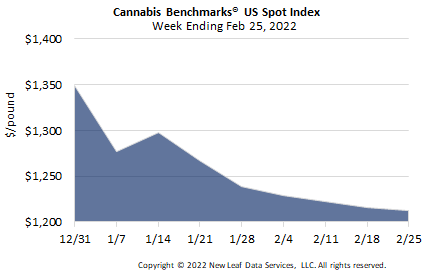

The U.S. Cannabis Spot Index decreased 0.3% to $1,212 per pound.

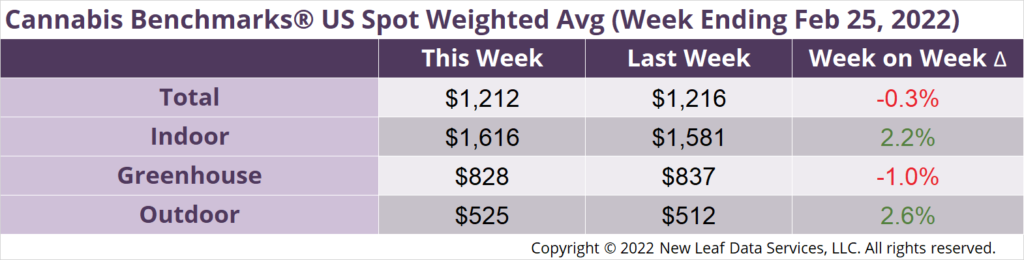

The simple average (non-volume weighted) price decreased $1 to $1,496 per pound, with 68% of transactions (one standard deviation) in the $664 to $2,329 per pound range. The average reported deal size increased to 2.5 pounds. In grams, the Spot price was $2.67 and the simple average price was $3.30.

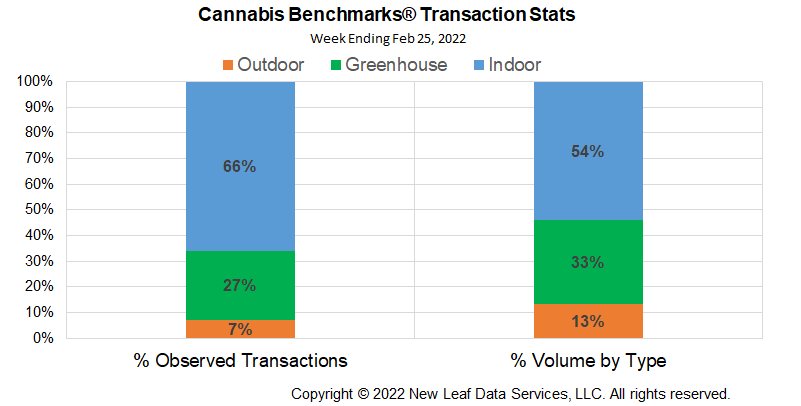

The relative frequency of transactions for indoor, greenhouse, and outdoor product were unchanged this week.

The relative volume of indoor flower fell 2%, while that of greenhouse flower was unchanged. Outdoor flower’s relative volume rose 2% this week.

Cannabis Benchmarks’ U.S. Spot Index fell slightly this week, losing $3.43 per pound with a 20-week average loss of -$11.25. Legacy states put in a mixed performance with Washington gaining nearly $4, Colorado skidded nearly $19, California falling nearly $26 and Oregon’s Spot rising nearly $19 per pound this week.

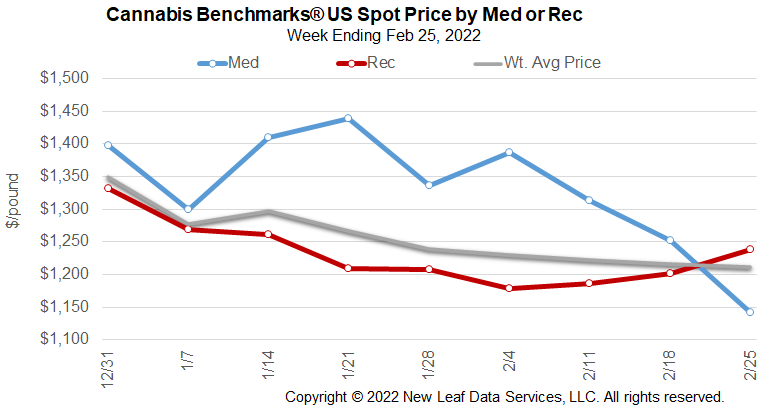

States newer to adult use legalization with existing medical markets are undergoing a transformation in price. Michigan has seen a downward pace of -$45.25 per pound per week, on average, over the previous 20-week period. Cannabis Benchmarks has learned that new growers are bringing product to the Michigan market at significantly lower prices and the state has its first significant outdoor crop weighing on the market as well.

Significant losses in new, high population states are in part attributable to the market shift toward extracted products that first began in legacy markets. Outdoor grown product in particular is being vacuumed up by extractors keen to offer new products and price points in their respective state markets. Growers have told Cannabis Benchmarks they are selling significant portions of their production in bulk to extraction firms at significantly lower prices than transactions for smokable flower. A recent sell-off in Massachusetts reflects such bulk deals, where larger trades at lower price points have been increasingly reported.

The speed at which the new markets are adopting strategies from legacy markets is affecting prices at a pace not previously seen. As a result, price adjustments are sudden and sharp in response to product demands – extracts and manufactured products containing them – that were born in legacy markets. Although it is not yet possible to trade interstate, industry developments – methods and products – are not so constrained, with new market uptake on legacy market practices affecting demand and pricing at a much faster pace.

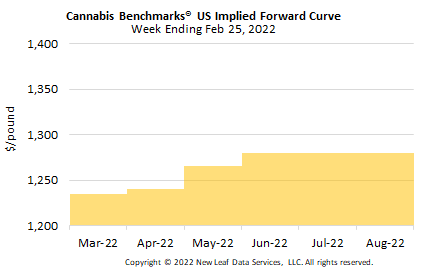

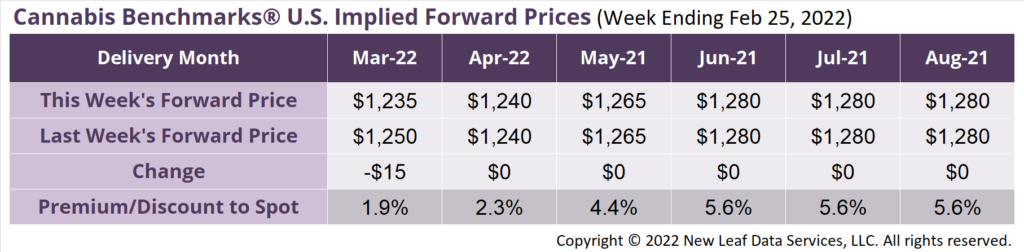

March 2022 Implied Forward assessed down $15 to close at $1,235 per pound.

The average reported forward deal size was 68 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 32%, 52%, and 16% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 89 pounds, 60 pounds, and 51 pounds, respectively.

At $1,235 per pound, the March 2022 Implied Forward represents a premium of 1.9% relative to the current U.S. Spot Price of $1,212 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Q4 2021 Cannabis Sales & Tax Receipts Decrease

Michigan

January Sales Fall Amid Price Crash

New Mexico

Water Rights Swamp Plant Count Increase for Micro Businesses

Montana

Recreational Market Opens in “Dead of Winter” to Some Disappointment – Interview