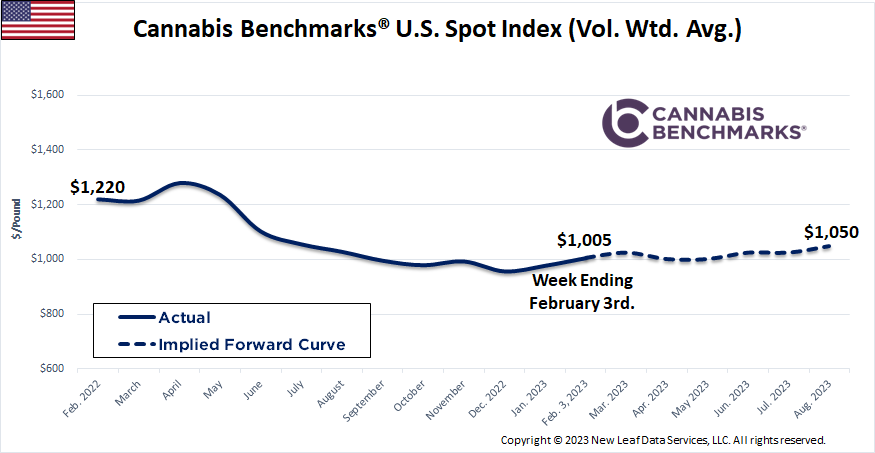

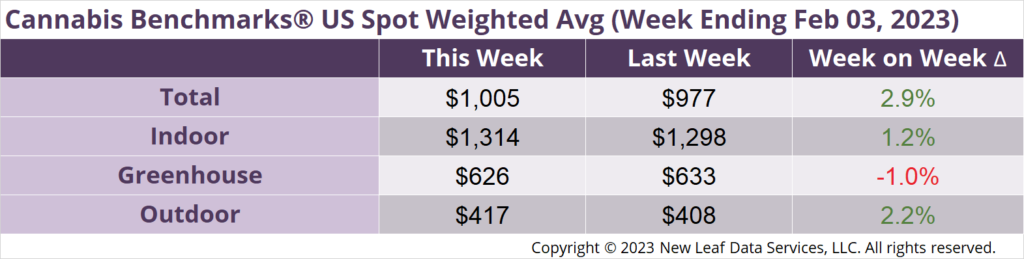

The U.S. Cannabis Spot Index increased 2.9% to $1,005 per pound.

In grams, the Spot price was $2.22.

Cannabis Benchmarks U.S. Wholesale Spot Index components rose this week with the weighted average of indoor flower prices ticking up for the fourth week in a row. Greenhouse product’s spot price also ticked higher, breaching the $1,000 level for the first time since November 2022. Outdoor flower’s price is up $9 on the week. The spot index itself fell $7 due to losses in Illinois, Michigan, Connecticut, and Massachusetts.

Cannabis Benchmarks U.S. Spot Index reflects wholesale price contributions from 19 states where cannabis is legally available in the U.S. The spot market index is “weighted” according to volume, which means states with the higher volumes of wholesale trading carry more weight than states with lower wholesale cannabis volume.

Indexes are often substituted for direct investment in particular commodities, which can involve all manner of transportation, storage, and credit fees. The most salient feature of an index – a broad measure of commodity prices – is the return on investment is wholly dependent on price performance, such that making a return on buying a commodity index depends on the price going up after the purchase is made. Booking a profit on a long (buy) position is made by selling the position at a higher price to lock in the difference between the purchase price and the sale price.

Trading an index as an active cannabis entrepreneur will ultimately help manage risk along the supply chain. Cultivators might sell a futures contract at the beginning of the planting season that represents all or part of an expected crop yield. For instance, selling an October futures contract at $1,000 per pound in Spring is a hedge against price movements during the growing season. The cultivator sells the $1,000 futures contract because it reflects prices they see in the current market and want to capture during harvest season. At the other end of the supply chain, retailers might hedge holiday purchases, locking in prices before they rise in response to seasonal demand.

Most futures contracts do not result in the delivery of the underlying commodity. Cultivators that “hedged” their crop with a futures contract might find that the price of cannabis post-harvest has fallen to $800 per pound. At harvest, the cultivator sells their physical crop for $800 per pound, $200 less than the Spring price. To close the hedge, the cultivator buys back the futures contract sold in the Spring for $800 in the market, thus making back the $200 lost on the physical harvest sale.

Index futures are vital for risk management purposes. Indeed, it’s safe to say losses across the supply chain and at vertically integrated cannabis firms over the last 18 months or so could have been offset were a futures market available for risk management. For a cannabis futures market to develop, regular banking services will have to be available to provide credit for cannabis entrepreneurs and the futures exchange. The fastest and most efficient way to pull big banking into the cannabis industry is to make cannabis legal federally; that’s a tall order, but other bills – the SAFE Banking Act for instance – would go a long way toward legitimizing and centralizing cannabis trade amid well-financed banks keen to offer credit to a new industry.

It’s important to track U.S. index prices. While national prices do not necessarily provide a granular view of individual state or local markets, the index points to large trends in the overall market that are useful to all participants. For instance, as week-on-week losses in wholesale prices narrowed in legacy states, Cannabis Benchmarks U.S. Spot Index indicated the steep downtrend that gripped the market since Summer 2021 was flattening, an early sign that out-of-control losses in markets nationwide were easing. Indeed, legacy state outdoor price losses began to shrink on a weekly basis shortly after U.S. index prices began to flatten out.

In short, indexes are vital to finding and tracking overall market direction. When combined with Cannabis Benchmarks state level indexes, market participants and others can observe detailed price data by grow type for each state, providing a more precise indication of where price is headed and allowing you to plan accordingly.

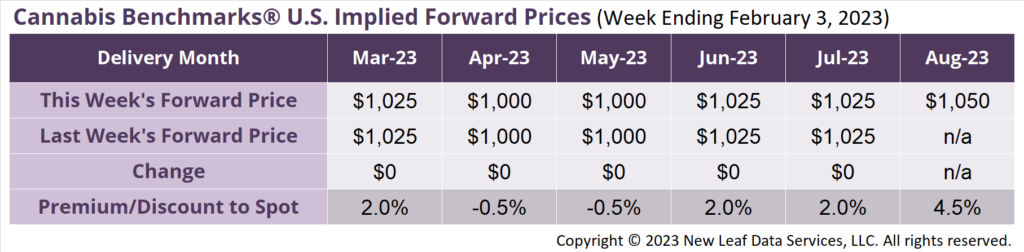

August 2023 Implied Forward initially assessed at $1,050 per pound.

At $1,025 per pound, the March 2023 Implied Forward represents a premium of 2.0% relative to the current U.S. Spot Price of $1,005 per pound.

DCC to CA Attorney General: Asked and Answered – Interviews

January Sales Down 5% M-on-M, Down 10% Y-o-Y

December Cannabis Sales Reverse Higher

Judge Rejects NY Appeal on Adult Use Dispensary Licenses