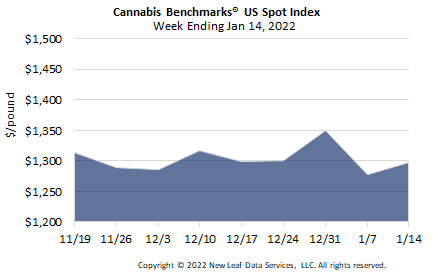

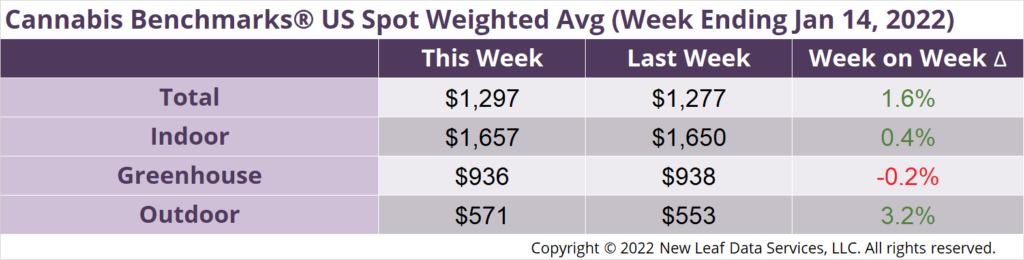

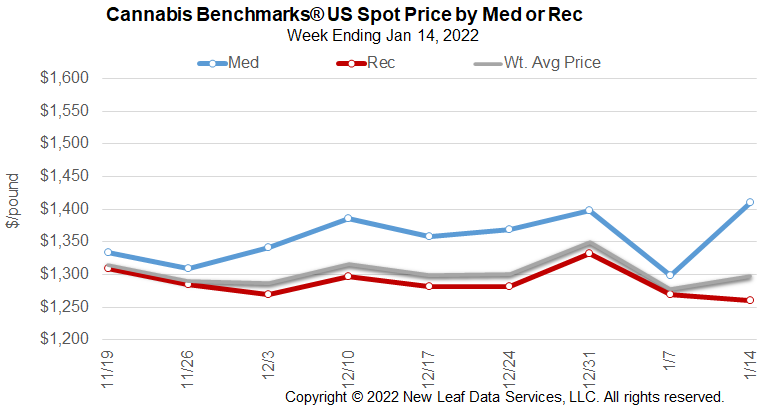

The U.S. Cannabis Spot Index decreased 1.6% to $1,297 per pound.

The simple average (non-volume weighted) price decreased $11 to $1,576 per pound, with 68% of transactions (one standard deviation) in the $787 to $2,366 per pound range. The average reported deal size increased to 2.3 pounds. In grams, the Spot price was $2.86 and the simple average price was $3.48.

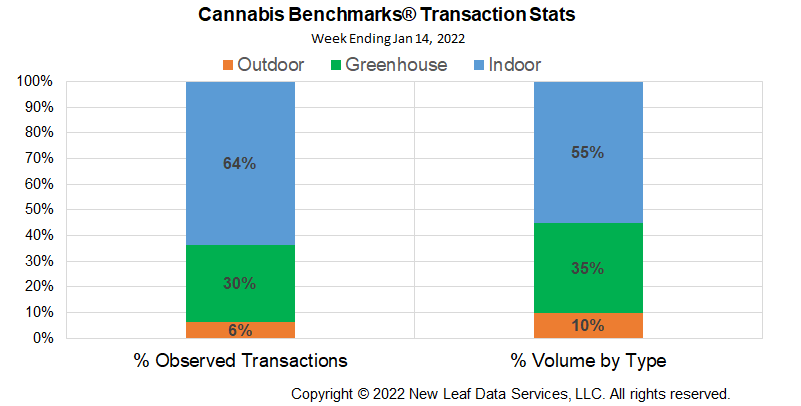

The relative frequency of transactions for indoor product decreased 2%, that for deals for greenhouse product increased by 2%, while that of outdoor flower was unchanged.

