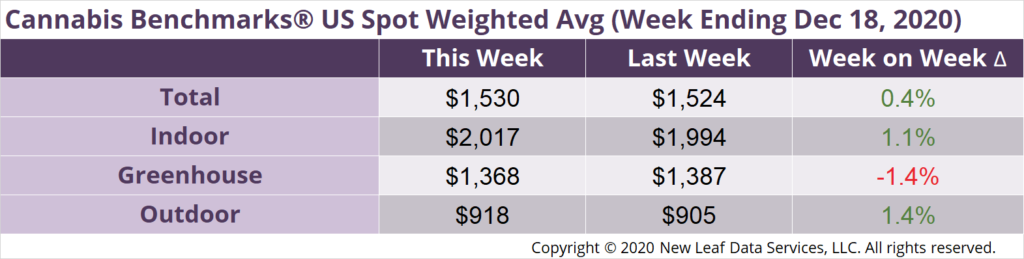

U.S. Cannabis Spot Index up 0.4% to $1,530 per pound.

The simple average (non-volume weighted) price increased $3 to $1,816 per pound, with 68% of transactions (one standard deviation) in the $1,084 to $2,548 per pound range. The average reported deal size was nominally unchanged at 2.4 pounds. In grams, the Spot price was $3.37 and the simple average price was $4.00.

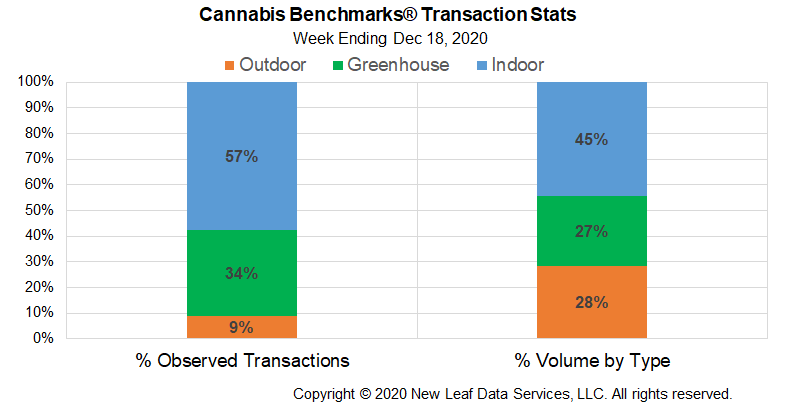

This week’s national transaction stats were essentially stable from last week. Members of our Price Contributor Network in Oregon pointed out this week that wholesale purchasing has subsided recently, in part due to the slowdown in sales we have noted in recent months. Additionally, due to section 280E of the Internal Revenue Code, which prohibits cannabis operations from deducting many expenses that are available for traditional businesses, it is more favorable for tax purposes for dispensaries and retailers to have less inventory on hand at the close of the calendar year.

