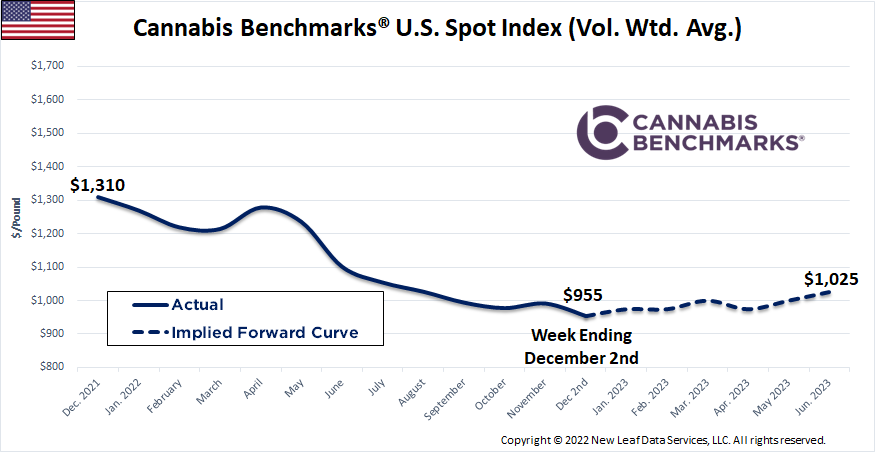

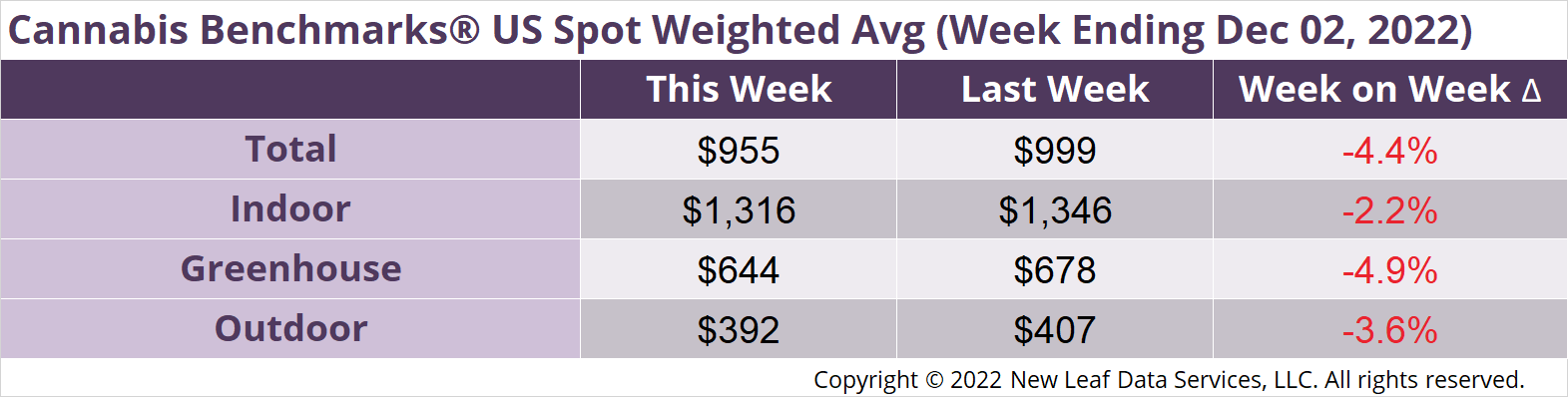

The U.S. Cannabis Spot Index decreased 4.4% to $955 per pound.

The simple average (non-volume weighted) price decreased $4 to $1,304 per pound, with 68% of transactions (one standard deviation) in the $517 to $2,091 per pound range. The average reported deal size was nominally unchanged at 2.6 pounds. In grams, the Spot price was $2.11 and the simple average price was $2.88.

