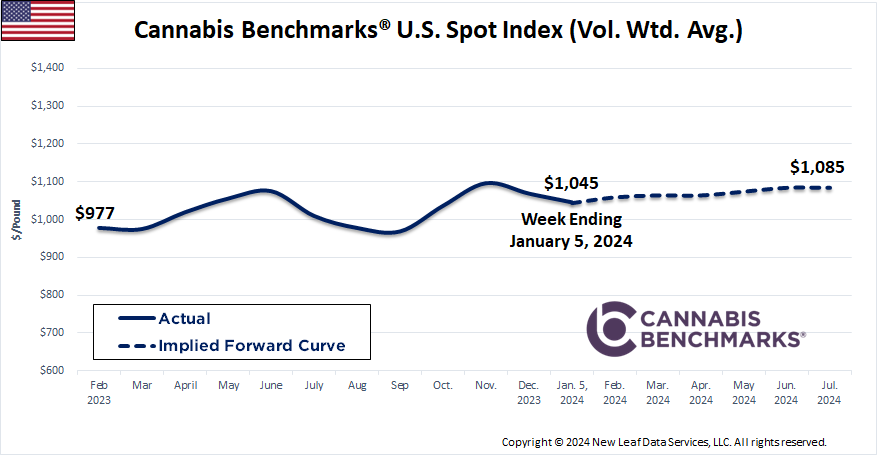

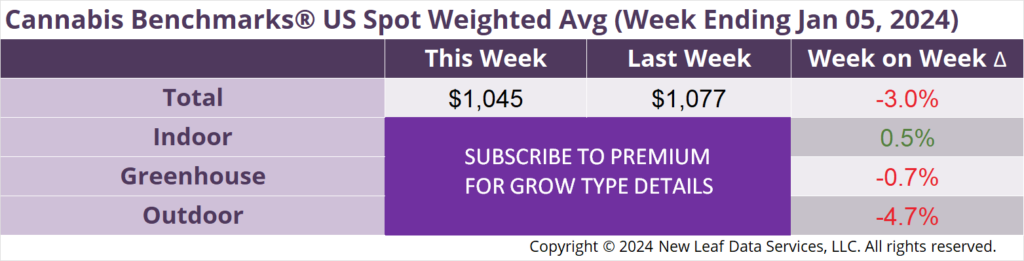

The U.S. Cannabis Spot Index decreased 3.0% to $1,045 per pound.

In grams, the Spot price was $2.30.

The U.S. Spot Index kicked off 2024 by returning to the downtrend that commenced in December 2023, after a momentary spike in the final week of the year. Historically, we’ve often observed a pop in wholesale prices around the end-of-year holidays as retailers stock up to offer promotions and cannabis products have become a part of the holiday spending splurge for some. As in other retail sectors, cannabis often sees a slump in sales following the holidays that spans the first two months of any given year, with depressed demand frequently leading to sliding wholesale prices.

The early weeks of 2023 were a departure from those historical trends following 2022’s dramatic price drop that saw the U.S. Spot plummet 27% from a peak of $1,301 in early April to $950 per pound near the end of the year. The 2022 decline reset wholesale flower prices to the levels they occupied in 2023 and through to the present moment. Last year, the U.S. Spot Index averaged $1,019 per pound, down 8% from the annual average price of $1,108 in 2022. However, 2023’s mean price is comparable – albeit up 1.8% – to that observed in the second half of 2022, when the U.S. spot averaged $1,001 per pound.

Indeed, prices for wholesale flower by grow type are for the most part commencing this year up from where they began 2023, as is the U.S. spot price. This week’s U.S. Spot price is up 8.7% year-on-year; indoor flower’s price this week represents a 13% increase; greenhouse flower has climbed 17% in the past year. Outdoor flower, meanwhile, is the only grow type that has seen a year-on-year decline, but just a small one, with this week’s national average price down just $5 from that recorded a year ago.

As we’ve noted in recent months, Q4 2023 did not see a pronounced seasonal decline in the price of outdoor flower that typically follows the autumn harvest. The national average price for outdoor flower occupied a tight range last year, with only $94 separating the low and high prices. This week’s price for outdoor product sits firmly within that range and does not appear set to test either support or resistance in the immediate future.

In the past, price destruction in the outdoor flower market has presaged losses for indoor and greenhouse flower. Following 2022’s downturn, it appears that outdoor flower found a bottom and has steadied. It has done so with help from production pullbacks in markets such as Colorado and California. Inventories of plant material in Michigan have been kept at reasonable levels post-fall harvest by licensees putting most of the crop toward extraction. Stable prices for outdoor – the most voluminous grow type – have provided a base for gains for indoor and greenhouse flower. Still, given plateauing demand in many markets, it’s doubtful that a sizable price recovery is in the cards barring an even larger contraction in production, which is unlikely, or some other major shakeup to market fundamentals.

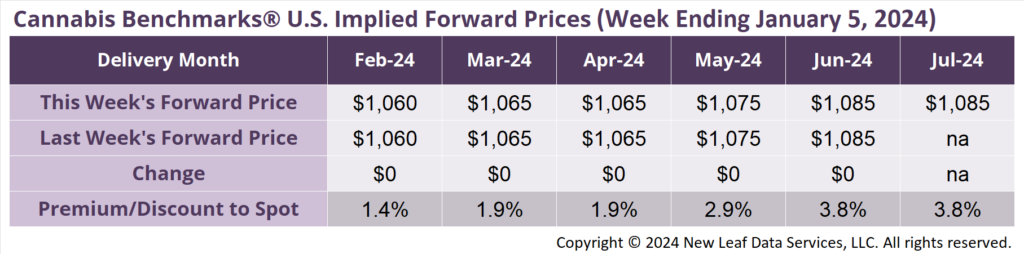

July 2024 Implied Forward initially assessed at $1,085 per pound.

At $1,060 per pound, the February 2024 Implied Forward represents a premium of 1.4% relative to the current U.S. Spot Price of $1,045 per pound.

2023 Production Stable YoY as Wholesale Prices Stick to $220 Range

Wholesale Prices Steady in H2 2023 – Can They Rise Above $1,500 / lb Again?

How Much Flower Was Sold by Licensed Retailers in 2023?

Wholesale Spot Price Up YoY Despite Late 2023 Downtrend