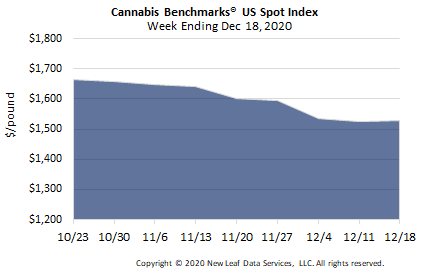

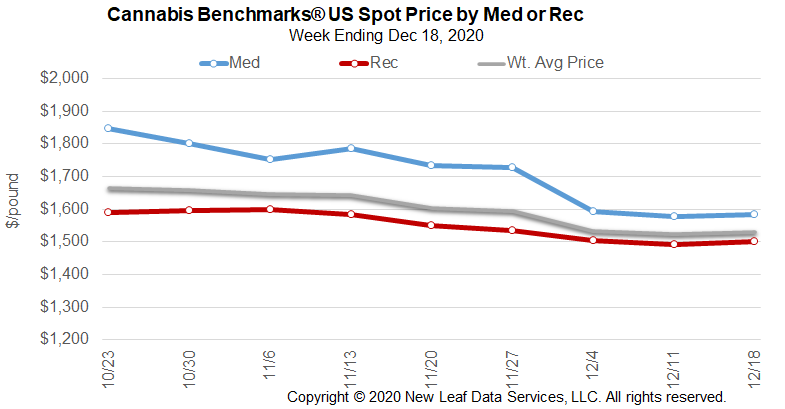

The U.S. Spot Index is currently trending downward for the first time since earlier this year, when it largely declined from mid-February through late May. Interestingly, the course of the national composite price this year has broadly echoed that observed in 2019, despite the disruption of the COVID-19 pandemic, as well as the opening or expansion of what have become significant new markets in 2020. In both 2019 and 2020, the U.S. Spot trended downward through Q1 and into Q2 before ascending through the late spring, summer, and early autumn. Also like last year, the national average rate for flower has turned downward after rising into the midst of the outdoor harvest season. In 2019 the U.S. Spot peaked in mid-November; this year the current year-to-date high was observed in late October.

Looking ahead, early reports from the West Coast suggest that damage and losses suffered by this year’s autumn crop from the devastating wildfire season may not be as severe as was feared just a couple months ago. Retailers are at this point likely stocked up for what has become a customary holiday season sales boost, but the first two months of any given year typically bring with them declining demand until retail revenues pick back up again in March. While the coronavirus and accompanying restrictions led to some departures from established monthly sales trends, this autumn and early winter has seen demand subside, in line with historical observations. The commencement of adult-use sales in Arizona, which are expected to begin in March or April 2021, are providing some upward pressure on national wholesale prices already, but it has not been sufficient to stop the downward direction of the U.S. Spot.

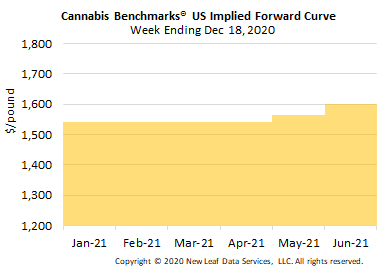

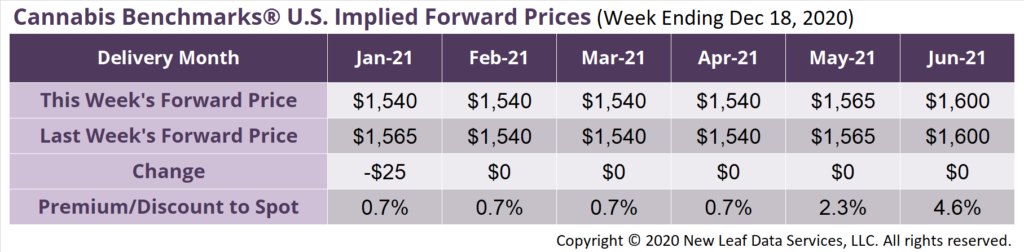

January 2021 Implied Forward down $25 to $1,540 per pound.

The average reported forward deal size was 36.5 pounds. The proportions of forward deals for outdoor, greenhouse, and indoor-grown flower were 46%, 36%, and 18% of forward arrangements, respectively. The average forward deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown flower were 54 pounds, 21 pounds, and 23 pounds, respectively.

At $1,540 per pound, the January Implied Forward represents a premium of 0.7% relative to the current U.S. Spot Price of $1,530 per pound. The premium or discount for each Forward price, relative to the U.S. Spot Index, is illustrated in the table below.

California

Report: Early Accounts Indicate Outdoor Harvest Largely Unscathed by Wildfires

Colorado

Taxes on Transfers of Flower by Adult-Use Cultivators to Integrated Retailers Will Increase by Over 30% in Q1 2021

Oregon

Ongoing Investigations Into Vape Products Will Result in Some Inventory Removed from Circulation

Michigan

Detroit to License Adult-Use Retailers as Soon as June 2021

Arizona

State Officials Already Issued Initial Draft Rules for New Adult-Use Market, More Iterations Expected in Coming Weeks