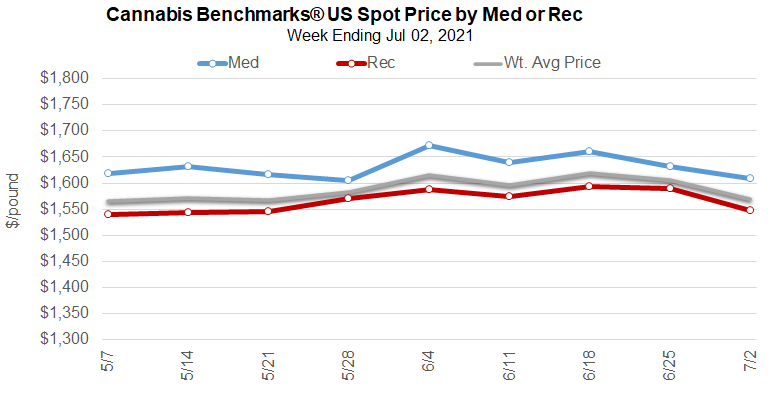

U.S. Cannabis Spot Index decreased 2.3% to $1,569 per pound.

The simple average (non-volume weighted) price decreased $7 to $1,838 per pound, with 68% of transactions (one standard deviation) in the $1,053 to $2,623 per pound range. The average reported deal size increased to 2.4 pounds. In grams, the Spot price was $3.46 and the simple average price was $4.05.

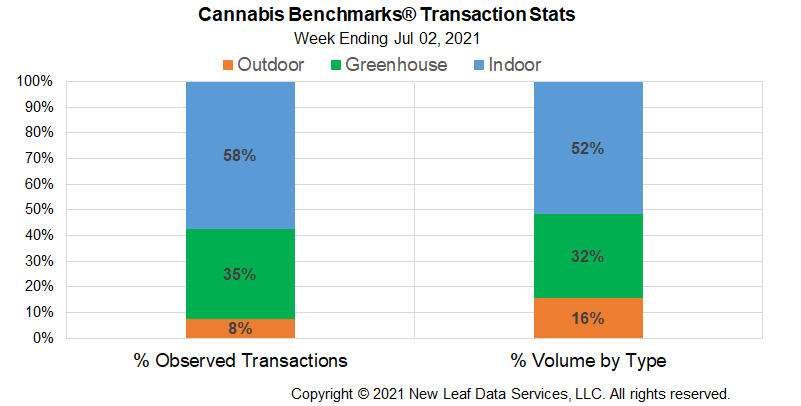

The relative frequencies of transactions for each grow type were largely stable from last week.

The relative volume of indoor flower contracted by 2% this week. The relative volume of greenhouse product expanded by the same proportion, while that for outdoor flower was unchanged.

The Heat Dome over the northwestern United States may affect cannabis prices throughout the growing season, with heat damaging plants planned for mid-summer light-deprivation harvests, scrambling the planting and early development of full-term crops, and sparking the early onset of wildfires. Cultivators are adapting by shading outdoor and greenhouse operations to protect plants, avoiding planting in extreme heat, and scheduling workers to avoid the hottest part of the day. The early arrival of wildfires in Northern California was also attributed in part to the Heat Dome, along with lightning strikes which sparked the still-uncontained 13,000-acre fire in Siskiyou County.

As we have covered previously, the past several years have seen record-breaking wildfire activity and drought in regions of California, Oregon, and Washington that are home to significant outdoor cannabis cultivation. However, this year’s extreme heat early in the season is a unique development, while drought is more severe currently along the West Coast than it was a year ago, prompting more – and more stringent – water restrictions for some growers, among other impacts. Many also fear that those factors will result in another record-setting fire season this year.

In recent years, such extreme weather and natural disasters have not significantly dented supply from outdoor production in the West Coast states. Last year, for example, growers in northern California and southern Oregon reported excellent growing season conditions up until the point wildfires threatened their crops close to harvest. However, as climate change continues to exacerbate heat, drought, and wildfires in unprecedented ways, we may see impacts to wholesale cannabis prices in the months ahead.

Finally, unprecedented heat may impact indoor growers as well. Increased production costs – or even crop loss or disruptions in the cultivation process – could ensue if strained HVAC systems cannot keep up or power outages occur.

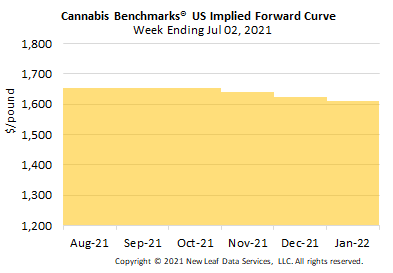

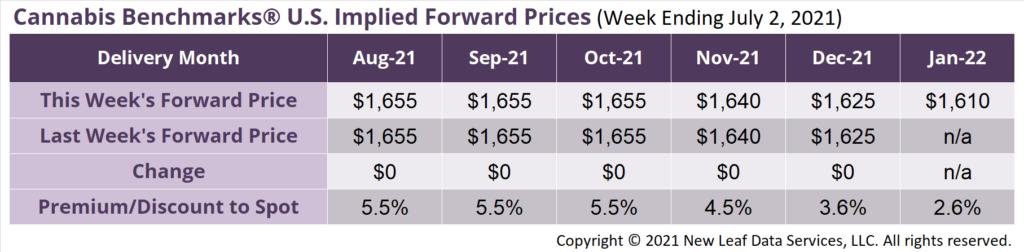

January 2022 Implied Forward initially assessed at $1,610 per pound.

The average reported forward deal size was 60 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 55%, 33%, and 12% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 73 pounds, 48 pounds, and 31 pounds, respectively.

At $1,655 per pound, the August Implied Forward represents a premium of 5.5% relative to the current U.S. Spot Price of $1,569 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

West Coast

Extreme Heat May Impact Outdoor Crops, Is Reportedly Disrupting Business in Oregon

Colorado

New Average Market Rates In Effect Beginning this Week; Tax on Internal Transfer of Flower by Adult-Use Cultivators Steady from Q2 to Q3

Michigan

Report: Industry-Group Funded Study Says 70% of Total Cannabis Sales in the State Take Place in Illegal Market