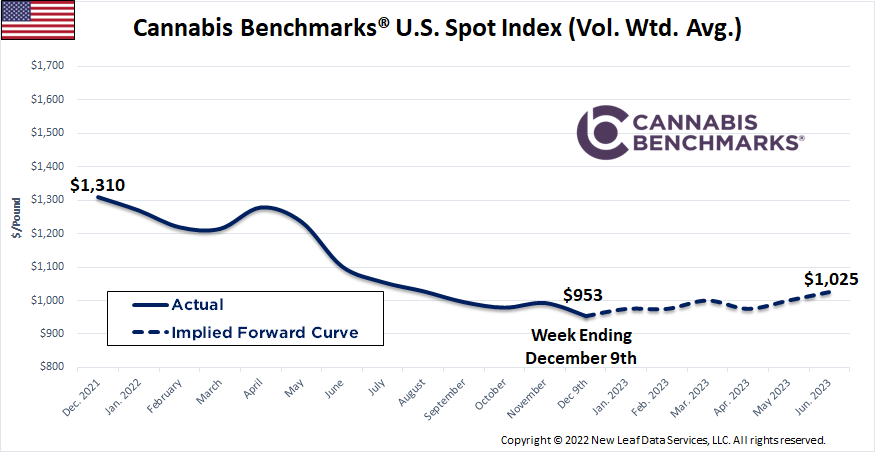

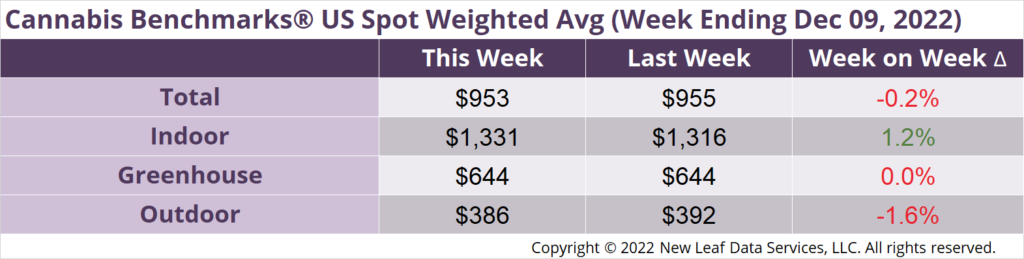

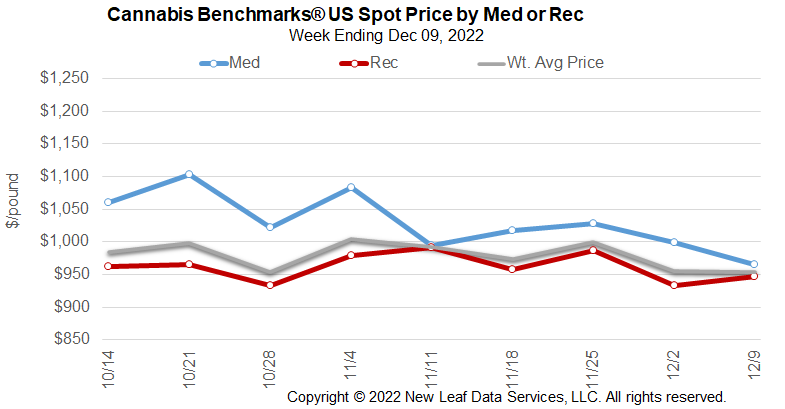

The U.S. Cannabis Spot Index decreased 0.2% to $953 per pound.

The simple average (non-volume weighted) price decreased $6 to $1,298 per pound, with 68% of transactions (one standard deviation) in the $529 to $2,067 per pound range. The average reported deal size was nominally unchanged at 2.6 pounds. In grams, the Spot price was $2.10 and the simple average price was $2.86.

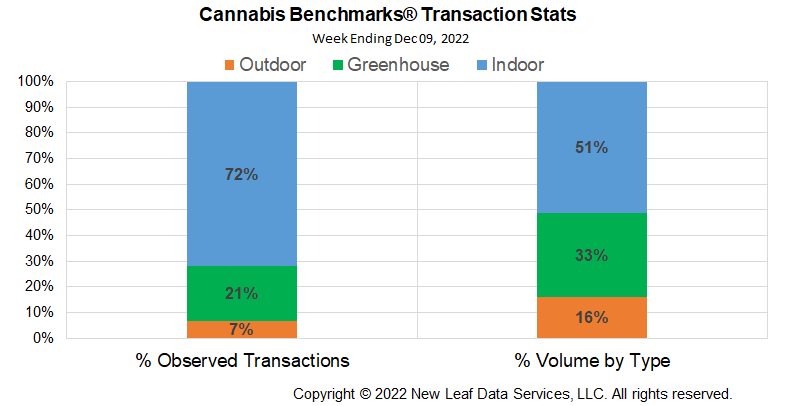

The relative frequency of transactions for indoor, greenhouse, and outdoor product were unchanged this week.