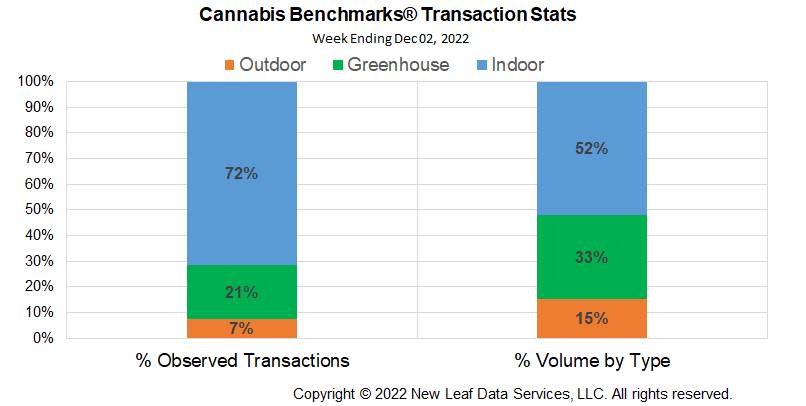

The relative frequency of transactions for indoor product rose 1% this week, while those of greenhouse and outdoor flower were unchanged on the week.

The relative volume of indoor product fell 2%, while that of greenhouse product rose 2%. Outdoor flower’s relative volume was unchanged on the week.

The U.S. Spot market fell $44 per pound this week on net spot market losses of $47 across legacy states as post-harvest trade weighs on the market.

California spot price fell $46 per pound this week, with outdoor product falling $30 per wholesale pound. Looking across California grow types, losses this week were largest on indoor-grown product, which fell $32, while greenhouse product slipped $27. Oregon spot gained $17 and has maintained price over a key threshold since the second week in July, defying the pressures of the post-harvest period. Indeed, Oregon greenhouse product price rose this week, gaining $39 per wholesale pound. While Oregon outdoor spot price is the lowest of the legacy states, price did increase by $4 this week and is holding a bit above historical lows.

The California / Oregon spot spread is at $63, with Oregon spot the lower of the two. Price vigilance in these two markets – and across grow types – is warranted, as they are likely to set base prices for the country due to prolific and consistent production and very high quality.

New Mexico prices have been taken to the woodshed. Spot prices are down over 31% this year, fell over 20% in November and fell $86 this week, reaching an all-time low after the adult use market opened just eight months ago. Production ramped up late last year and early this year as medical growers expanded into the adult use market, followed by smaller outfits eager to get into the new industry. The state is turning out to be a cautionary tale about the vicissitudes of cannabis pricing and, for some, a hard lesson in free enterprise. For more on New Mexico, read the interview in our Premium Weekly Report.

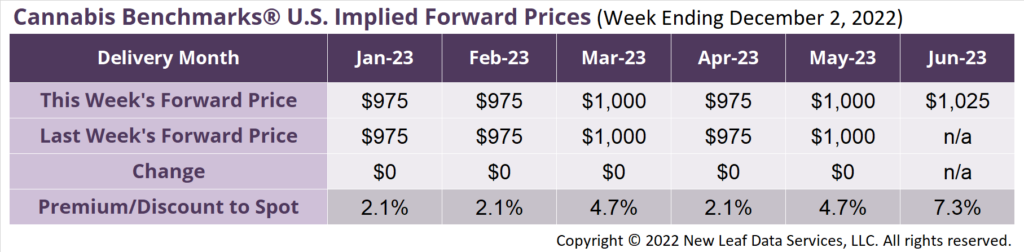

June 2023 Implied Forward initially assessed at $1,025 per pound.

The average reported forward deal size increased to 81 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 45%, 42%, and 13% of forward arrangements, respectively.

The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 96 pounds, 72 pounds, and 58 pounds, respectively.

At $975 per pound, the January 2023 Implied Forward represents a premium of 2.1% relative to the current U.S. Spot Price of $955 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.