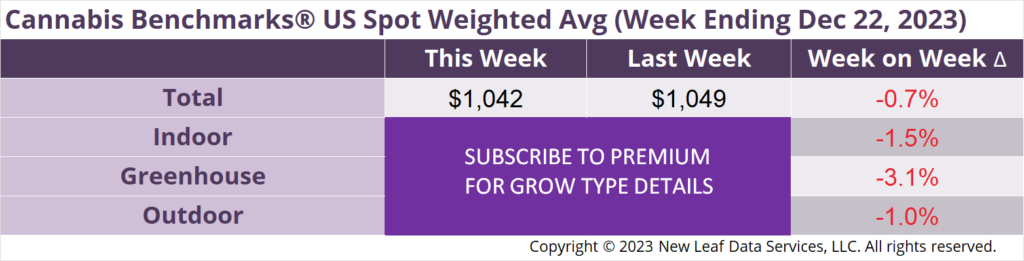

The U.S. Cannabis Spot Index decreased 0.7% to $1,042 per pound.

In grams, the Spot price was $2.30.

The U.S. Spot Index ticked downward again this week, declining 0.7% to $1,042 per pound. All grow types saw relatively small week-on-week decreases in their volume-weighted average prices.

Despite the recent, now month-old downtrend, national wholesale flower prices remain up year-on-year. The overall U.S. Spot is up 9% from $956 per pound a year ago; indoor flower is up 6.6%; greenhouse product’s national price is up 13.8%; and outdoor flower’s price this week represents a 16% premium compared to the week ending December 23, 2022.

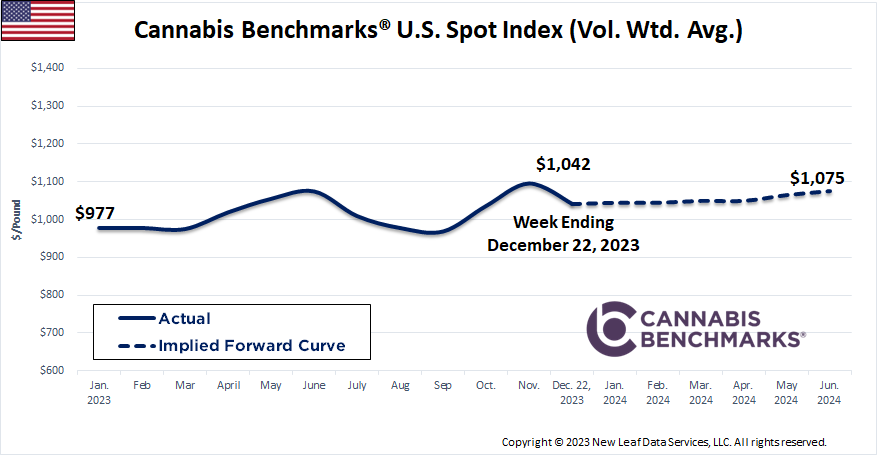

Looking back on this year, the U.S. Spot wholesale flower price opened 2022 at $961 per pound. From December 2022 through early March this year, the national average flower price tested the $950 per pound floor three times before commencing a spring rally that took price up to $1,096 per pound. A subsequent summer slide took the U.S. Spot down to a historic low of $936 per pound in mid-September. After finally breaking through the $950 level, price recovered quickly and ascended to form a recent double top at $1,112 and $1,115 per pound in the first and final weeks of November, bringing us to the current downtrend.

Although there was some volatility in the final three quarters of this year, the national average flower price exhibited more stability relative to the 27% peak-to-trough decline that took place from early April to mid-December last year. Additionally, the U.S. Spot tracked within a $179 range in 2023, significantly tighter than the $332 and $351 ranges it occupied in 2021 and 2022, respectively.

Based on this year’s price movement, it appears that the national wholesale cannabis flower price index has for the moment established support around $950 per pound and resistance at roughly the $1,115 per pound level.

Overall, after the roughly 40% drop from June 2021 through December 2022 – a downturn experienced to some degree in nearly every individual state market – it seems that the legal cannabis market as a whole this year adjusted and is beginning to settle into a new post-Covid reality. Apart from newly-opened and still developing markets, demand in many states has steadied and settled into predictable patterns. While there is still widespread oversupply, the production side is taking steps toward right-sizing, particularly in mature markets like California, Colorado, and Oregon.

While 2023’s price action suggests a trend toward reduced volatility, there are factors that could push prices in unexpected directions in the near future. In particular, the industry is collectively holding its breath awaiting a decision from the U.S. Drug Enforcement Administration on rescheduling. Rescheduling would not alter the supply / demand fundamentals of the market, but it would result in cannabis businesses boasting more favorable balance sheets. This could lead to increased investment flowing into the industry and perhaps expansion of cultivation and product manufacturing capacity, which is probably unnecessary in many states. In other words, while equities would almost certainly rally if cannabis were to be rescheduled, the ultimate result on the ground could be more oversupply if rescheduling is not accompanied by broader reform that involves interstate commerce.

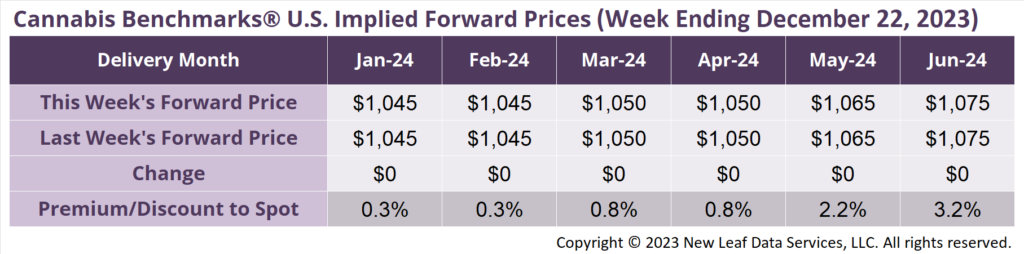

January 2024 Implied Forward unchanged at $1,045 per pound.

At $1,045 per pound, the January 2024 Implied Forward represents a premium of 0.3% relative to the current U.S. Spot Price of $1,042 per pound.

State AG’s Opinion Forecloses Possibility of Interstate Trade

New Market Rates for Wholesale Taxation Published

October Sales Slip as Wholesale Price Seems Set to Slide

New Retailers Open after Lifting of Injunction, but State Faces Another Lawsuit Over Licensing