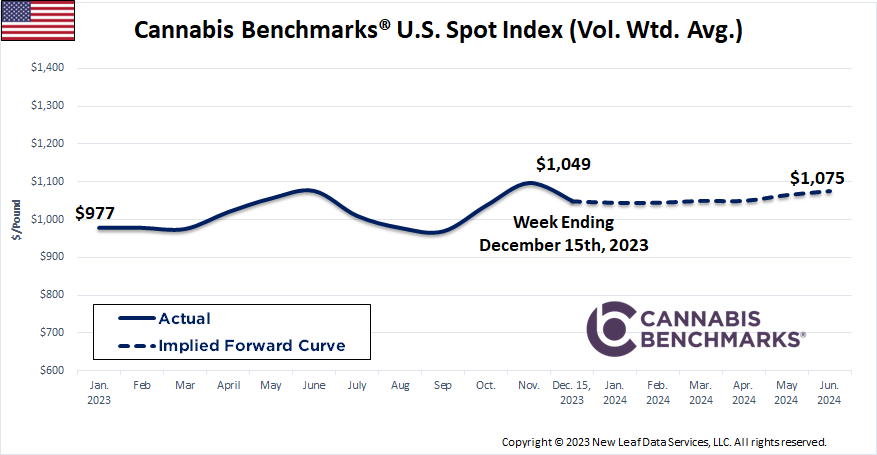

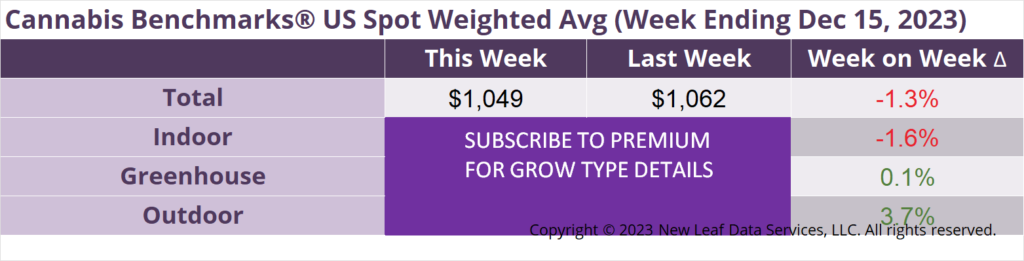

The U.S. Cannabis Spot Index decreased 1.3% to $1,049 per pound.

In grams, the Spot price was $2.31.

The U.S. Spot wholesale flower price declined for a third consecutive week, falling to $1,049 per pound. The downturn in the aggregate flower price was driven by decreasing rates for indoor flower, along with a higher proportion of lower-priced outdoor product reported.

While larger volumes of sun-grown flower are helping pull down the national volume-weighted average price, wholesale prices for outdoor flower on the national and state levels have held very firm in the wake of this year’s harvest. In fact, on the national level, monthly average outdoor flower prices have ascended from September. December’s month-to-date average price for outdoor flower is up 5.1% from September’s.

On the state level, the spot wholesale price for outdoor flower in California this week is down just 2.5% from the opening week of October. Colorado’s outdoor flower price this week is off just 0.7% in the same span. Meanwhile, Oregon’s outdoor flower price is up 17% from the opening week of October to this week, while Washington’s is up 23.3%. Outdoor flower prices in the four major western markets are also converging; this week they ranged between a low of $427 and a high of $476 per pound.

Another interesting observation from this week’s price data is the broader convergence of wholesale flower prices in states west of the Mississippi River: namely Arizona, California, Colorado, Oklahoma, Oregon, and Washington. This week, the low and high spot wholesale prices in those states were separated by just a $217 range.

We’ve previously commented on regional price convergence in neighboring states, but the relatively close alignment of prices across a large geographical area – from the Pacific Ocean to Oklahoma in the lower Midwest / eastern Southwest – is notable. All of the states under discussion have fairly open licensing schemes and plentiful sun-grown production.

Outliers in the region include New Mexico and Nevada. The former is still a relatively young market in a low-population state, while Nevada’s market has limited licensing and a desert climate inhospitable to outdoor production. Incidentally, only $83 separates the spot wholesale flower prices of these two states this week.

Ultimately, as legalization continues to proliferate, wholesale prices will normalize across markets with similar regulatory structures, costs of production, and demand levels. The fact that interstate trade is already happening – albeit illegally – likely also plays a role in the current convergence.

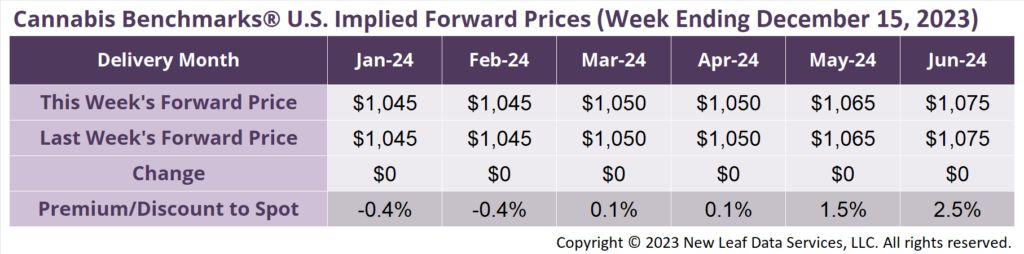

January 2024 Implied Forward unchanged at $1,045 per pound.

At $1,045 per pound, the January 2024 Implied Forward represents a discount of 0.4% relative to the current U.S. Spot Price of $1,049 per pound.

Wholesale Prices Trading in $100 Range for 14+ Months, Even with Cultivation Pullback

Emerging Gradual Downtrend Echoes 2022 Wholesale Price Movement

Young Adult Use Market Boasts Highest Wholesale Prices in U.S.

Wholesale Price Trending Down After Previous Long-Term Stability