The relative volumes of indoor flower fell 3%, while that of greenhouse flower rose 1%. Outdoor flower’s relative volume increased by roughly 1%.

U.S. outdoor grown flower jumped $17.96 per pound this week with legacy states putting in a mixed performance. Average weekly losses across Washington, Oregon, California and Colorado have been narrowing with harvest season and some states appear to have had a holiday price bump.

The 20 week average price per pound loss in U.S. outdoor grown spot has narrowed to -$8.02. Washington state outdoor grown tacked on over $22.29 this week. The 20 week average price per pound change in Washington is -$10.15. Oregon outdoor grown shed $16.20 per pound this week. The average weekly price change per pound in Oregon is -$13.53. California outdoor grown prices fairly skyrocketed this week, gaining over $56 per pound. Average weekly losses in California outdoor grown have narrowed to -$7.13 per pound. Colorado outdoor grown fell nearly $36 per pound this week. Colorado outdoor grown losses have also been narrowing with the average weekly loss at just -$6.29 per pound this week.

In order to reverse losses in the outdoor flower market, demand is going to have to vastly expand and fundamental regulatory changes, a tax holiday for instance, will have to occur nearly simultaneously. Is there a chance these two events will happen? California will be considering tax reform this year, as noted below, and some state data is showing consumers slowly moving toward edible and other extraction products. However, shifts in demand trends in legal markets have generally been gradual. Similarly, changes to California’s tax regime would have to be instituted by the legislature, and even if passed are not likely to be implemented until late this year at the earliest, and possibly not until 2023.

That said, some outdoor pricing downtrends are slowing. This does not necessarily mean an uptrend is starting, especially in light of what available data and accounts from operators have shown was significant year-on-year growth in outdoor harvest volumes in 2021. For context, market participants in California and Oregon both reported large amounts of supply from 2020’s outdoor crop persisting in the market deep into 2021. With even bigger harvests brought in last year and demand stagnating, we can expect outdoor-grown inventory from 2021 to remain available well into this year.

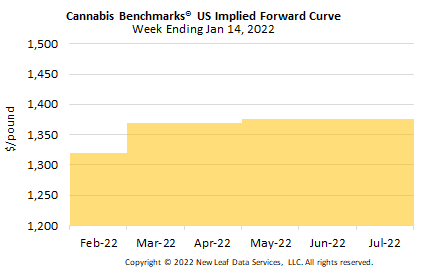

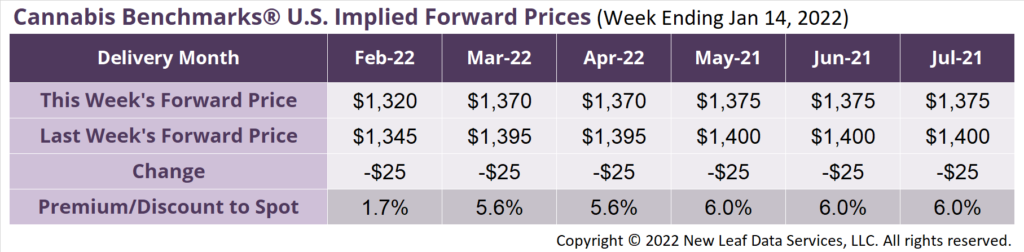

February 2022 Implied Forward assessed down $25 to $1,320 per pound.

The average reported forward deal size declined to 60 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were unchanged at 37%, 47%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 79 pounds, 52 pounds, and 42 pounds, respectively.

At $1,320 per pound, the February 2022 Implied Forward represents a premium of 1.7% relative to the current U.S. Spot Price of $1,297 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Newsom Budget Will Work to Save Legal Cannabis Industry

Oklahoma

Big December Dip in Licensees Explained

Colorado

Wholesale Cannabis Prices Hit November Retail Sales

Arizona

Arizona Adult Use Sales Share Tops 50%