The relative volume of indoor product fell 1%, while that of greenhouse product was unchanged. Outdoor flower’s relative volume rose 1% on the week.

Rhode Island’s spot price was trading in the mid $3,100s per pound in July, but made a very quick adjustment when the adult use market opened last week: it fell over 16% to trade very near Massachusetts’ spot price. New England’s cannabis markets are demonstrating that like commodities, under similar economic conditions, should be priced alike.Sudden, sharp, and steep price adjustments in the cannabis industry are becoming more frequent as more states open for legal adult use sales. In fully legitimate commodity markets, the price changes would be called “disorderly;” that is, there is no balance between buy and sell orders.Orderly markets are those where price is determined by a nearly equal number of buyers and sellers agreeing on price that is roughly in line with recent pricing patterns. Bid and ask markets are for such volume that is typical for the underlying market. Cannabis market pricing cannot be considered “orderly” in that there are no bids below current price that are in line with previous price paid because market liquidity has dried up.If disorderly market conditions are allowed to continue without some braking mechanism – a short term shuttering of the market or intervention by financial institutions, for example – the market in question will lose value that is unlikely to be re-captured. Regional cannabis markets appear to be undergoing disorderly price adjustments that are likely to become permanent. That is, cannabis prices appear to be adjusting toward equilibrium without brakes of any sort. This suggests permanently lower prices are likely to develop first regionally, then nationwide. So what happened in Rhode Island over the past few weeks – a nearly 33% downside price adjustment – is likely to happen in other new, contiguous states to a greater or lesser degree, but in the same direction.

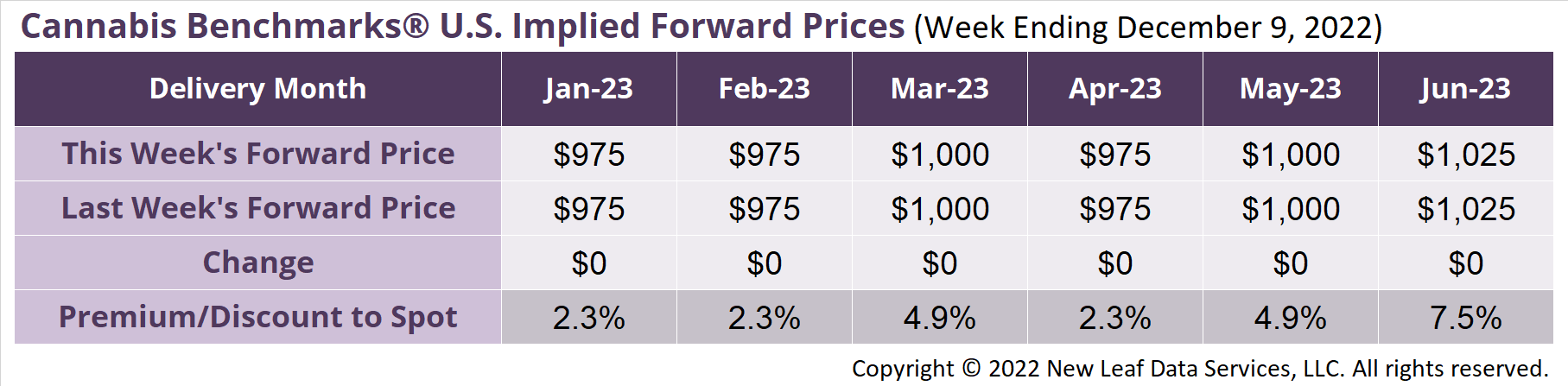

January 2023 Implied Forward unchanged at $975 per pound.

The average reported forward deal size increased to 78 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 46%, 42%, and 13% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 92 pounds, 70 pounds, and 57 pounds, respectively.

At $975 per pound, the January 2023 Implied Forward represents a premium of 2.3% relative to the current U.S. Spot Price of $953 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.