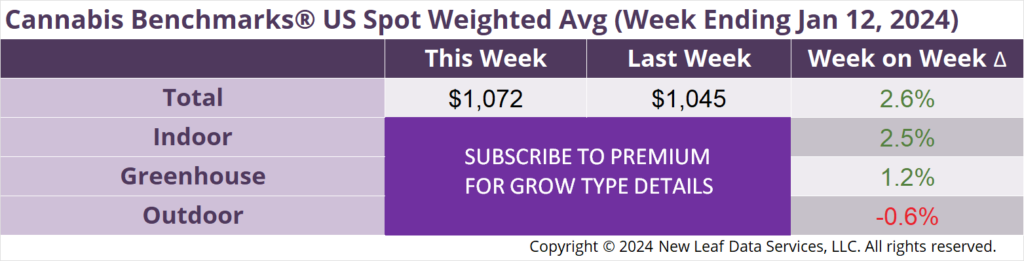

The U.S. Cannabis Spot Index increased 2.6% to $1,072 per pound.

In grams, the Spot price was $2.36.

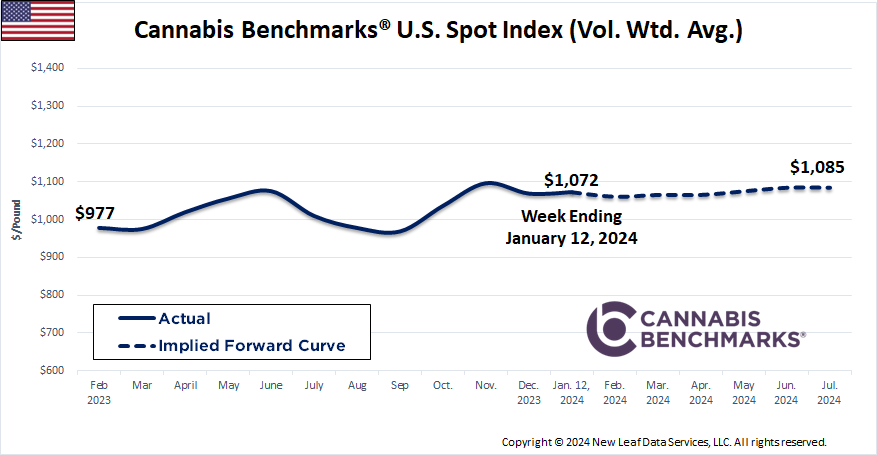

The U.S. Spot Index jumped back up again this week, rising almost 3% to settle at $1,072 per pound. The national average wholesale flower price has been choppy since November 2023. Notably, the range in which price action is taking place is contracting, especially compared to the June through mid-September slide that was followed by a steep climb that took price up to a recent peak at $1,115 per pound in November.

Additionally, what looked like the beginnings of a downtrend – a double top formation in November followed by price breaking through support in December – now appears to be transforming into a sideways drift. From June 2022 through August 2023, the U.S. Spot price dwelt firmly between $950 and $1,100 per pound. In September, the national average flower price broke through support to fall to a historic low of $936. Instead of proceeding lower, however, the over three-month-long downtrend reversed dramatically, underpinned by firm prices for outdoor-grown flower. Price spiked to break through the $1,100 per pound resistance level in the November double top, then dropped back down.

Price now appears to be consolidating. It has bounced within a $35 range – between $1,042 and $1,077 per pound – for just over the past month, halting the apparent downtrend that seemed to be forming in the November – December period. Given the current widespread uncertainty in the market – including fundamental supply / demand changes in mature states (California, Colorado), plateauing growth in “middle aged” markets (Illinois, Massachusetts, Michigan), and bumpy rollouts in states new to legalization (New York, Connecticut), as well as the prospect of federal rescheduling – consolidation is unsurprising.

Looking to the state level, price movement in major markets similarly suggests consolidation, with an absence of pronounced trends or signs of a breakout in one direction or another. California may be the only exception, as price shows a clearly-discernible downtrend beginning in June 2023. The Golden State’s spot wholesale flower price proceeded lower this week by almost 8%, breaking through a recently-established support level despite a notable jump in prices for indoor flower in the state. However, gradually declining prices for sun-grown flower and larger volumes of such product being traded pulled down the overall volume-weighted price.

Unlike in the past, though, California’s trend is not necessarily the nation’s. Now, relatively stable wholesale rates in high-volume markets such as Michigan, Colorado, Oregon, Washington, Massachusetts, and Illinois are working to mitigate somewhat the influence of the Golden State on the national volume-weighted flower price.

Cannabis Benchmarks is pleased to announce that we are now reporting weekly price assessments for wholesale flower in Montana. In the coming weeks and months, we will be adding even more state markets and product types to our wholesale price reporting and analysis – stay tuned!

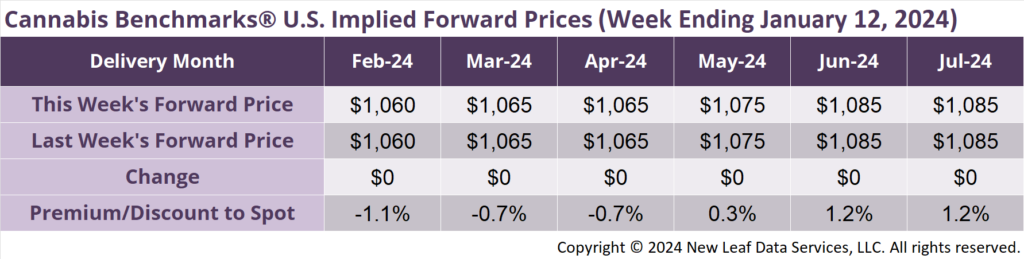

February 2024 Implied Forward unchanged at $1,060 per pound.

At $1,060 per pound, the February 2024 Implied Forward represents a discount of 1.1% relative to the current U.S. Spot Price of $1,072 per pound.

Wholesale Prices Locked in $100 Range as November Sales Drop to Lowest Level in Over 6 Years

Total Sales Approach $2 Billion in 2023; Wholesale Prices Rally to Close Year

Spot Flower Price Dips Below $2,800 / Pound to Open 2024

Wholesale Prices on the Upswing as Low Inventory Reported in Dispensaries